Tag Archive: consumers

What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

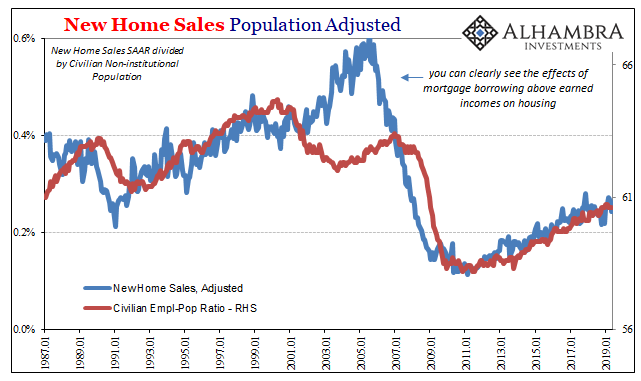

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

Read More »

Read More »

Housing Isn’t Just About Real Estate

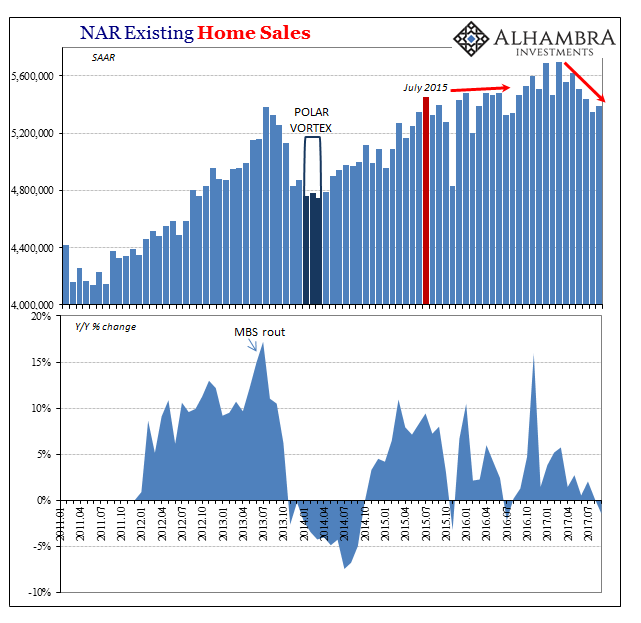

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year.

Read More »

Read More »

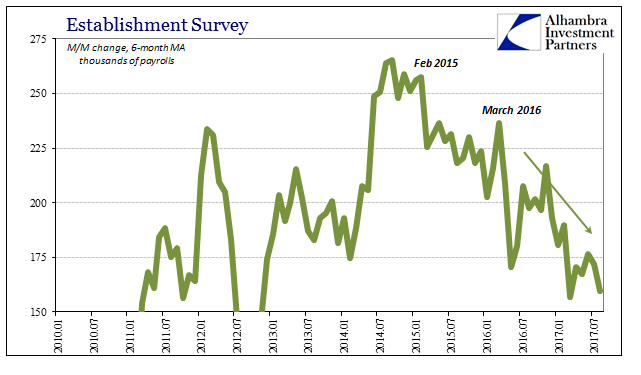

2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a third round of QE back in 2012.

Read More »

Read More »

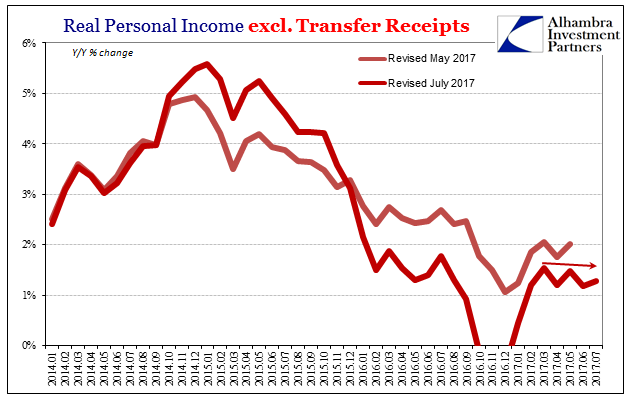

Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income.

Read More »

Read More »

Pending Home Sales: Home Attitude Adjustments

The National Association of Realtors (NAR) reported today that pending home sales declined for the third straight month. As with so many other accounts, it’s not really the downside that is relevant but how instead there has been little to no growth for quite some time now. The NAR’s index value, which is how the organization reports the level of pending sales, was 108.5 in May 2017. That’s up 42% from the low in 2010, but also slightly less than...

Read More »

Read More »

Lackluster Trade

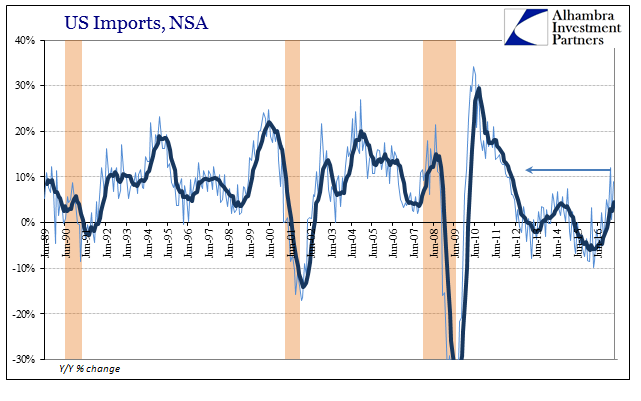

US imports rose 9% year-over-year (NSA) in March 2017, after being flat in February and up 12% in January. For the quarter overall, imports rose 7.3%, a rate that is slightly more than the 2013-14 comparison. The difference, however, is simply the price of oil.

Read More »

Read More »

The Expanded Retail Sales Gap

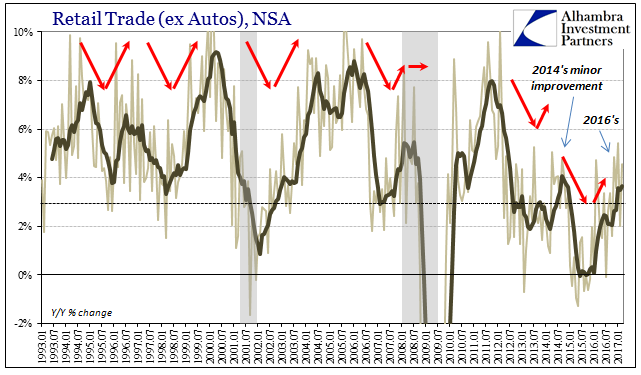

Retail sales growth in February 2017 was going to be low by virtue of its comparison to February 2016 and the extra day in that month. The Census Bureau’s autoregressive models are supposed to normalize just these kinds of calendar irregularities so that we can make something close to apples to apples comparisons. The seasonally-adjusted estimate for February, however, was calculated to be less than the one for January 2017, therefore suggesting...

Read More »

Read More »

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

No Acceleration In Industry, Either

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry.

Read More »

Read More »