Tag Archive: commodities

Global Asset Allocation Update

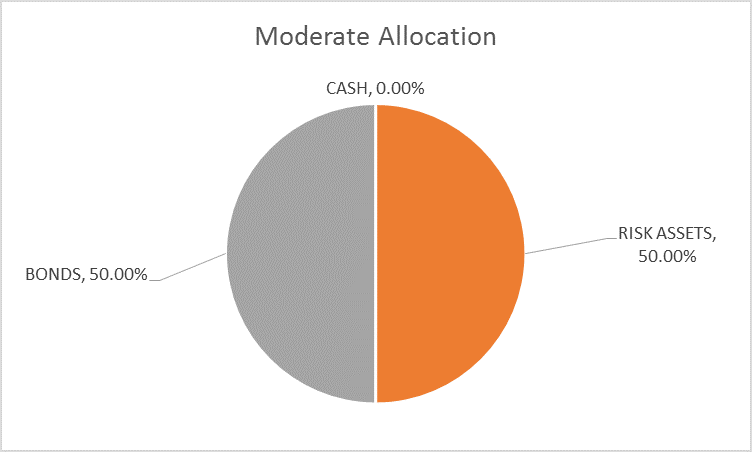

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

Time, The Biggest Risk

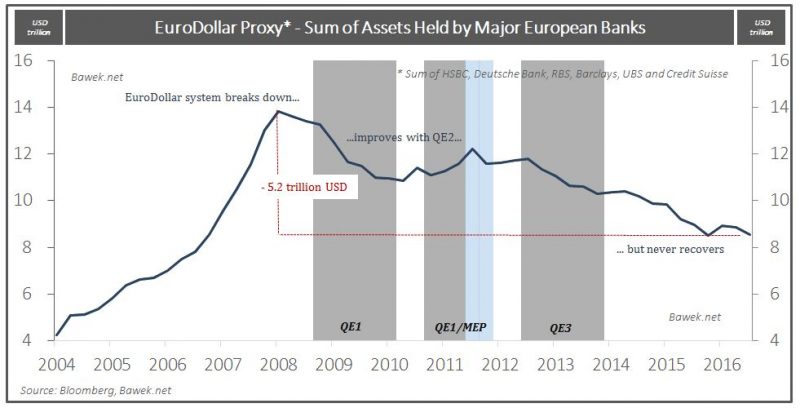

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the failures of QE’s 1 and 2. This...

Read More »

Read More »

Bi-Weekly Economic Review

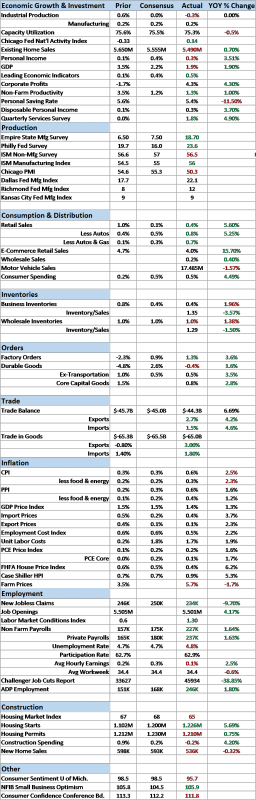

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

Incrementum Advisory Board Meeting, Q1 2017 and Some Additional Reflections

The quarterly meeting of the Incrementum Advisory Board was held on January 11, approximately one month ago. A download link to a PDF document containing the full transcript including charts an be found at the end of this post. As always, a broad range of topics was discussed; although some time has passed since the meeting, all these issues remain relevant.

Read More »

Read More »

How to Invest in the New World Order

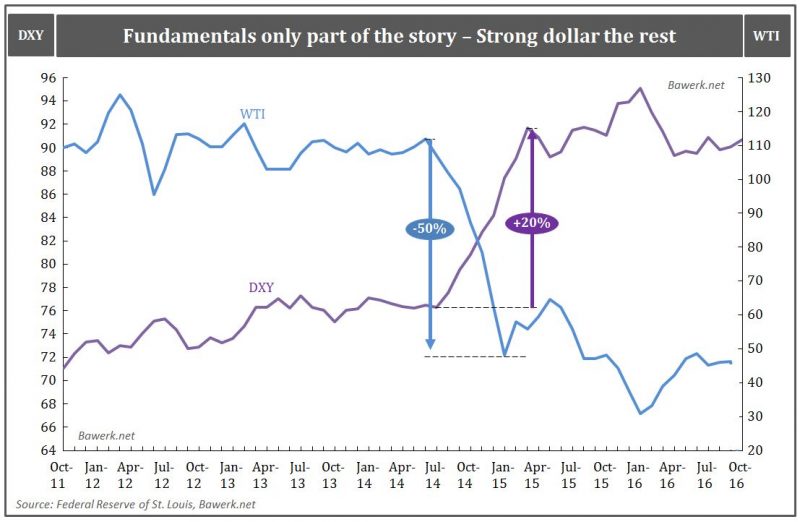

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar.

Read More »

Read More »

Crude Oil Has Entered a Seasonal Downtrend

Many market observers are probably expecting crude oil prices to enter a seasonal uptrend due the beginning heating season. After all, the heating season in the Northern hemisphere means that energy consumption will rise. The effect of the heating season on demand is however offset by other factors, such as the use of alternative energy sources and fixed prices agreements made in advance. The question is: what is the actual seasonal trend in crude...

Read More »

Read More »

Great Graphic: CRB Index Revisited

Interest rates and 10-year break-evens are rising. Some think the CRB Index is tracing out a head and shoulders bottom. We look for inflation in non-tradable goods' prices (think services).

Read More »

Read More »

“Subtle forward guidance”: The marriage between best practice central banking and commodity markets

In the years following the 2008 crash and today, the use of forward guidance from central banking policy makers has become increasingly important. What this nonsense ultimately has translated into is a ridiculous track record in posting upbeat assessments on the economic environment, aimed at trying to fool the marginal investor into believing “there are no need for worry, central bankers have everything under control”.

Read More »

Read More »

Great Graphic: China’s PPI and Commodities

China's PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China's PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside.

Read More »

Read More »

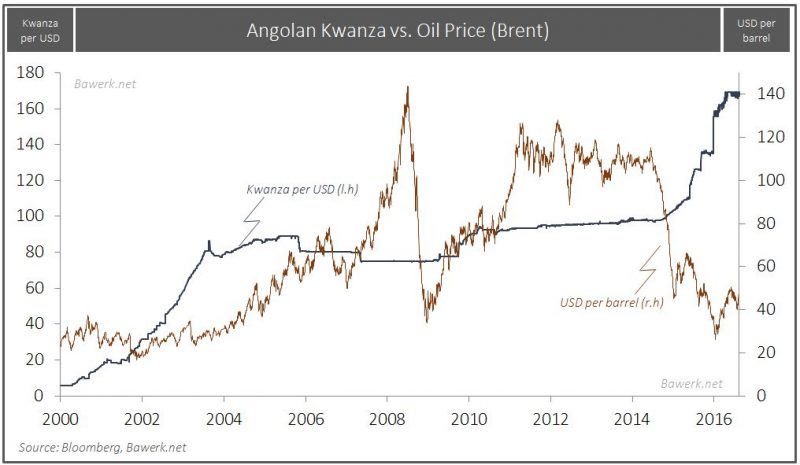

The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August.

Read More »

Read More »

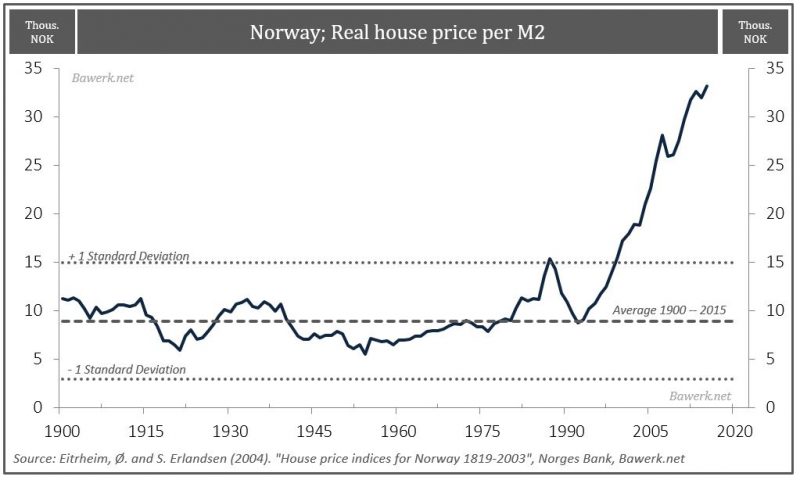

Norway: Towards Stagflation

We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades.

Read More »

Read More »

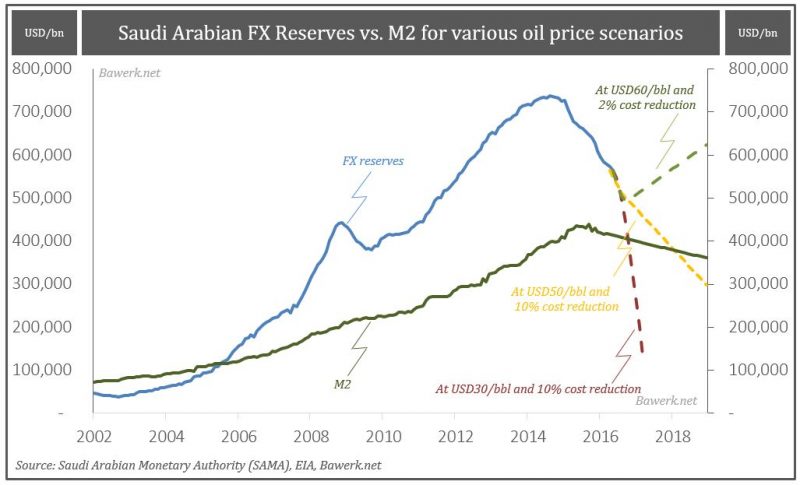

Saudi-Arabia: Peg or Banking Crisis?

During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the...

Read More »

Read More »

The Stunning Idiocy of Steel Tariffs

Victims of the Boom-Bust Cycle The world is drowning in steel – there is huge overcapacity in steel production worldwide. This is a direct result of the massive global credit expansion that has taken place over the past 15 years. Much of this capac...

Read More »

Read More »

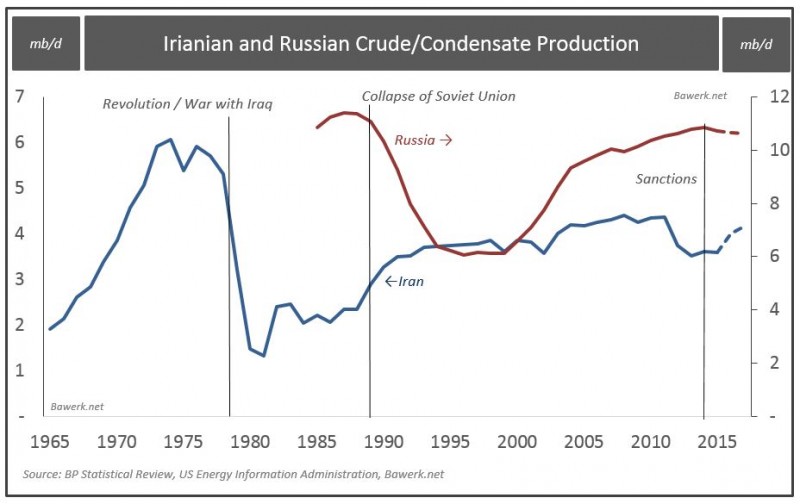

OPEC Politics: Russian King, Iranian Crown Prince?

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town.

Read More »

Read More »

Commodities – Will the Rally Continue?

Pros and Cons The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to c...

Read More »

Read More »

Revisiting the CRB Index

The CRB Index is building on last Friday's gains, when it gapped higher. That gap marked the end of the down move we anticipated on March 28. The index fell through the two supports we identified (171.30 and 169.50), before bottoming on April...

Read More »

Read More »

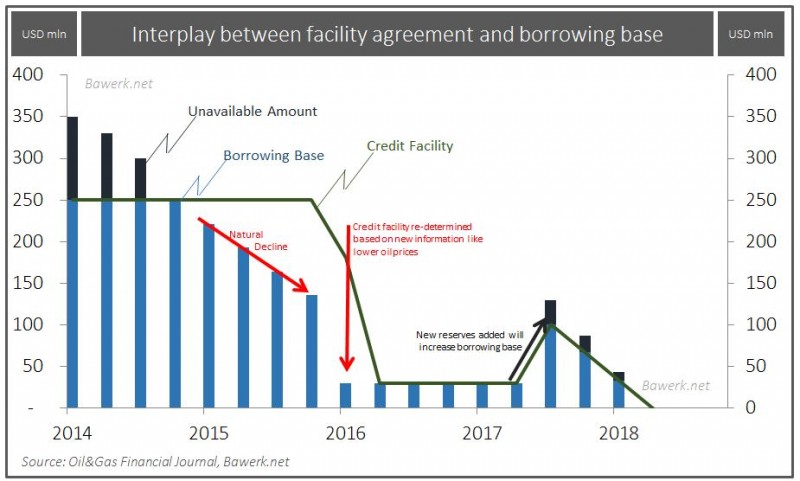

OPEC’s Doha Dilemma: 3mb/d US lock in?

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs.

Read More »

Read More »

Great Graphic: Bottom Building on CRB Commodity Index?

Marc Chandler shows that after the commodity currency Canadian Dollar, also the CRB Commodity index could have found a bottom. See here his Great Graphic on the CAD bottom buildung. See also the CAD resilience despite falling oil prices.

Read More »

Read More »