Tag Archive: China

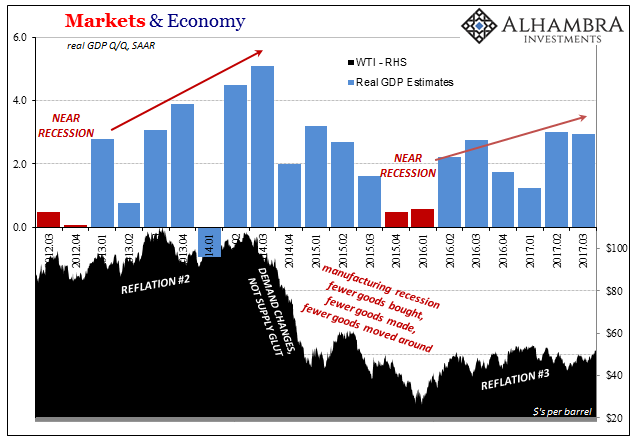

Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy...

Read More »

Read More »

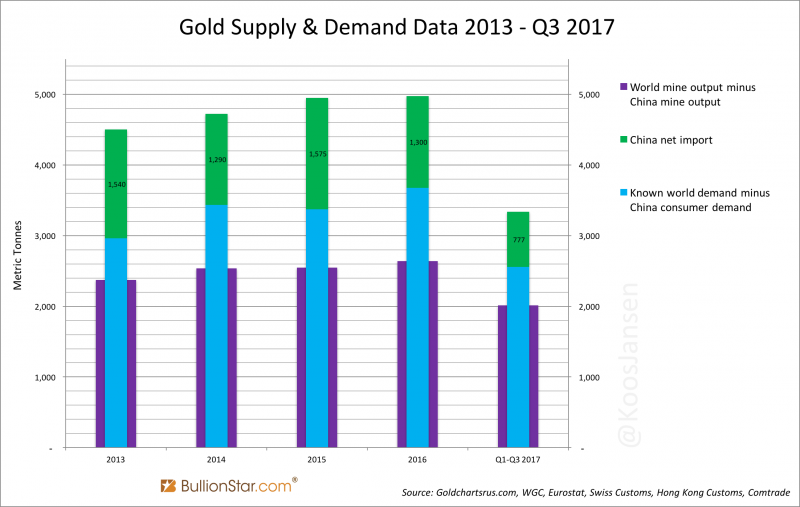

China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day.

Read More »

Read More »

Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »

Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic.

Read More »

Read More »

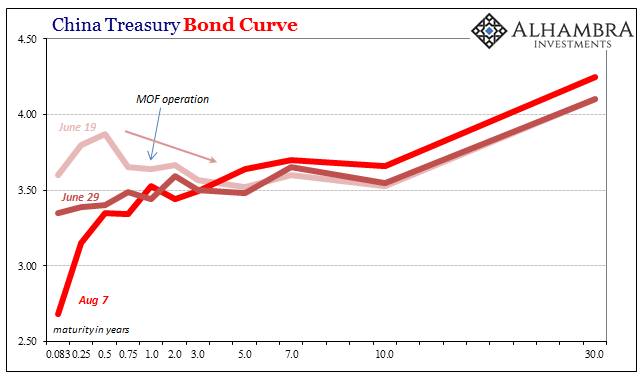

Bonds And Soft Chinese Data

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year.

Read More »

Read More »

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public, demand soared as investors...

Read More »

Read More »

A Look Inside The Secret Swiss Bunker Where The Ultra Rich Hide Their Bitcoins

Somewhere in the mountains near Switzerland’s Lake Lucerne lies a hidden underground vault containing a vast fortune. It’s no ordinary vault, according to Quartz. Built inside a decommissioned Swiss military bunker dug into a granite mountain, it’s precise location is a closely guarded secret, and access is limited by myriad security precautions.

Read More »

Read More »

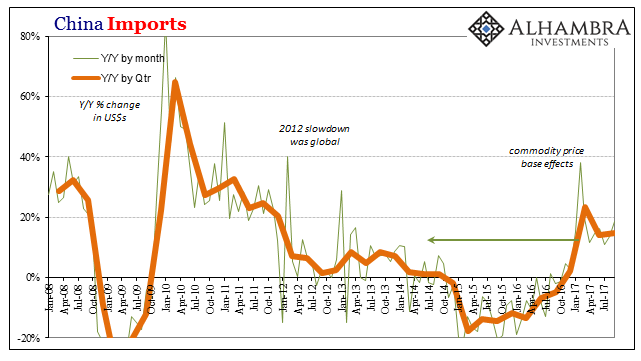

Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence...

Read More »

Read More »

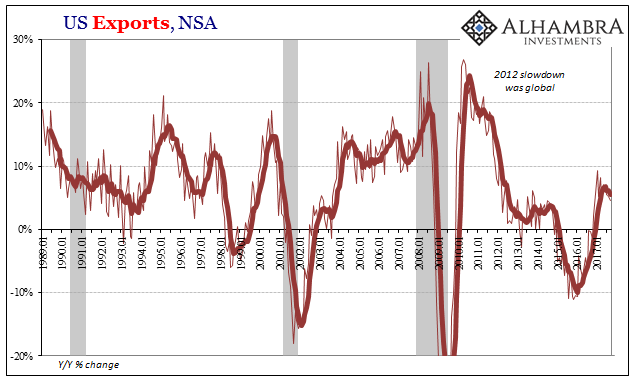

China Exports/Imports: Enforcing A Global Speed Limit

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

Read More »

Read More »

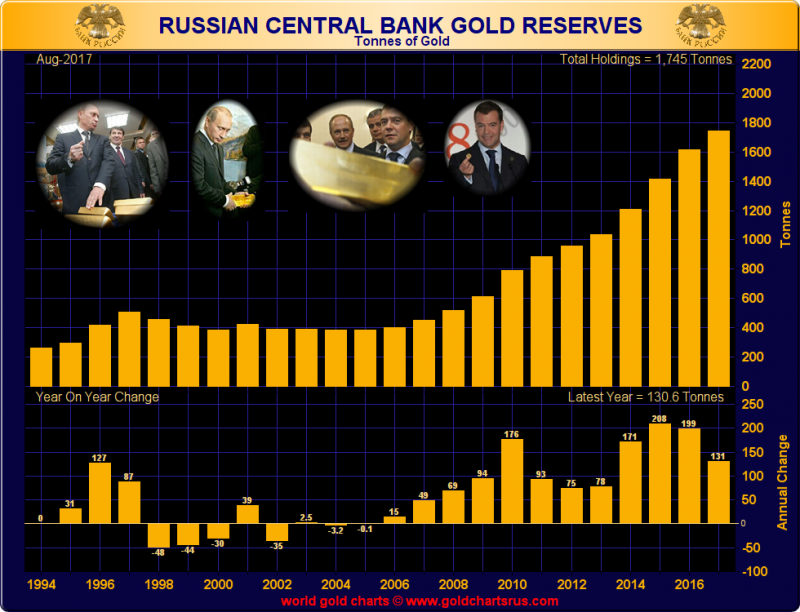

Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those of China and Russia.

Read More »

Read More »

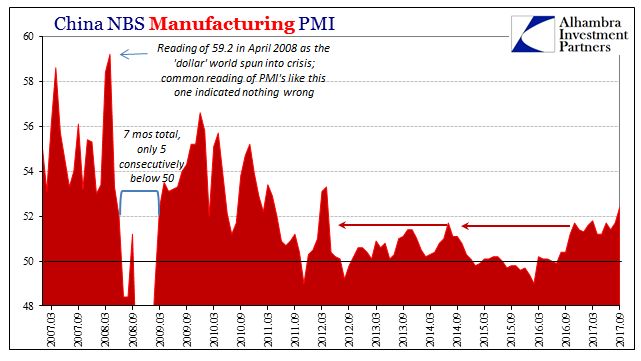

Noisy PMI’s In China

In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes. In China, the potential for irregularity is perhaps as great, though it has nothing to do with the weather. In a little over a week, Communist Party officials will gather for their 19th Party Congress.

Read More »

Read More »

“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without dumping a huge and unwelcome...

Read More »

Read More »

Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese reformer.

Read More »

Read More »

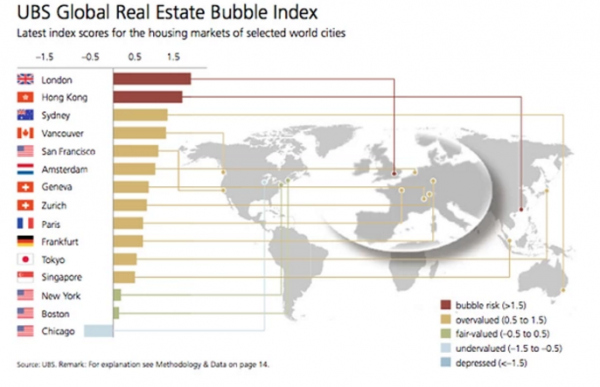

The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk.What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble.

Read More »

Read More »

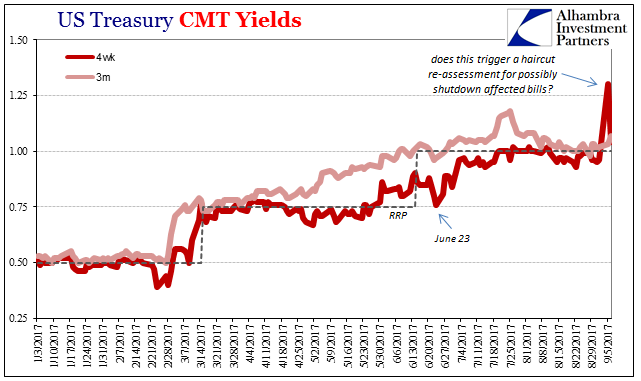

It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

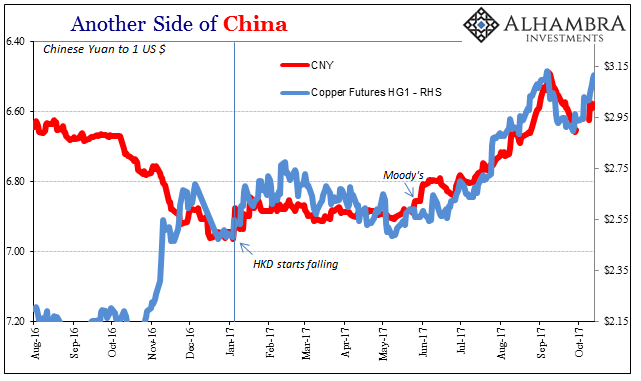

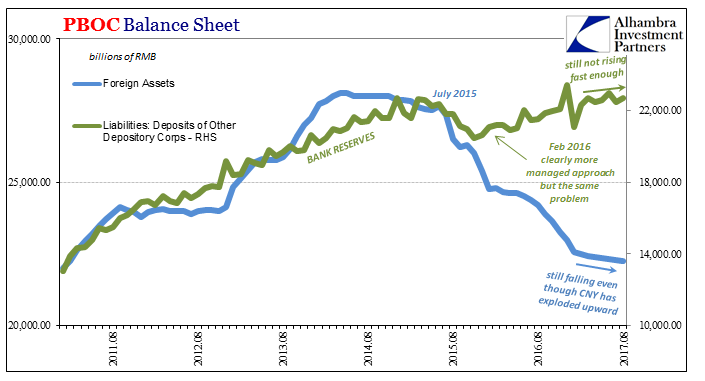

Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely.

Read More »

Read More »

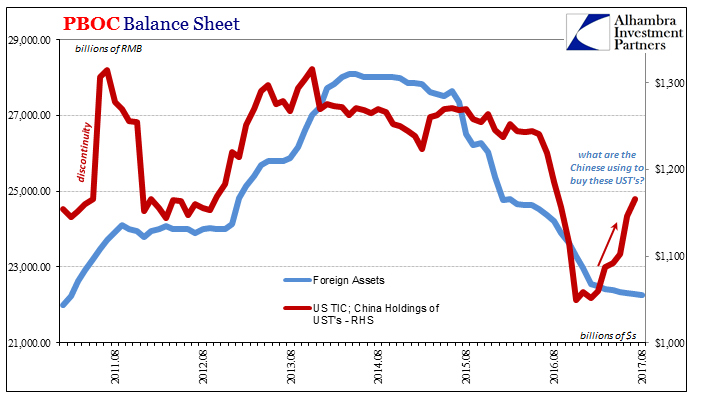

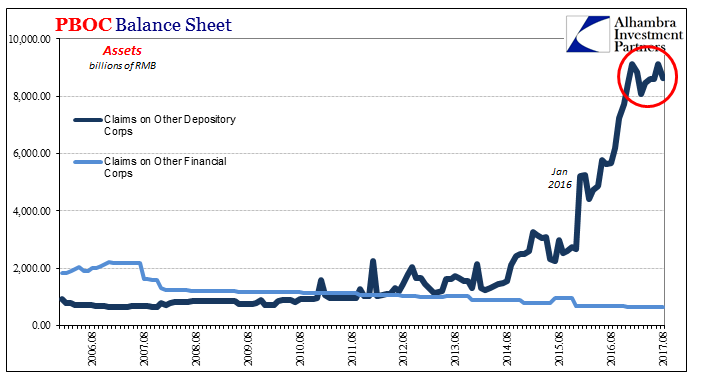

PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.

Read More »

Read More »