Tag Archive: China Fixed Asset Investment

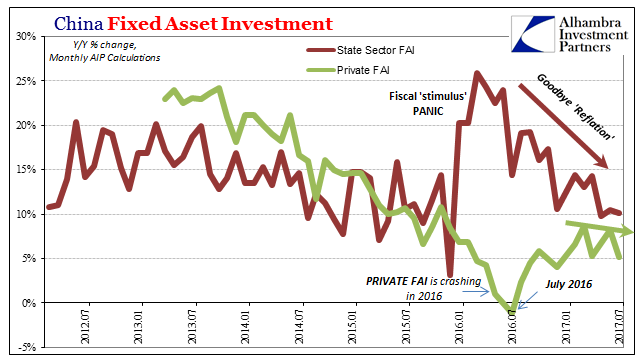

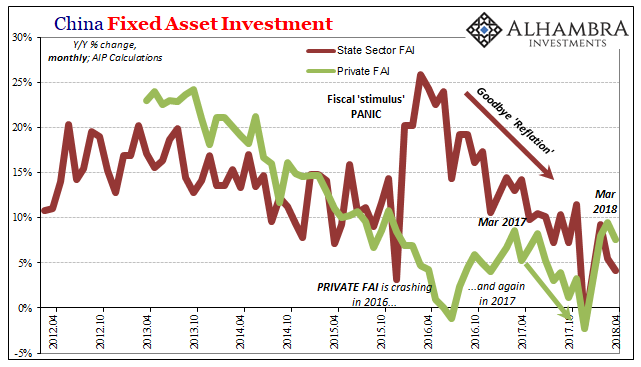

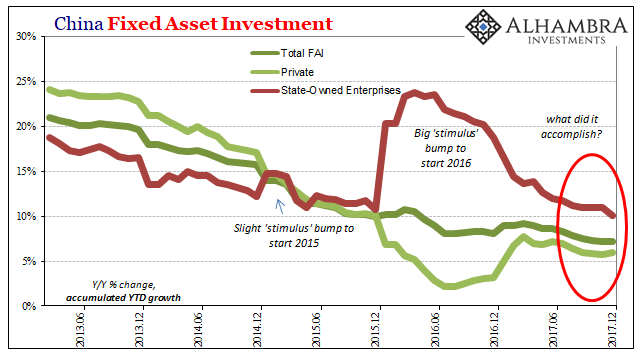

Chinese Fixed Asset Investment measures the change in the total spending on non-rural capital investments such as factories, roads, power grids, and property.

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

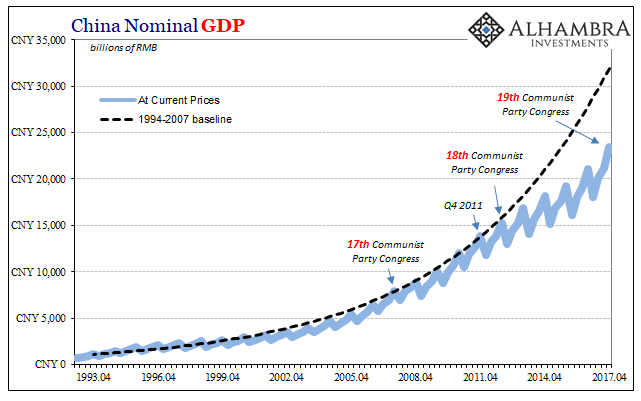

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

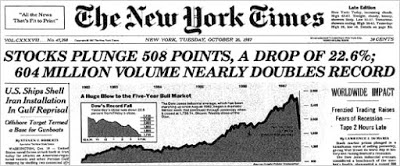

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese reformer.

Read More »

Read More »

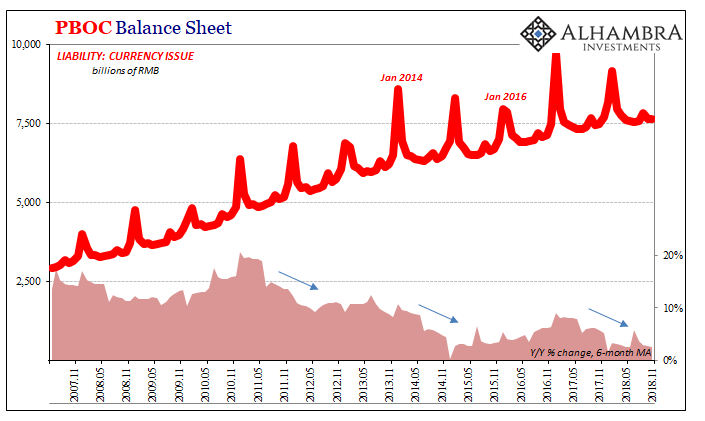

PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

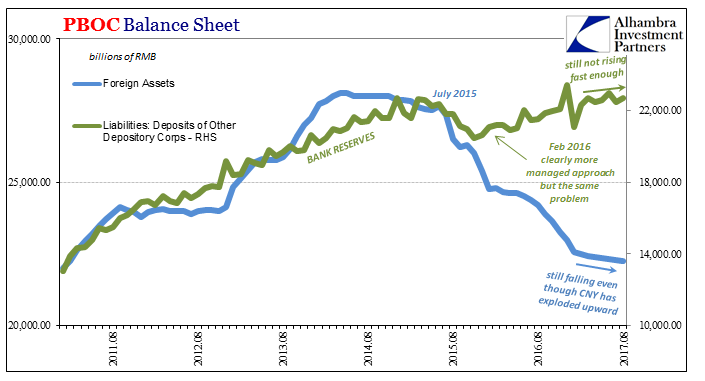

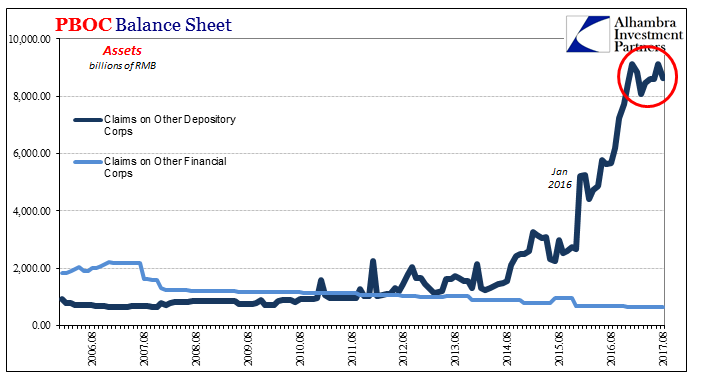

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.

Read More »

Read More »

A Clear Anchor

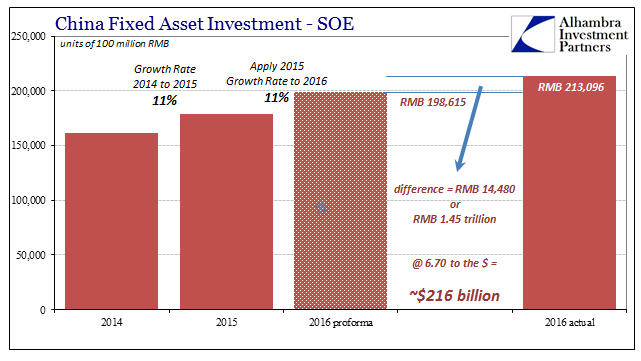

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE). By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP

Read More »

Read More »

FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration's agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the...

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

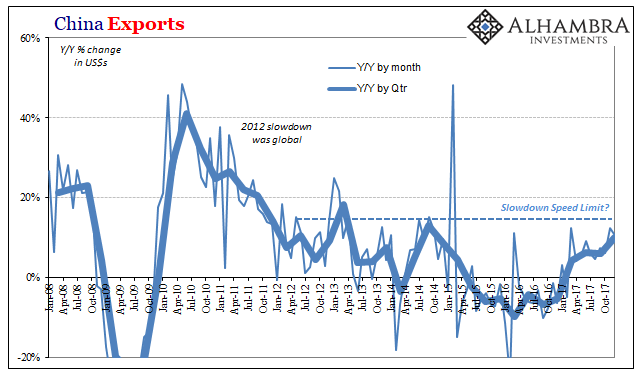

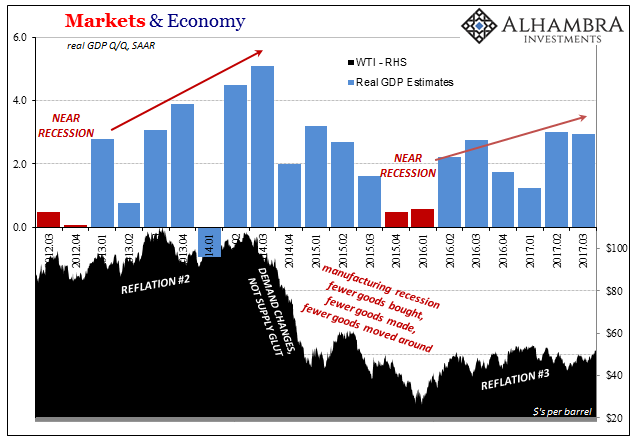

China: Losing Economic ‘Reflation’

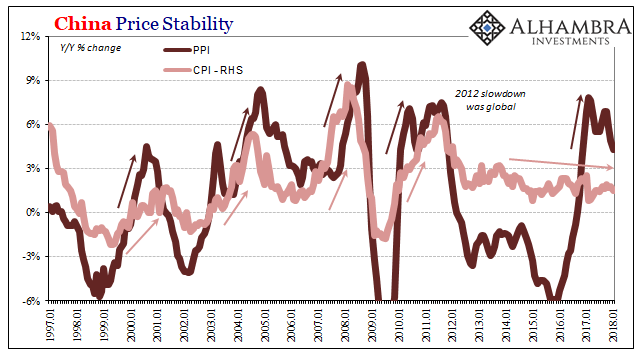

If “reflation” was born last year in Japan, and I think it was, it was surely given its most tangible dimensions in China. The idea that the Bank of Japan was going to do something magnificent was perhaps always a longshot, but enough given the times for people to hope (sentiment) they might try (helicopter). The Chinese, however, have been relatively more pragmatic. Authorities began 2016 with an actual rather than imagined “stimulus” injection...

Read More »

Read More »

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »

China’s Economy Shorthand the Largest Asset Bubble in Human History

The term “ghost city” is a loaded one, often deployed to skew toward a particular viewpoint. In the context of China’s economy, it has become shorthand for perhaps the largest asset bubble in human history. While that may ultimately be the case, in truth China’s ghost cities aren’t about the past but its future.

Read More »

Read More »

FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies.

Read More »

Read More »

Chinese Basis For Anti-Reflation?

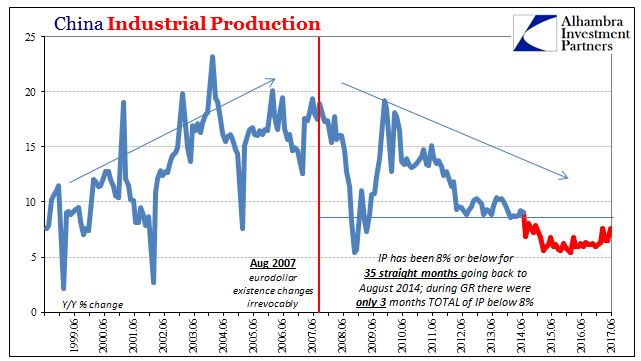

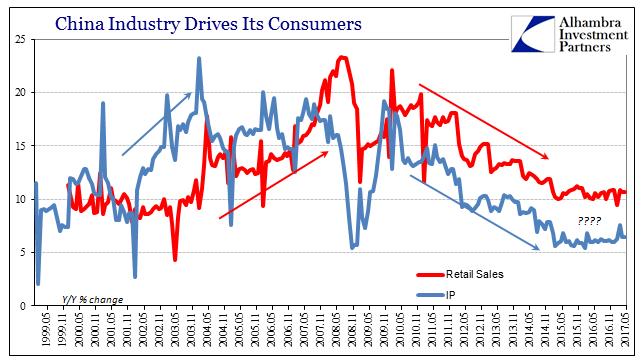

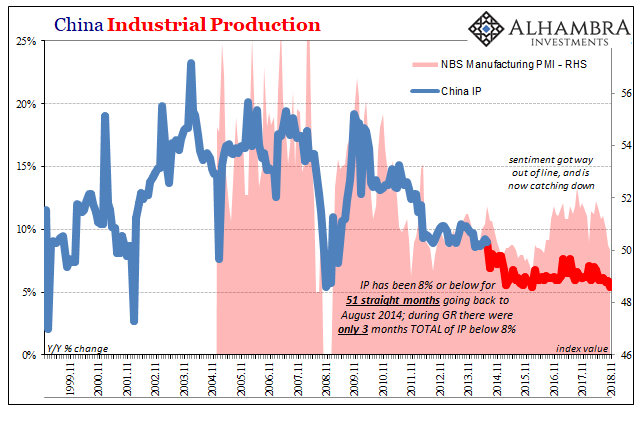

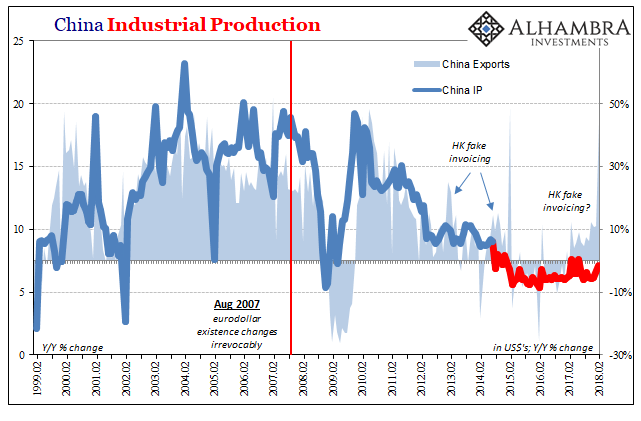

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

FX Daily, May 15: Softer Dollar and Yen to Start the Week

The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated.

Read More »

Read More »

FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to open, the dollar is softer against the all major currencies and many emerging market currencies.

Read More »

Read More »

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

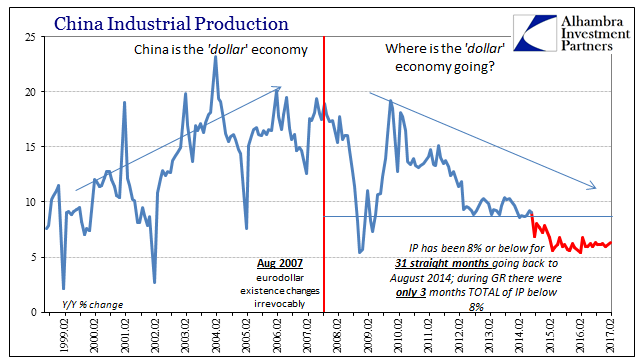

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

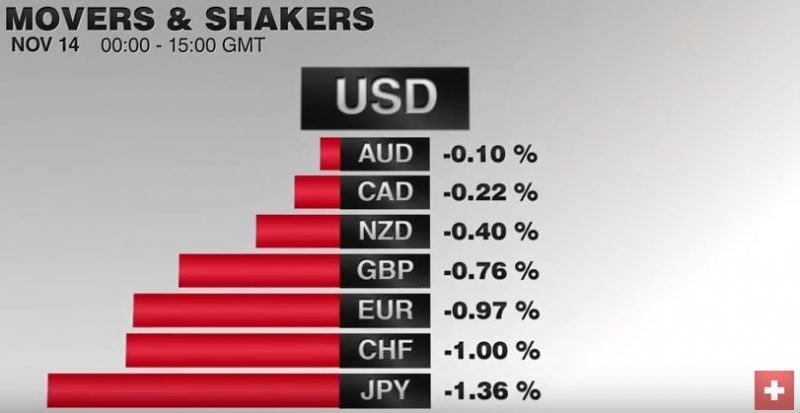

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »