Tag Archive: China Fixed Asset Investment

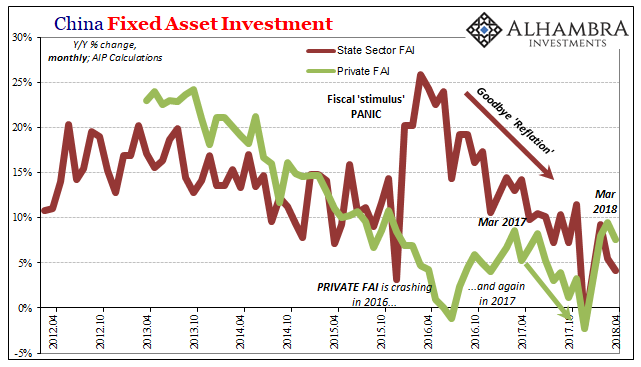

Chinese Fixed Asset Investment measures the change in the total spending on non-rural capital investments such as factories, roads, power grids, and property.

FX Daily, August 14: Consolidation Featured Ahead of the Weekend

The equity rally is stalling ahead of the weekend. Most markets in the Asia Pacific region eased, though China and Australia advanced. Japanese shares were mixed. The Nikkei, though advanced for the fourth consecutive session, while the Topis slipped.

Read More »

Read More »

FX Daily, June 15: Unwind Continues

Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today's activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei's 3.5% drop, and South Korea's 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

China’s Eurodollar Story Reaches Its Final Chapters

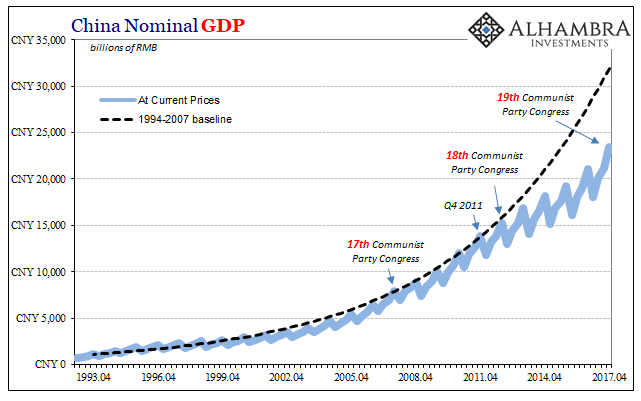

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream.

Read More »

Read More »

The Relevant Word Is ‘Decline’

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation.

Read More »

Read More »

Anchoring Globally Synchronized Growth, Or We Gave Up Long Ago?

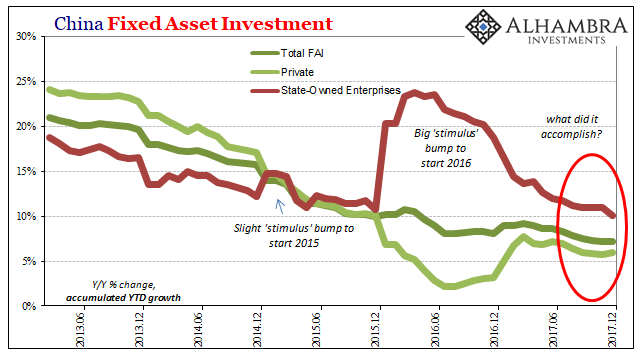

January was the last month in which China’s National Bureau of Statistics (NBS) specifically mentioned Fixed Asset Investment (FAI) of state holding enterprises (or SOE’s). For the month of December 2017, the NBS reported accumulated growth (meaning for all of 2017) in this channel of 10.1%. Through FAI of SOE’s, Chinese authorities in early 2016 had panicked themselves into unleashing considerable “stimulus.”

Read More »

Read More »

FX Daily, May 15: Firm US Rates Underpin Greenback

US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a three-day advance. China and India were able to buck the regional move. China's economic data was mostly softer than expected and is consistent with a gradual turn in the cycle as the Lunar New effect fades.

Read More »

Read More »

China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really,...

Read More »

Read More »

FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week's high near $1.24, and sterling rose through the January high to reach its best level since the mid-2016 referendum. Sterling rose through $1.4375 before the easing after the employment report.

Read More »

Read More »

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

China’s Questionable Start to 2018

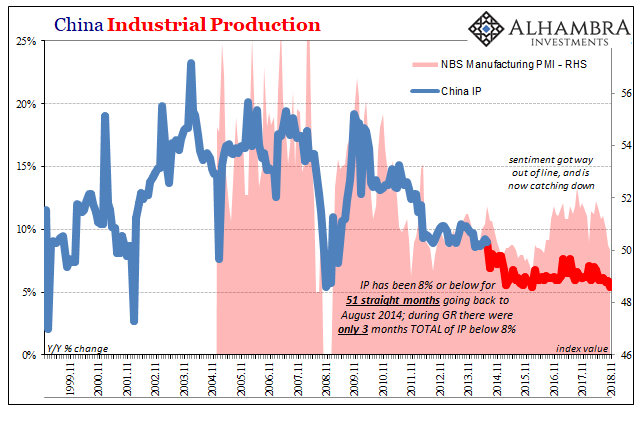

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

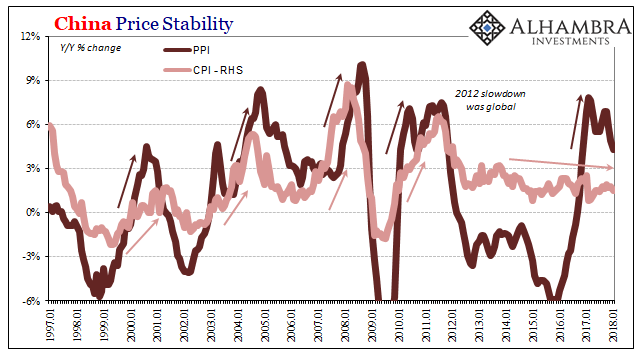

China: Inflation? Not Even Reflation

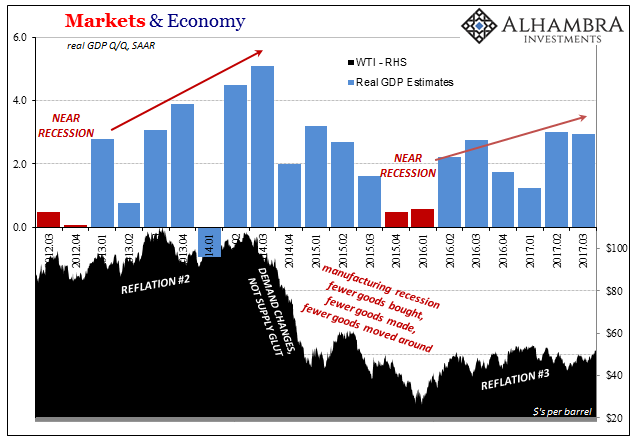

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still.

Read More »

Read More »

FX Daily, January 18: Currencies Consolidate After Chop Fest

The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed's Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries.

Read More »

Read More »

The Dea(r)th of Economic Momentum

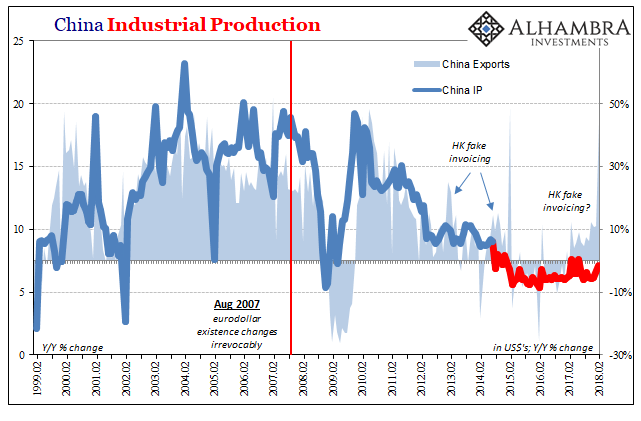

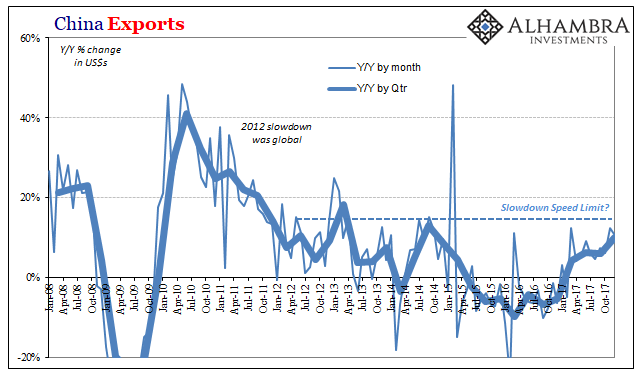

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape.

Read More »

Read More »

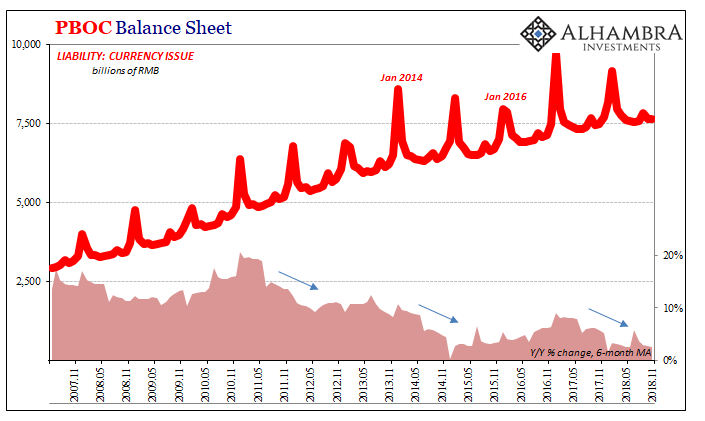

Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day).

Read More »

Read More »

FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment forecasts. Yet its interest rate trajectory and inflation forecasts were largely unchanged. Yellen, as her recent predecessors have done, played down the implications of the flattening of the yield curve.

Read More »

Read More »

Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have pushed oil investors to buy...

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »