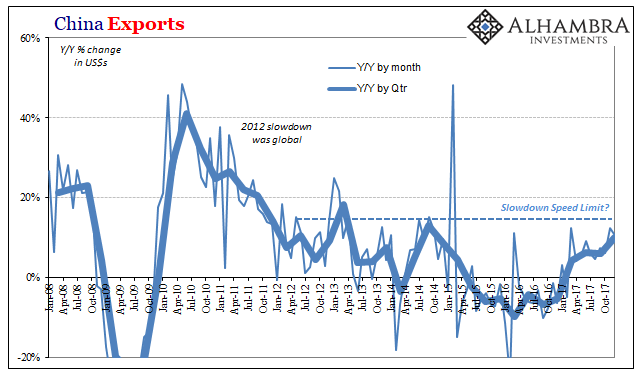

Tag Archive: China Exports

The term export means shipping in the goods and services out of the jurisdiction of a country. The seller of such goods and services is referred to as an “exporter” and is based in the country of export whereas the overseas based buyer is referred to as an “importer”. In international trade, “exports” refers to selling goods and services produced in the home country to other markets.

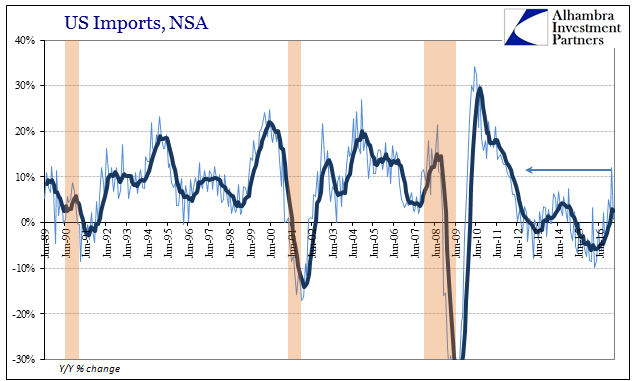

February US Trade Disappoints

The oversized base effects of oil prices could not in February 2017 push up overall US imports. The United States purchased, according to the Census Bureau, 71% more crude oil from global markets this February than in February 2016. In raw dollar terms, it was an increase of $7.3 billion year-over-year. Total imports, however, only gained $8.4 billion, meaning that nearly all the improvement was due to nothing more than the price of global oil.

Read More »

Read More »

FX Daily, March 08: Dollar Bid as Rates Firm

The US dollar is moving higher against nearly all the other major foreign currencies today. As far as we can tell, the driving force remains interested rate considerations. US rates are rising in absolute terms and about Europe and Japan. The US 10-year yield is moving above the downtrend that has been in place since the day after the Fed hiked rates last December.

Read More »

Read More »

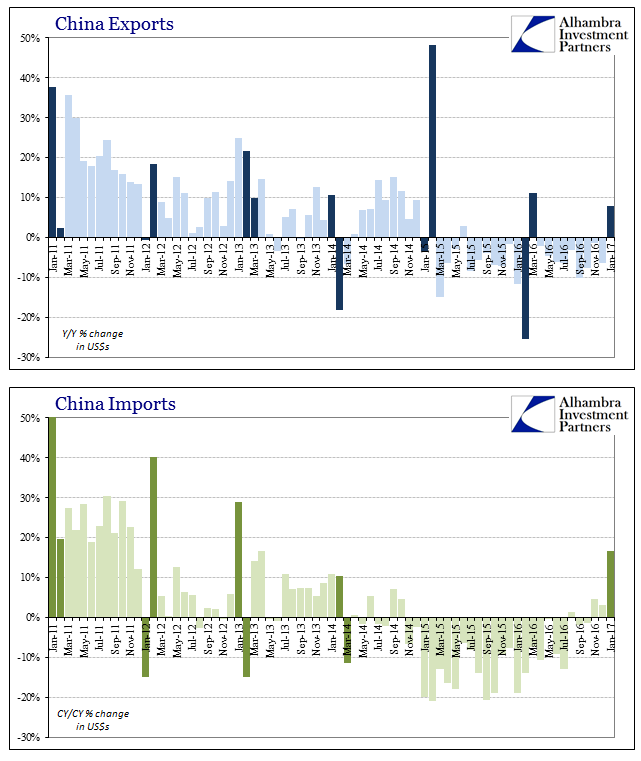

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »

FX Daily, February 10: US Dollar Holding on to Week’s Gains

The US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week's decline. The Aussie is the strongest on the day, up about 0.2% to trim the week's loss to about 0.45%.

Read More »

Read More »

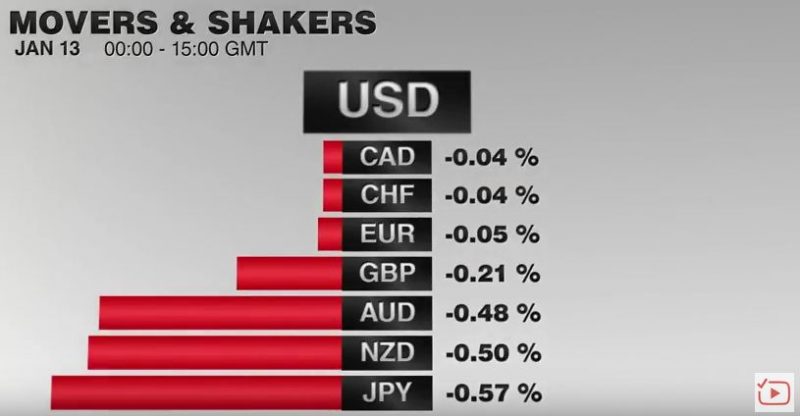

FX Daily, January 13: Corrective Forces Persist

The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote.

Read More »

Read More »

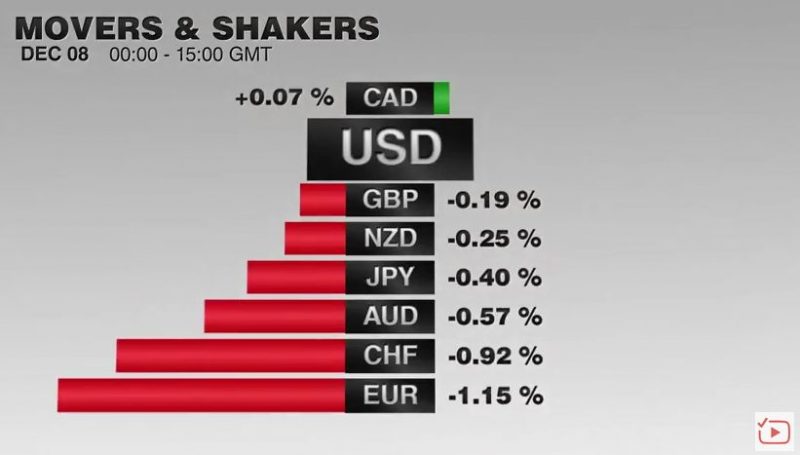

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

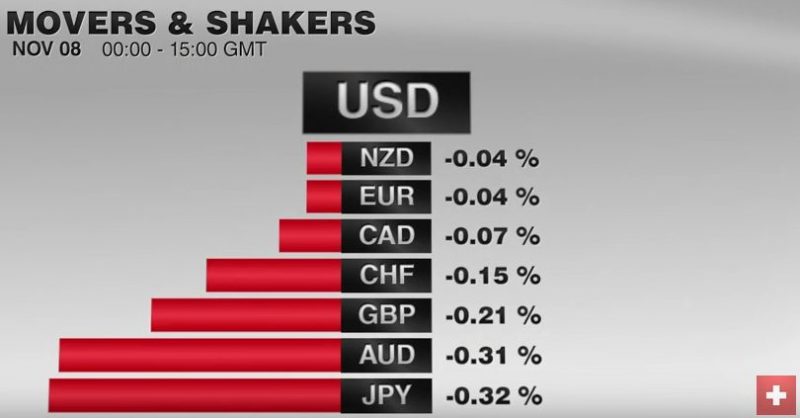

FX Daily, November 08: Consolidation Featured as Market Catches and Holds Breath

The equity markets snapped their losing streak yesterday and are consolidating today. The US dollar is narrowly mixed. The euro and sterling are slightly firmer, but well within yesterday's ranges. The dollar-bloc is a bit lower, and once again the Australian dollar is struggling to sustain moves above $0.7700.

Read More »

Read More »

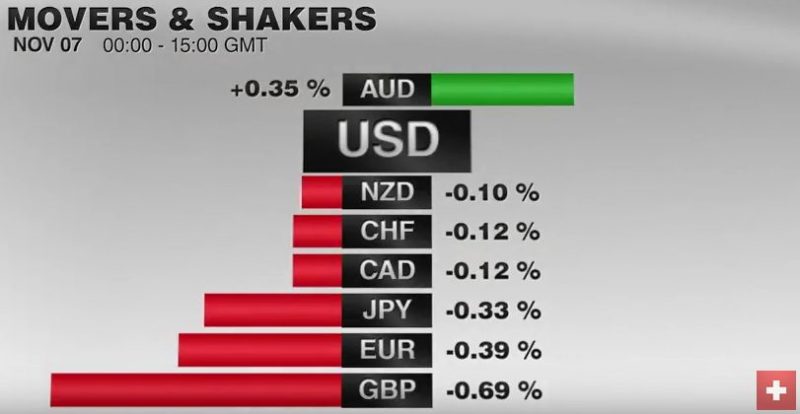

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »

FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow.

Read More »

Read More »

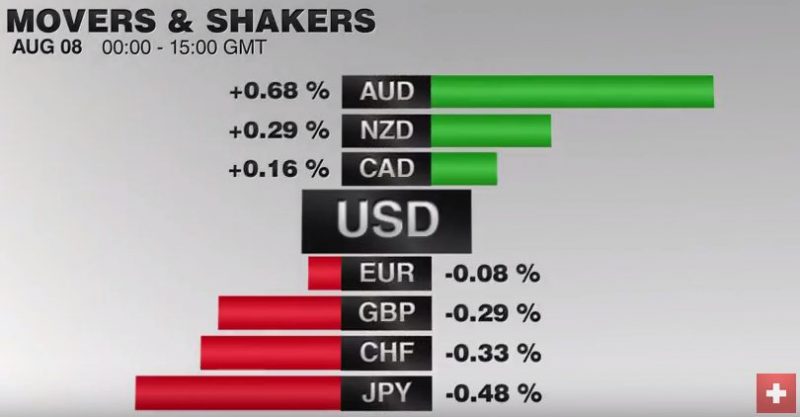

FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia.

Read More »

Read More »

FX Daily, July 13: Sterling and Yen Momentum Slows

The two main developments in the foreign exchange market this week in recent days has been the opposite of what has transpired over the past several weeks. Sterling moved higher quickly. The yen moved down just as fast. Over the past five sessions through late-morning levels, sterling has gained 2.5% while the yen has shed 2.8%.

Read More »

Read More »

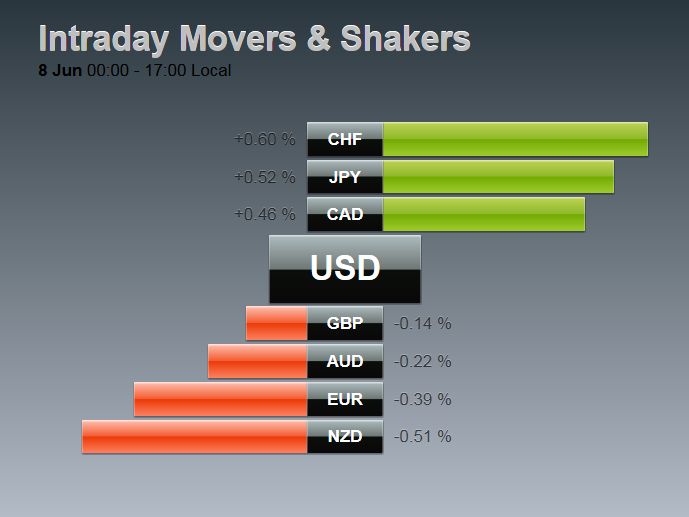

FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

Once again the Swiss Franc appreciates both against EUR and USD.

The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596.

The foreign exchange market is quiet. The euro remains confined to the

narrow range seen on Monday between $1.1325 and $1.1395. We continue to

look for higher levels near-term as the

drop from May 3 (~$1.1615) to May 30 (just be...

Read More »

Read More »