Tag Archive: $CHF

Rate Adjustment Underpins Greenback

Overview: The adjustment to US interest rates

continues and this helps underpin the US dollar. The 10-year yield rose to

4.40% yesterday, the highest it has been since last November. It is trading

4.34%-4.38% today. The two-year yield is firm though holding below the Q1 high

set last month near 4.75%. This week, for the first time since last October,

the Fed funds futures do not have at least a quarter point cut discounted for

July. As recently as...

Read More »

Read More »

Can the US Employment Report be Anti-Climactic Ahead of Long North American Weekend?

Overview: Nothing is decisive, but the recent

string of data pushes the needle a little more to a soft landing for the US

economy and gave the US dollar another leg up. The risk is that some of the buying

drained some of the interest that may materialize after today's US jobs report. The

greenback is softer against the major currencies except the Japanese yen. The

dollar is extending its rally against the yen for the sixth consecutive session

and...

Read More »

Read More »

EMU GDP Surprises, while the Yen’s Short Squeeze Continues

Overview: The month-end and slew of data is making for a

volatile foreign exchange session, while the rash of earnings has generally

been seen as favorable though weakness was seen among the semiconductor chip

fabricators. China, Hong Kong, and Japanese equities fell but the other large

markets in the region rose.

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »

US CPI to Accelerate, while Omicron adds Color to Covid Wave that was Already Evident

At the risk of over-simplifying, there seem to be three sources of dynamism in the investment climate: Covid, the Federal Reserve, and market positioning. The last of these is often not given its due in narratives in the press and market commentary, so let's begin there. The anthropologist Clifford Gertz once posed the question about distinguishing between someone winking and someone with a twitch in their eye, and a person mimicking the wink or...

Read More »

Read More »

Market Shrugs Off Chinese Signals and Keeps the Yuan Bid

Overview: The US dollar has come back bid from the weekend against most currencies following the talk by a couple of Fed governors about the possibility of accelerating the tapering at next month's FOMC meeting. The weekend also saw protests against the social restrictions being imposed by several European countries in the face of a surge in Covid cases. The Swedish krona, yen, and sterling are the weakest, while the dollar-bloc currencies are...

Read More »

Read More »

FX Daily, June 9: Profit-Taking Gives Turn Around Tuesday Its Name

Overview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia's 2.4% rally and the 1.6% gain in Hong Kong stood out. Europe's Dow Jones Stoxx 600 was off for a second day (~1.3%), and US stocks are trading heavily, warning that the S&P 500 may give...

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

FX Daily, August 5: China Strikes Back

Overview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the mainland session a little above CNY7.03 and CNH7.07 for the offshore yuan.

Read More »

Read More »

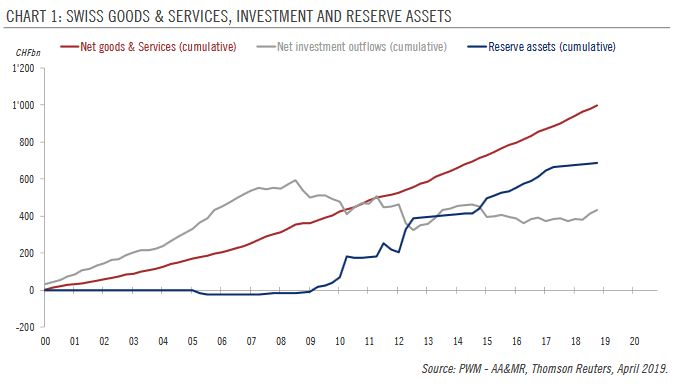

Limited room for Swiss franc depreciation

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less...

Read More »

Read More »

FX Daily, February 11: Dollar Starts New Week on Firm Note

Lifted by the re-opening of Chinese markets after the week-long Lunar New Year holiday, global equities are trading firmer. Outside of Japanese markets that were closed, the large markets in Asia--China, Taiwan, South Korea, and Hong Kong advanced.

Read More »

Read More »

FX Daily, November 29: Reluctant to Extend Dollar Losses

Overview: The biggest US equity advance since Q1 has helped lift global markets today. The MSCI Asia Pacific Index rose for the fourth session, and nearly all the bourses in the region rallied with the notable exception of China and Hong Kong. Almost all the sectors in Europe are rallying but energy and real estate. US oil inventories rose three times more than expected and Putin expressed little support for fresh output cuts.

Read More »

Read More »

Dollar Slips, though Emerging Markets Trade Heavily

The US dollar is beginning the new week on a soft note, as China threatens not to accept the invitation for trade talks in Washington if the US imposes new tariffs on $200 bln of its goods, which the Wall Street Journal reports could come as early as today. Meanwhile, the MSCI Emerging Markets Index is giving back half of the 2.5% rally seen in the second half of last week.

Read More »

Read More »

FX Daily, September 10: Initial Extension of Euro and Sterling Losses Stall

The US dollar's pre-weekend gains were extended against most the major currencies, but the euro, sterling, and Australian dollar have recovered in the European morning. Emerging markets currencies are mixed. The Indian rupee is the weakest(of the emerging market currencies (~-0.8%) following the widening of the Q2 current account deficit at the end of last week and ahead of the August trade deficit which is expected to show the impact of rising...

Read More »

Read More »

FX Weekly Preview: Testing the Dollar’s Breakout

The US dollar surged last week, with the Dollar Index rising 1.25%, the most since April. The dollar is being boosted by two drivers. The first is the policy mix and interest rate divergence. The other is the intensification of pressure on emerging market. Turkey has a disastrous combination of more fundamentals, large short-term foreign currency debt obligations, unorthodox policies, and the lack of credibility.

Read More »

Read More »

FX Daily, June 21: Dollar Driven Higher

The half-hearted and shallow attempts by the currencies to recover appear to be emboldening the dollar bulls today, The greenback is higher against all major and emerging market currencies today. Demand for dollars is strong enough to offset the broader risk-off environment that is pulling stocks and core yields lower that is usually supportive of the yen.

Read More »

Read More »

FX Daily, June 01: Ironic Twists to End the Tumultuous Week

The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade).

Read More »

Read More »

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »

Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

The Swiss National Bank's decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not exactly clear where the euro bottomed in the frenzied activity that followed the SNB's surprise move. Bloomberg records the euro's low near CHF0.8520.

Read More »

Read More »