Tag Archive: capital flows

FX Daily, March 16: Equities Firm, but Markets Tread Gingerly

Overview: Yesterday's new record highs in the S&P 500 and Dow Jones Industrial helped set the tone for today's advance in the Asia Pacific region and Europe. The MSCI Asia Pacific Index snapped a two-day decline, with other major markets rising today.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

Forex Forensics: The Case of the Yen

Over the past five sessions, the yen is the strongest of the major currencies, appreciating about 1.7% against the US dollar, eclipsing the Swedish krona, which rallied strongly today after the Riksbank's surprise rate hike. Given the sell-off in equities and the decline in markets, the yen's strength is not surprising.

Read More »

Read More »

Capital Flocks to the US

The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing.

Read More »

Read More »

Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China's practices are a source of frustration and animosity broadly and widely.

Read More »

Read More »

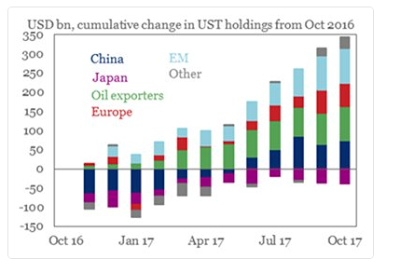

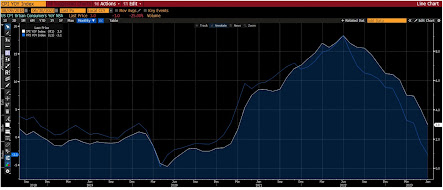

Great Graphic: Treasury Holdings

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed's balance sheet shrinks, investors will have to step up their purchases.

Read More »

Read More »

Impressive Japanese Flows at the end of the Fiscal Year

Japanese investors bought foreign bonds in the last week of March for the first time in nine weeks. Foreigners bought the most Japanese stocks since last April. The pain trade is for a break of JPY110.

Read More »

Read More »

Japanese Capital Flows: Six Observations

The following observations are drawn from the weekly report of Japan’s Ministry of Finance unless noted otherwise. We use the weekly data instead of monthly to identify changes of trend earlier. We use simple convention of the week by the last rather than the first day. That means that the report for the week ending April …

Read More »

Read More »

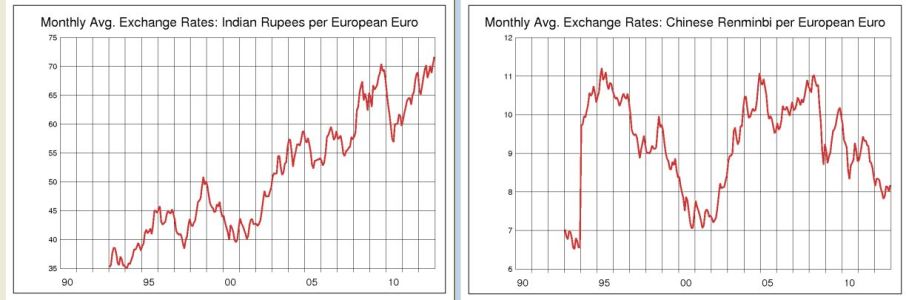

(1) What Determines FX Rates?

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

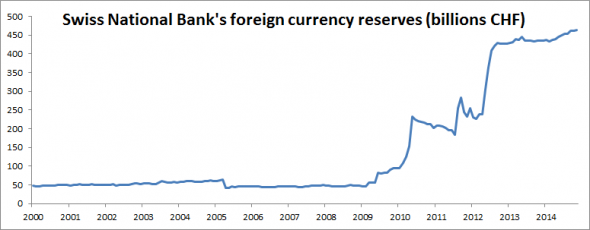

Why did the Swiss franc spike? Lack of Capital Outflows

There is a straightforward answer to the question in the headline: more money has been trying to get into Switzerland than get out, which didn’t affect the exchange rate as long as the Swiss National Bank bought foreign currency. As soon as they stop...

Read More »

Read More »