Tag Archive: bond market

Deja Vu

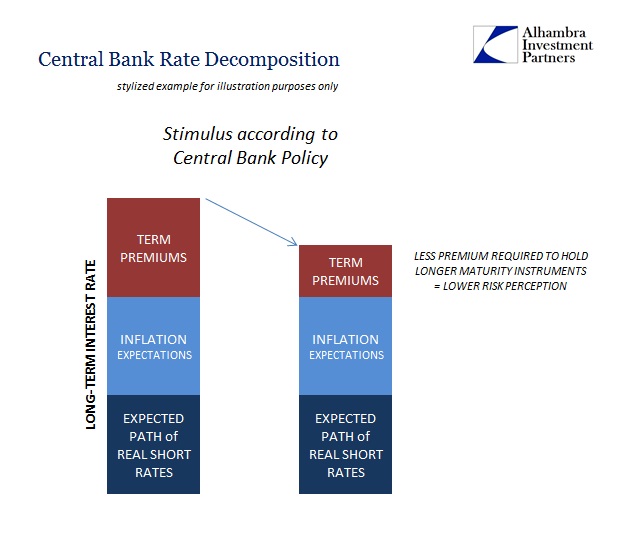

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to...

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

Retail Sales Conundrum

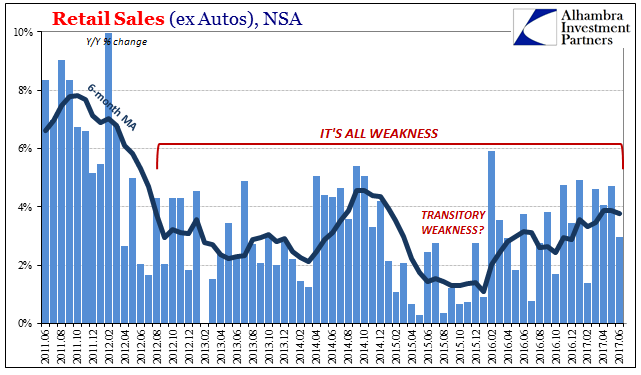

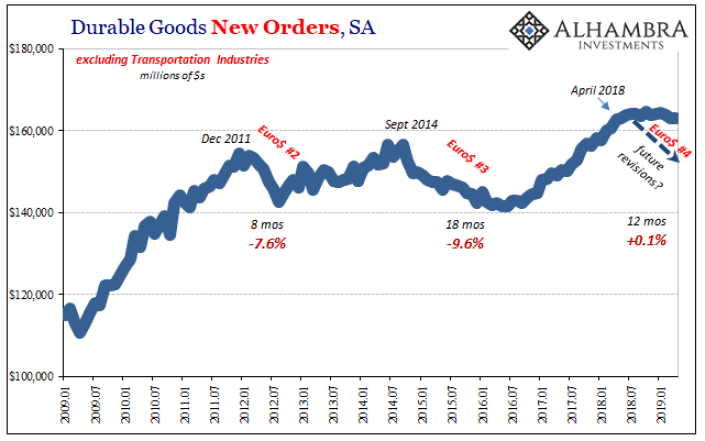

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January.

Read More »

Read More »

Fading Further and Further Back Toward 2016

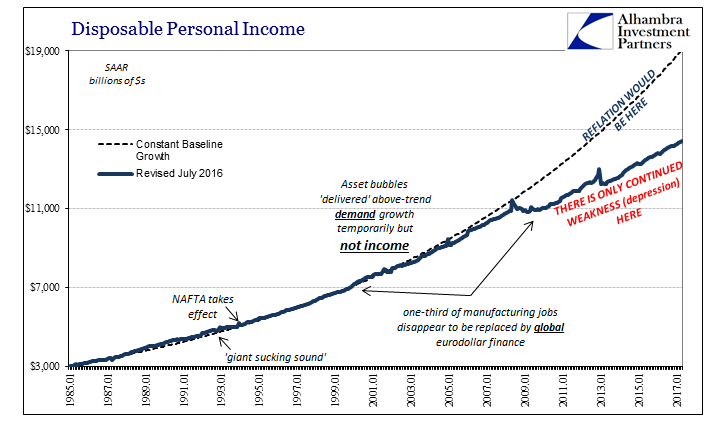

Earlier this month, the BEA estimated that Disposable Personal Income in the US was $14.4 trillion (SAAR) for April 2017. If the unemployment rate were truly 4.3% as the BLS says, there is no way DPI would be anywhere near to that low level. It would instead total closer to the pre-crisis baseline which in April would have been $19.0 trillion. Even if we factor retiring Baby Boomers in a realistic manner, say $18 trillion instead, what does the...

Read More »

Read More »

Repeat 2015; An Embarrassing Day For The Fed

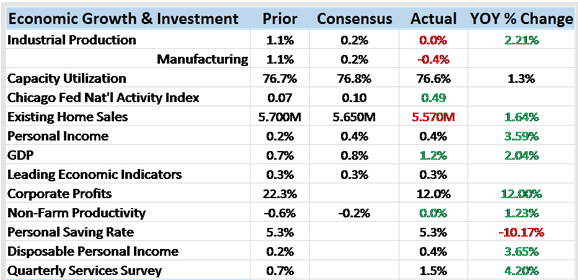

Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

Read More »

Read More »

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

Less Than Nothing

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs.

Read More »

Read More »

The Wrong People Have An Innate Tendency To Stand Out

I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of that kind could be transposed...

Read More »

Read More »

Noose Or Ratchet

losing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks.

Read More »

Read More »

Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it.

Read More »

Read More »

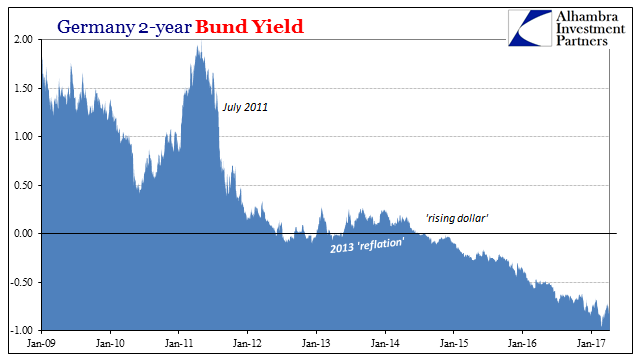

The Global Burden

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

US Jobs: Who Carries The Burden of Proof?

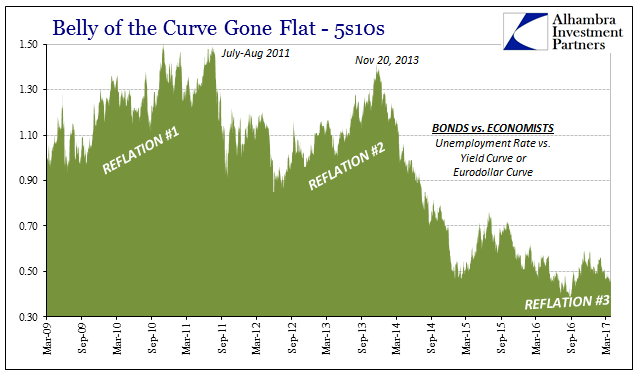

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »