Tag Archive: Bank of Japan

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

Greenback Softens Ahead of CPI

Overview: It appears that investors have become more concerned about growth prospects and less about inflation in recent days. The US 10-year yield that had flirted with 3.20% at the start of the week is now around 2.93%.

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

Yields Jump, Greenback Bid

Overview: Yields are surging. Canada and Australia's two-year yields have jumped 20 bp, with

the US yield up 10 bp to 2.37% ahead of the $50 bln sale later today. The US 10-year yield has risen a more modest three basis points to 2.50%, flattening the 2-10-year yields curve. The 5–30-year curve has inverted for the first time since 2016.

Read More »

Read More »

US Jobs, EMU CPI, Japan’s Tankan, and China’s PMI Highlight the Week Ahead

This year was supposed to be about the easing of the pandemic and the normalization of policy. Instead, Russia's invasion of Ukraine threw a wrench in the macroeconomic forecasts as St. Peter’s victories broke the brackets of the NCAA basketball championship pools.

Read More »

Read More »

The Week Winds Down with Equities under Pressure and the Dollar Mostly Firmer

Overview: The combination of the volatility and a large number of central bank meetings have exhausted market participants, and the holiday phase appears to have begun. Equities are under pressure following the sell-off yesterday in the US. Japan, China, and Hong Kong suffered more than 1.2% losses, while Australia, South Korea, and Taiwan posted minor gains. It was the fifth loss in the past six sessions for the MSCI Asia Pacific Index. Europe's...

Read More »

Read More »

Central Bank Fest

Next week is the last big week of the year, and what a week it will be: Five major central banks meet and at least nine from emerging market countries. Norway's Norges Bank is the most likely major central bank to hike its key (deposit) rate (December 16). It would be the second hike of the year. The economy is enjoying a solid recovery, and headline inflation rose to 4.6% in November, its fastest pace since 2008. The underlying rate, which...

Read More »

Read More »

You Don’t Have To Take My Word For It About Eliminating QE

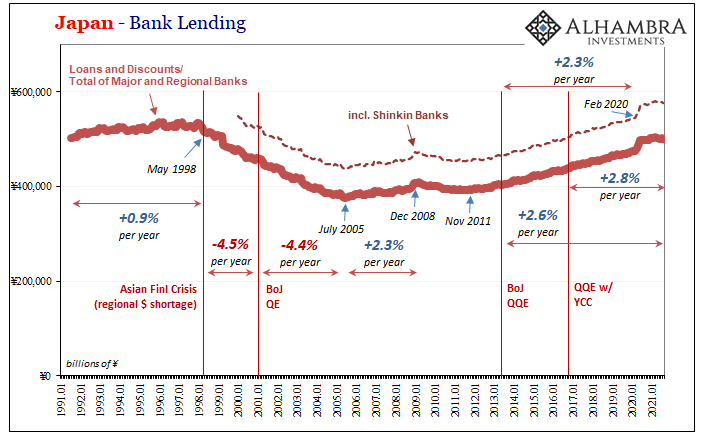

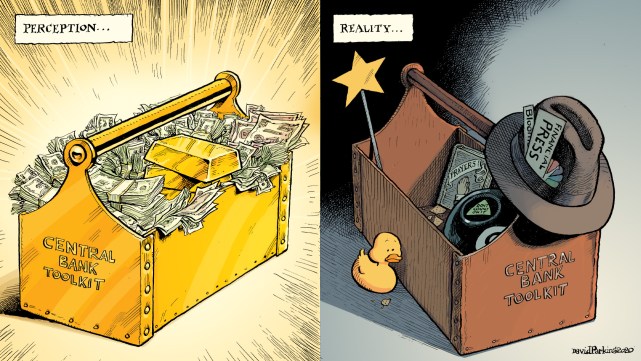

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s.

Read More »

Read More »

Week Ahead: The First Look at US and EMU Q3 GDP and more Tapering by the Bank of Canada

The macro highlights for the week ahead fall into three categories. First are the preliminary estimates for Q3 GDP by the US and the EMU. Second, are the inflation reports by the same two. The US sees the September PCE deflator, which the Fed targets, while the eurozone releases the first estimate for October CPI. Third are the meetings of three G7 central banks, the BOJ, the ECB, and the Bank of Canada. The broad backdrop includes softening...

Read More »

Read More »

August Avoids Zero In JGB’s

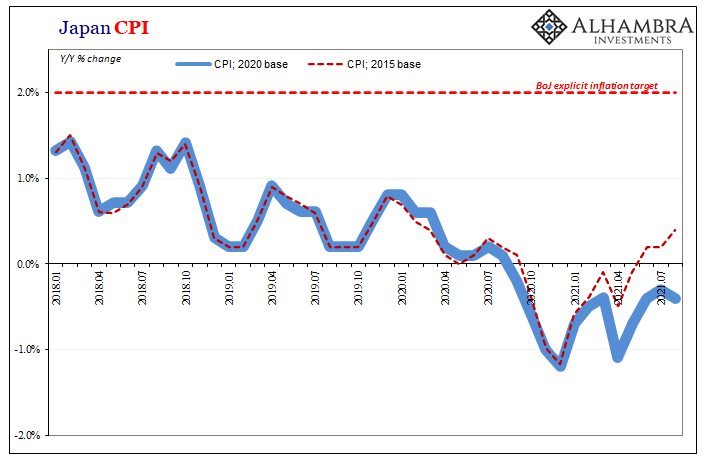

Central banks and their staffs have long been accused of trying to hide inflation. This allegation had been a staple of their critics, those charging reckless monetary policies for creating “too much” money that had allegedly been causing price imbalances all over the financial map.

Read More »

Read More »

What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%.

Read More »

Read More »

FX Daily, July 16: BOJ Tweaks Forecasts

The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland's cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European bourses are edging higher, while US futures are oscillating around unchanged levels.

Read More »

Read More »

Measuring Inflation and the Week Ahead

There is quite an unusual price context for new week's economic events, which include June US CPI, retail sales, and industrial production, along with China's Q2 GDP, and the meetings for the Reserve Bank of New Zealand, the Bank of Canada, and the Bank of Japan.

Read More »

Read More »

FX Daily, June 18: Markets Quiet Ahead of Triple Witching

After some dramatic moves over in the immediate post-Fed period, the markets have quieted. The kind of volatility that is sometimes associated with triple witching expirations in the US may have already taken place. Asia Pacific equities were mixed, but the MSCI benchmark finished with its second consecutive weekly decline.

Read More »

Read More »

FX Daily, April 27: Markets Mark Time Ahead of Fed

Short-covering ahead of the FOMC's outcome tomorrow appears to be lending the US dollar support today. It has extended yesterday's gains against the euro, sterling, and yen. Among emerging market currencies, the Turkish lira, along with the South Korean won and Taiwanese dollar, lead the few advancers.

Read More »

Read More »

Nine Percent of GDP Fiscal, Ha! Try Forty

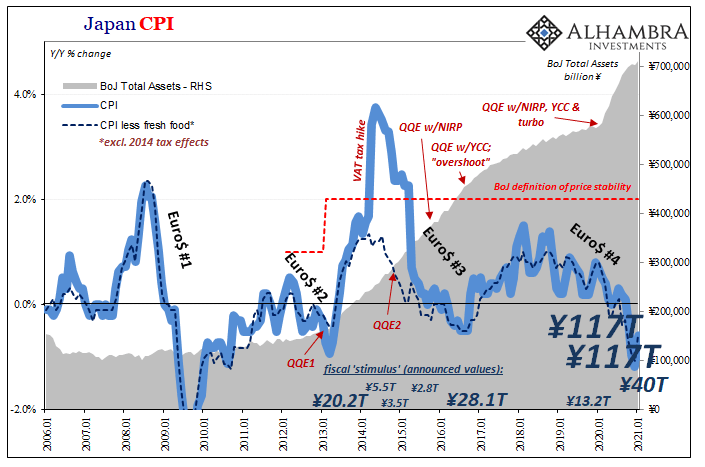

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

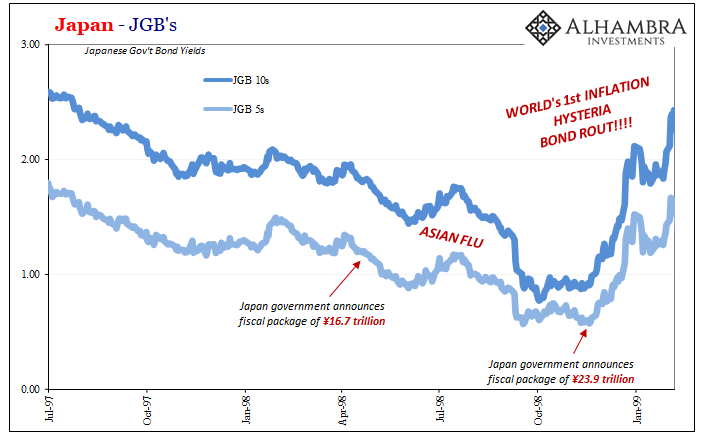

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

FX Daily. October 29: Markets Continue to Struggle

The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region.

Read More »

Read More »

FX Daily, October 20: Narrowly Mixed Markets as Clearer Direction Sought

The capital markets lack a clear direction today. This is reflected in narrowly mixed equities, bonds, and currencies. The spreading contagion is giving rise to new economic concerns, among other things, and the UK-EU talks are struggling to resume, while Pelosi-Mnuchin talks in the US continue to drag.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »