Tag Archive: Bank of Japan

FX Daily, September 30: SNB Intervenes to Polish Q3 Results

True to its recent habit, the US dollar is finishing the week on a firm note. On the month, though, the greenback has fallen against most of the majors, but sterling, the Canadian dollar, and the Swedish krona. Global equities are trading heavily, and investors' angst is lending support to bond markets.

Read More »

Read More »

FX Daily, September 26: Dollar Mixed while Stocks Slide to Begin Last Week of Q3

The US dollar is narrowly mixed. The euro, yen and Swiss franc are higher, while the dollar-bloc and sterling are softer. The moving element here is not so much the greenback, which serving more as a fulcrum, but idiosyncratic, country-level developments.

Read More »

Read More »

Japan’s Planners Ratchet up Monetary Experimentation

It was widely expected that the BoJ would announce something this week after it promised to perform a comprehensive review of its monetary policy. It certainly did deliver a major tweak to its inflationary program, but its implications were seemingly not entirely clear to everybody (probably not even to the BoJ).

Read More »

Read More »

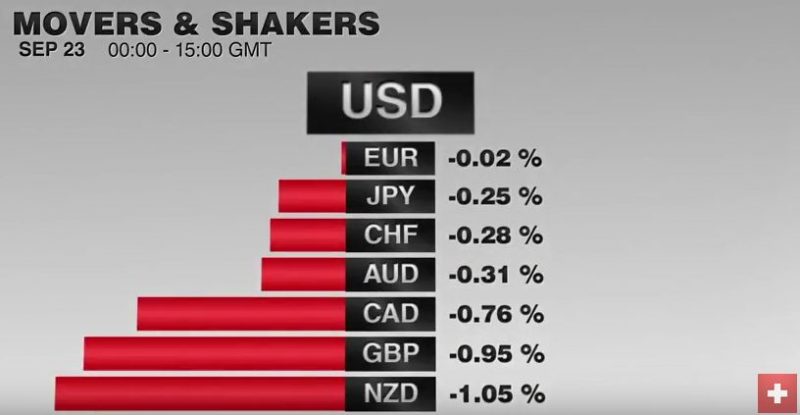

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

The EUR/CHF accelerated its decline since yesterday's strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged.

We know that the Swiss Franc has similar "counter-dollar" status as gold.

Read More »

Read More »

Why should you Buy Government Bonds with Negative Yields?

A question worth asking considering the rather large amount of them knocking about at the moment. According to JPM, the total universe of government bonds traded with a negative yield was $3.6tr last week or 16 per cent of the JPM Global Government Bond Index. It’s an answer in itself, really.

Read More »

Read More »

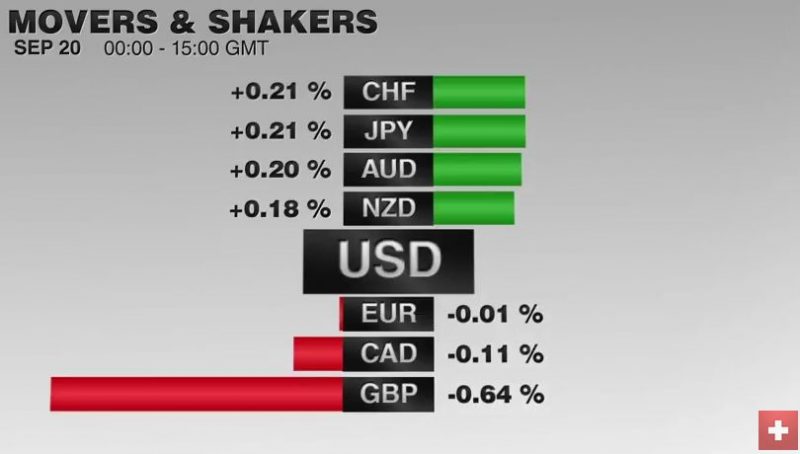

FX Daily, September 20: The Swiss Franc Continues To Rise.

The trade balance express if a currency is overvalued or not. The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued. And the franc continues to appreciate.

Read More »

Read More »

FX Daily, September 19: Dollar Begins Important Week on Softer Note

The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »

Read More »

FX Weekly Preview: Punctuated Equilibrium and the Forces of Movement

Shifting intermarket relationships pose challenge for investors. The market is convinced the Fed will not raise rates. Greater uncertainty surrounds the BOJ; there seems less willingness to shock and awe.

Read More »

Read More »

Janet Yellen’s Shame

n honest capitalism, you do what you can to get other people to voluntarily give you money. This usually involves providing goods or services they think are worth the price. You may get a little wild and crazy from time to time, but you are always called to order by your customers.

Read More »

Read More »

Cash Bans and the Next Crisis

Money sometimes goes “full politics”. Take poor Kenneth Rogoff at Harvard. He wants a dollar with a voter registration card, a U.S. flag on its windshield, and a handgun in its belt – the kind of money that supports the Establishment and votes for Hillary.

Read More »

Read More »

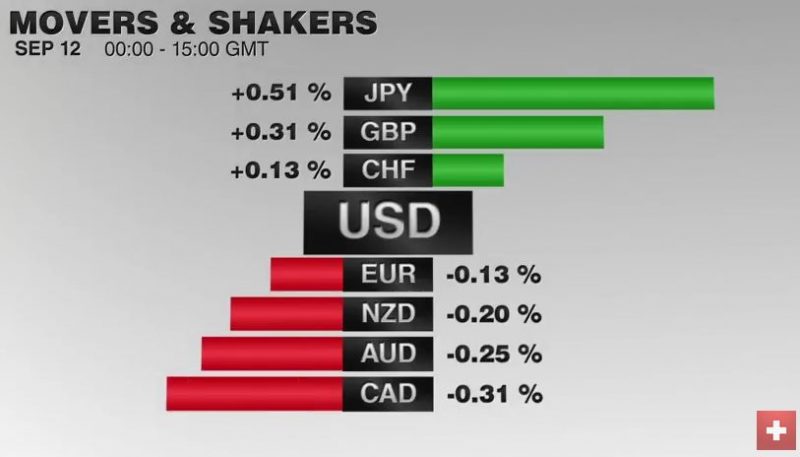

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

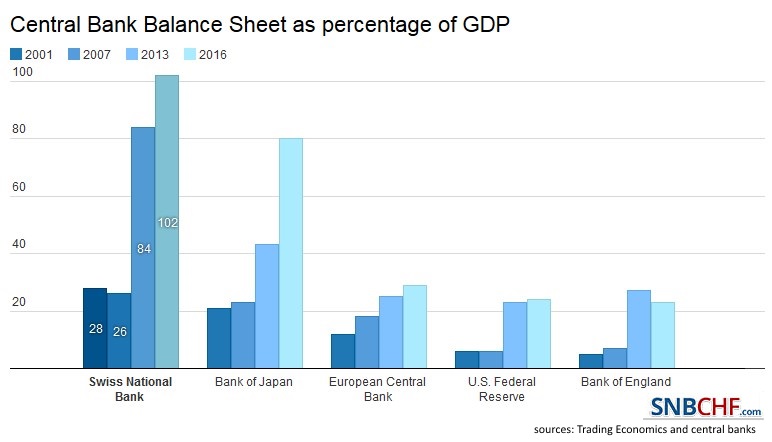

SNB Balance Sheet Now Over 100 percent GDP

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

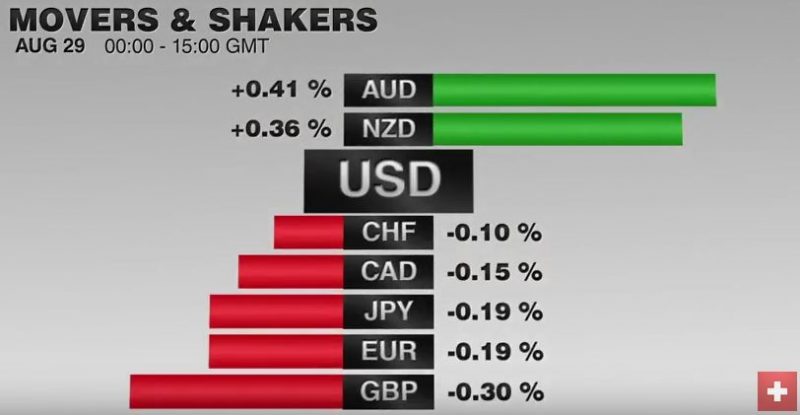

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »

FX Daily, August 26: And now for Yellen…

Yellen's presentation at Jackson Hole today is the highlight of the week. It also marks the end of the summer for many North American and European investors. It may be a bit of a rolling start for US participants, until after Labor Day. However, with US employment data next Friday, many will return in spirit if not in body.

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »