Tag Archive: Australia

FX Daily, May 20: Politics Overshadows Economics Today, but Japan’s Economy Unexpectedly Expanded in Q1

Encouraged by the election results, investors bid up Indian and Australian currencies and equities. Japan offered a pleasant surprise by reporting the world's third-largest economy expanded in Q1. Most other equity markets in Asia fell, and European stocks have the week with small losses.

Read More »

Read More »

FX Daily, May 17: China Questions US Sincerity

Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and...

Read More »

Read More »

FX Daily, May 13: Investors Still Looking for New Balance

The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the agreement. Now China was given around a month to capitulate to US demands or face a 25% tariff on their remaining exports to the US.

Read More »

Read More »

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

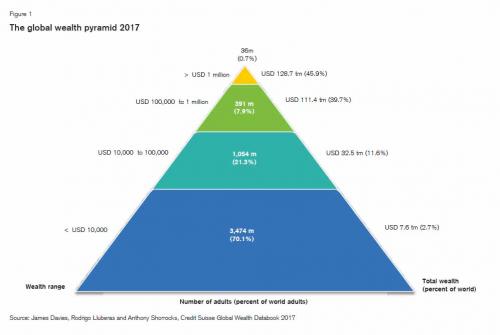

For The First Time Ever, The “1 percent” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank's infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past year, suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without dumping a huge and unwelcome...

Read More »

Read More »

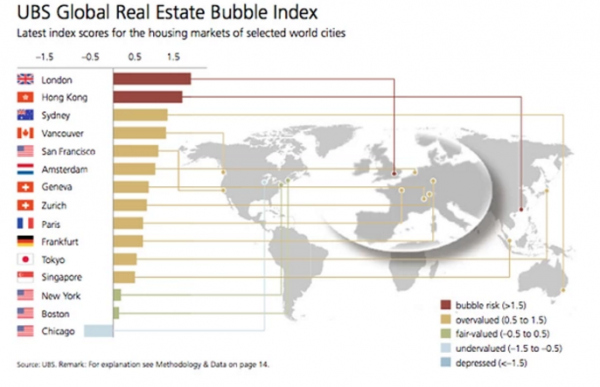

The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk.What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble.

Read More »

Read More »

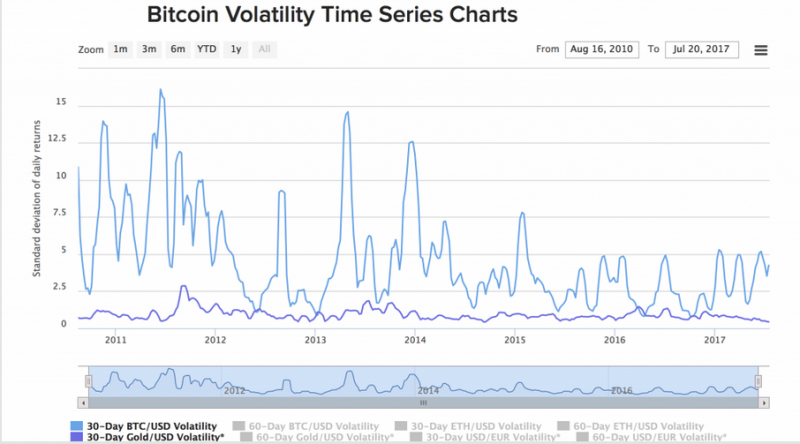

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »

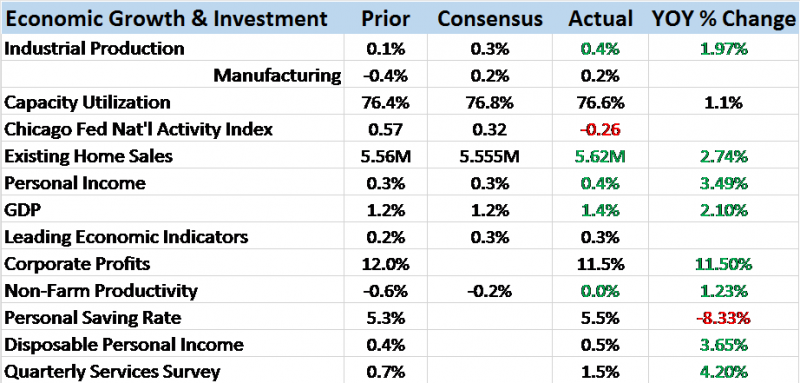

Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels.

Read More »

Read More »

FX Daily, June 19: Dollar Mixed while Equities Recover to Start Eventful Week

The US dollar is mixed against the major currencies, and while it is firmer against the euro and yen, it is within last week's ranges. The success of Macron's new party in France, and the majority is secured, was well anticipated by investors and is having little effect on today's activity in the capital markets.

Read More »

Read More »

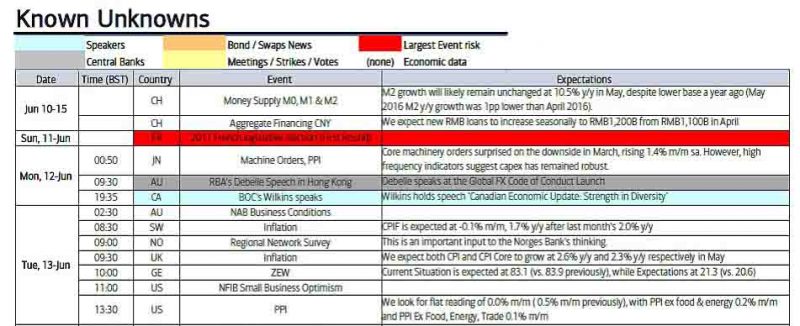

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Great Graphic: Iron Ore and the Australian Dollar

This Great Graphic, from Bloomberg, shows the correlation between the price of iron ore and the Australian dollar on a rolling 60-day basis over the past year. The correlation is a little more than 0.81. The relationship is the tightest since last August. This is purely directional.

Read More »

Read More »

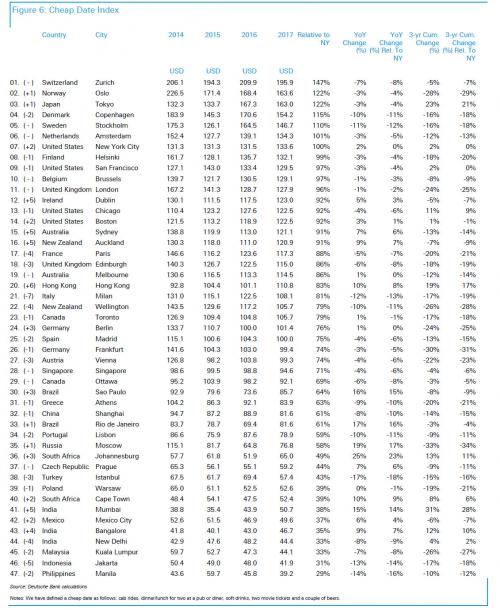

These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of & cheap dates in the world's top cities.

Read More »

Read More »

Life Expectancy Indicates A Nation’s Overall Well Being – So Why Is America’s Dropping?

‘Exceptional’ America is seriously lagging behind in global life expectancy… Via: MesoTreatmentCenters.org Some additional details… Life Expectancy Indicates a Country’s Overall Well Being—So Why Is Ours Dropping? The last time U.S. life expectancy declined at birth 1992-1993: 75.8 to 75.5 years Resulting from high death rates from AIDS, flu epidemic, homicide, and accidental deaths After … Continue reading »

Read More »

Read More »