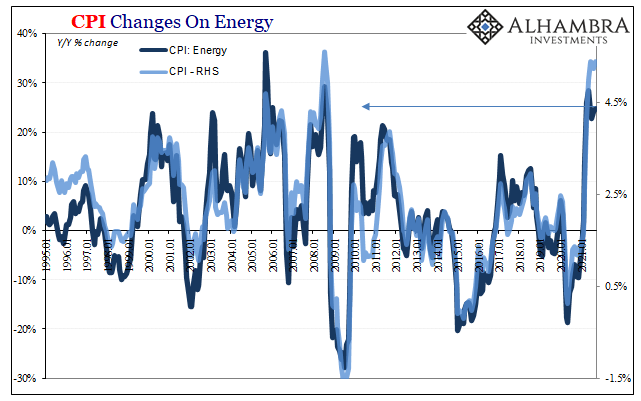

It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE.

Read More »

Tag Archive: 1970s

Don’t Worry, Inflation Will Come Back! It is already there; just not where you might live!

We name the main drivers of disinflation and manipulators of the CPI: Markets, central banks, investors, governments, statisticians, ageing, entrepreneurs, global competition, and last but least the euro.

Read More »

Read More »

History: The Lost 1980s Decade in Latin America

Peripheral Europe is going to follow step and step the Mexican and the resulting Latin American debt crisis of the 1980s.

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

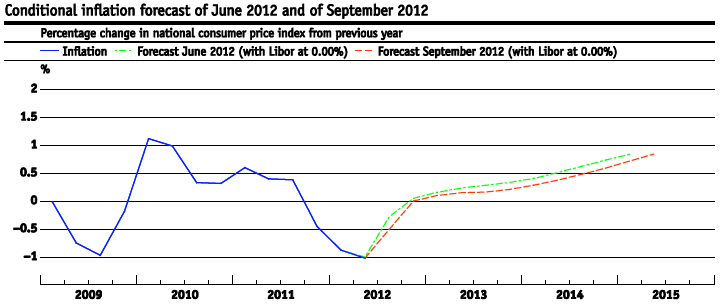

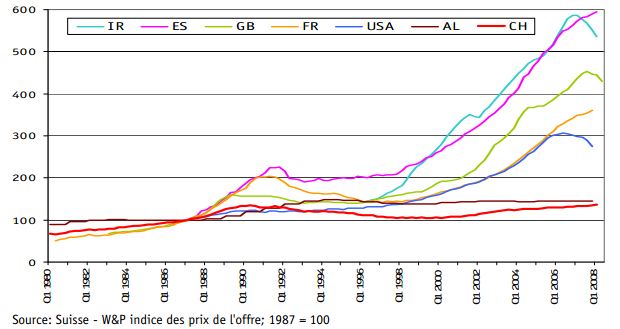

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

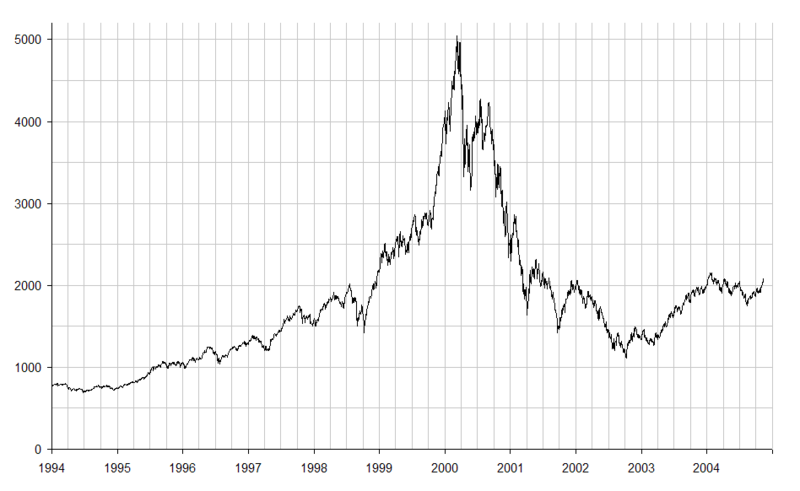

Why the Euro Crisis may last another 15 years

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »

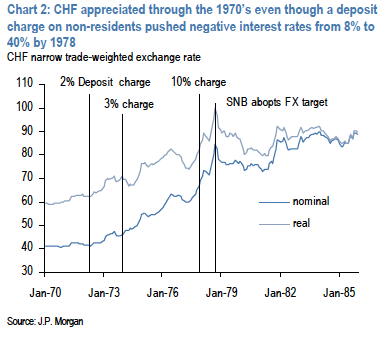

JP Morgan: Reflections on negative interest rates in Switzerland

Negative interest rates naturally attract attention given Switzerland’s use of these between 1972-1978.

Read More »

Read More »

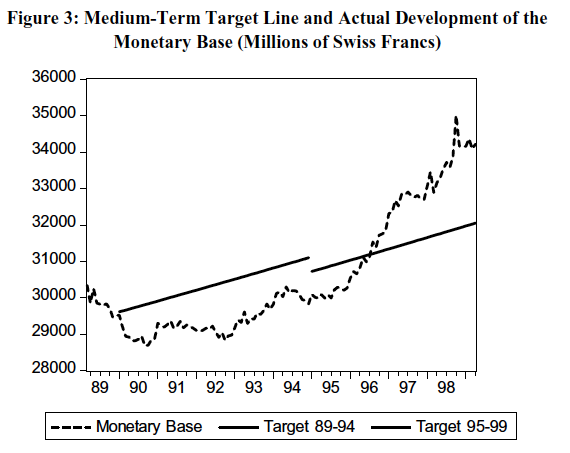

Swiss Inflation, GDP, Monetary Base between 1974 and 2000

Some background statistics on the Swiss monetary policy in the 1970s from Swiss Monetary Targeting 1974-1996: The role of internal policy analysis. More details and monthly data on inflation here.

Read More »

Read More »