To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the U.S. against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US but weakened it in other countries. Real interest rates were positive. The markets thought that the debt-financed growth could continue for years; they created the dot com bubble on top of it that strengthened technology stocks and the related currency, the dollar. This rare situation led to excessively weak oil and gold prices.

Why was the gold price so low in 1999/2000?

In the late 1990s the gold price reached its lowest level in real terms for two decades.

The reasons why it was so weak during the so-called “Clinton boom” from 1995 to 2001 come surprisingly from MMT (modern monetary theory), a theory that in many points opposes gold, in particularly because its proponents are in love with fiat, “the lawful act to declare paper as money”. However, they do not like excessive private debt, which is an idea common to Austrian economists.

Domestic Private Surplus, Govt Surplus

The following points caused gold prices to weaken in the late 1990s:

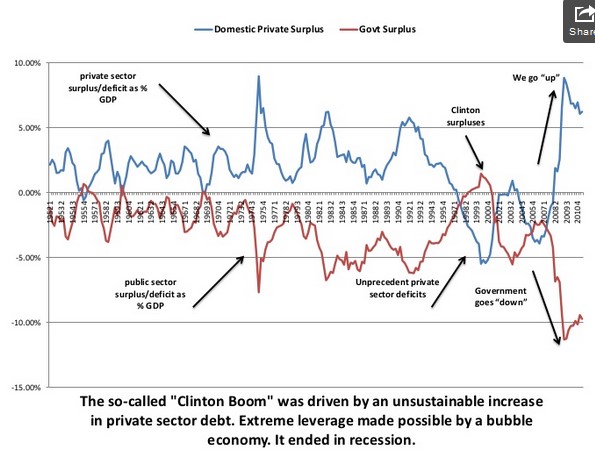

- Strong private debt (the figures above include both entrepreneurs and households) helped to increase US GDP growth.

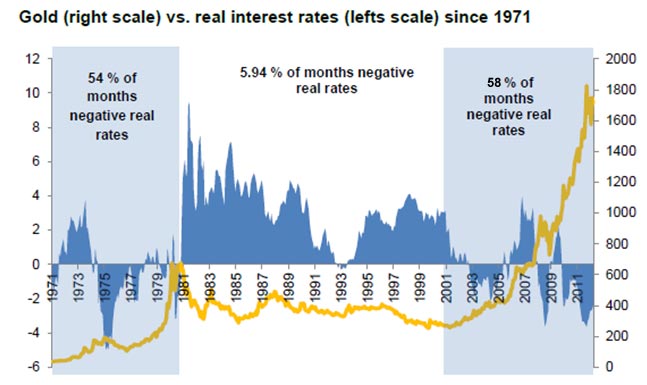

- Monetary policy was tight, since 1995 the Fed had been on a rate hike cycle to increase private savings. Real interest rates were positive.

- Fiscal policy was tight, Clinton reduced public debt. MMT actually criticized the Fed and that tight fiscal policy: for them it paved the way for the recession in 2002. MMT advocates counter-cyclical fiscal measures.

In the global macro picture of the late 1990s some other explanations can be found:

- Asia needed austerity after the 1997/1998 crisis, and this was reflected in the low GDP growth in Europe and Asia. This again weakened the oil price and made gold production cheaper. Austerity reduced Asian gold demand.

- In the late 1990s, Europeans implemented austerity to enable the Euro introduction by fulfilling the Maastricht criteria.

- Moreover, after the reunification, Germany went into a phase of heavy spending. This helped to reduce the US trade deficit. In 1995 Germany, changed path and steered towards fiscal austerity. But the private sector continued expansion, and the household savings rate decreased.

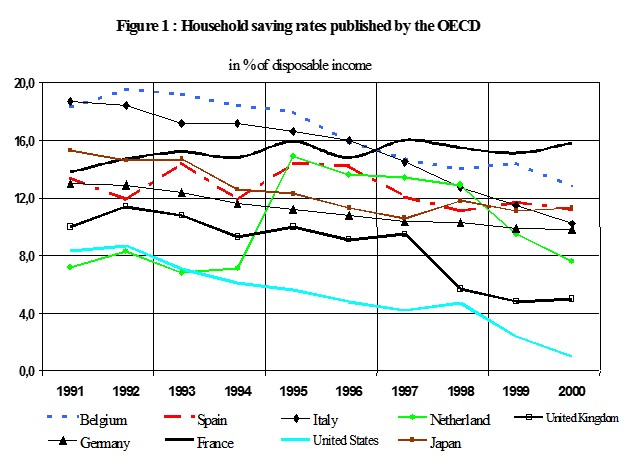

source OECD

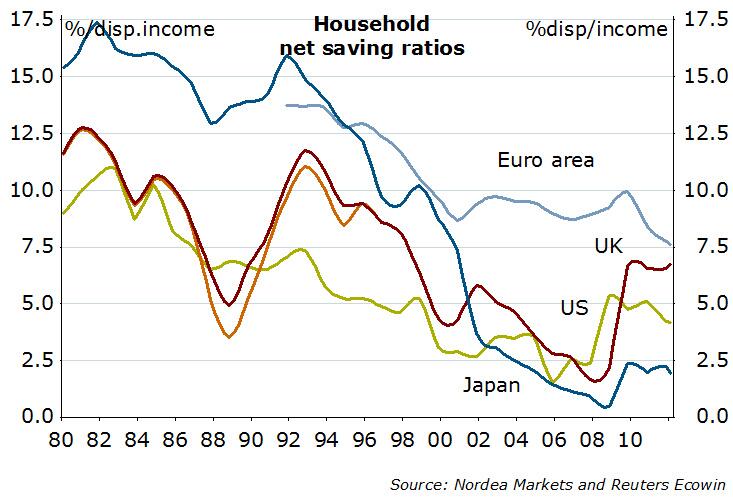

The following graph from the OECD shows how Americans reduced their savings rate while people in France, Belgium, Italy or Spain kept it high.

US citizens were the out-layers, savings to income fell from 8% in 1991 to nearly 0% in the year 2000. Entrepreneurs, as foreseen in most economic theories, borrowed as well and depressed the total private savings rate to far below zero.

The United Kingdom, Germany or the Netherlands did not need to do much “euro introduction austerity”, their household savings rates went in the same direction as the American one, but they were still considerably higher.

In summary, private spending and private debt went in two different directions: more private spending and more private debt in the U.S., as opposed to less private spending growth and less private debt in most parts of the world. This increased US GDP, while the rest of the world slowed. Strong GDP growth attracted yield-seeking capital flows from Europe. This fostered US growth and investments, while capital was missing in Asia.

Any gold investor should keep this in mind: more private debt generally weakens the gold price in the short-term, more public debt strengthens it. Finally strong private spending and debt phases lead to a recession and to increases in the private savings rate. The reaction of policy makers to higher savings are fiscal deficits as “counter-cyclical element”. Gold appreciates most when during recessions US policy makers use both monetary and fiscal easing.

Any gold investor should keep this in mind, more private debt generally weakens the gold price in the short-term, more public debt strengthens it. Effectively, public deficits often acts as counter-cyclical elements to counter strong increases in the private savings rate.

When tight fiscal and monetary policy sent the US economy into a recession in 2001/2002, Krugman and his colleagues started the next assault on the American household savings rate, with which they wanted to create the “next bubble”. Effectively the household savings rate fell to zero again. And we know the consequences of that.

What can we learn from it?

We are in a similar situation as in 1999/2000. Since the Fed started QE3, we live in a period of rising US private debt and consequently stronger US GDP growth, while austerity still reigns in Europe. Interest rates are high in Emerging Markets. Given that the inflow of US investors is limited and restricted to safe government bonds, this also implies austerity.

For the gold price this combination implies weakness, but the situation is far from being as bad as in 1999/2000.

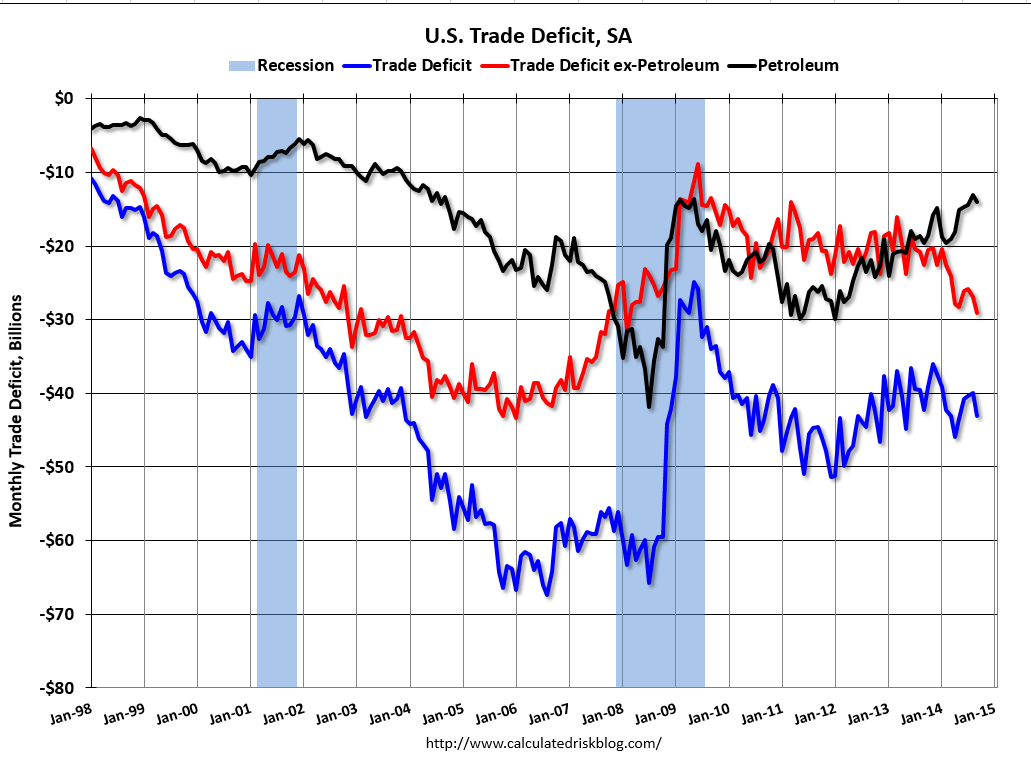

The slack in the U.S. labor market remains: this will prevent the Fed from quickly hiking rates as they did between 1995 and 2000, and it gives the rest of the world time to recover. We can already see the light at the end of the gold weakness tunnel. In a first step, the U.S. trade deficit ex-petroleum is increasing. While goods are flowing into the United States, this props up money in surplus countries like China, Germany, South Korea, Switzerland and even Italy. These inflows also mitigate the effects of the euro crisis. These trade flows are countered by financial flows that bet on (or beg for) higher Fed interest rates.

As Michael Pettis details, current Japanese monetary policy, commonly called Abenomics, aims to boost the household savings rate from values below zero. This weak spending further weakens the gold price.

But despite the big Fukushima shock on the trade balance, the Japanese surplus is finally rising, and Japanese GDP GDC growth is falling. But as we have already explained, falling GDP is a good sign for a consumerist nation.

We do not think that the gold price has bottomed out. We still see the need for more American irrational exuberance, moreover we have already indicated that wages in Emerging Markets have risen too much, too quickly and potentially irrationally.

Investment recommendation

For investors with a gold portion that lies under the Swiss National Bank’s (SNB) gold share of 7.8%, we recommend slowly increasing this inflation hedge part of the portfolio.

Read more in “Why did the Swiss National Bank sell all that gold at the cheapest prices? Stupidity?”

Investors should distribute purchases over different levels, like 1150$, 1100$, 1000$ and 900$ to finally reach a target according to personal safety needs. We do not doubt that this share lies at 20% for conservative investors like central banks. For the reserve currencies of the dollar and partially the euro, this central bank ratio should be even higher, and it is in reality.

Background

Evarist Lefeuvre, Chief Economist of Natixis America at the LBMA conference 2014: Triple Digit Gold?

G. Dorgan (continously updated): The Six Major Fundamental Factors that Determine Gold and Silver Prices

G. Dorgan (2014): FX Rates, Contrarian Investments and the Misleading Concept Called GDP

Michael Pettis (2013): Abenomics is just a measure to enforce higher household savings

OECD (2002): The various measures of savings rates and their interpretation

Stephanie Kelton, Mitch Green, University of Missouri (2012), MMT Basic : You cannot consider the deficit in isolation Slideshare

G. Dorgan (continuously updated), More on rising wages in Emerging Markets: A Little History of Wages, Inflation, Treasuries and the Fed

G. Dorgan (2013): The Dollar, the ISM, Buy American and Irrational Exuberance

G. Dorgan (continuously updated), Financial Cycles History, 1998-2002: The Dot com Bubble and Bust and European and Asian Austerity as its Enabler