Money creation and sight deposits may have two points of view:

1. The central bank creates money – i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money – inflows in CHF on Swiss bank accounts make those banks increase their “sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present both alternatives.

Reading one: “Central banks create money – SNB decides on its own about interventions.

Overview: Sight deposits are currently the by far most important means of financing for SNB currency purchases. Sight deposits are assets for commercial banks that deposit money at the SNB, but for the SNB they are liabilities, debt. The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. Therefore the weekly monetary data gives an far earlier indication of of SNB interventions than the relatively late releases of balance sheet data.

Total sight deposits have increased to a total of 449 billion francs from 220 bln. at the beginning of 2012 and only 28 bln in 2011.

The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. Therefore the weekly monetary data gives an far earlier indication of of SNB interventions than the relatively late releases of balance sheet data.

Total sight deposits have increased to a total of 449 billion francs from 220 bln. at the beginning of 2012 and only 28 bln in 2011.

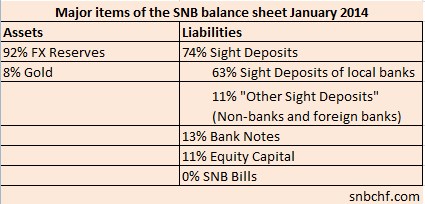

Together with around 65 billion CHF in bank notes, the sight deposits provided by Swiss banks build up the so-called “central bank money” or ”monetary base” M0. This central bank money M0 is combined with sight deposits owned by other counter parties and SNB owners’ equity to obtain the total of 522 bln. SNB Liabilities, the means of financing the total of 522 billion SNB reserves, its assets.

If the CHF exchange rate could freely float then sight deposits at the SNB would not increase, but the FX rate would adjust until there is less desire to hold CHF deposits. With a stronger CHF it would make sense for Swiss investors to buy foreign assets because those assets would become cheaper in CHF. Some critics (e.g. here Marc Meyer at Inside Paradeplatz) say that the SNB weakens the Swiss economy, because it buys foreign assets. This is not exactly true, because the SNB makes Swiss investments like houses and stocks cheap. But the SNB also weakens the price of CHF loans for investment abroad. They are cheaper than they would be in a free market, simply because CHF is cheap for foreigners.

This is the first way of looking at it: The SNB prints more money, it increased its debt in order to buy more foreign reserves and to keep the EUR over 1.20.

Reading two: “Commercial banks create money – inflows in CHF on bank accounts trigger SNB interventions”.

There is a second way of looking at it, it represents somehow an opposite explanation, namely “commercial banks and foreign investors create M0 money”:The Swiss do not know how to invest their money obtained by huge trade and current account surpluses. Foreigners that seek safe-havens have the same problem. Instead of investing money abroad they leave existing funds and newly generated income on their Swiss bank account.

By simple balance sheet logic, the Swiss bank needs to book an asset for the obtained cash liability to the client. The bank could decide to create a big cash vault or it could lend the funds to somebody. But nowadays, the Swiss bank does not want to take risks neither: it does like to lend more than necessary in CHF for Swiss mortgages or to lend in foreign currency, e.g. to a foreign bank in the weak euro members. As opposed to this lending, depositing these funds at the central bank neither weaken the Basel 3 ratios nor require additional counter-cyclical capital. The bank also opts against a big cash vault because it would have costs of maybe 0.1% of the total. In the Swiss case there is a big economies of scale effect.

The bank finally deposits the funds at the central bank as an (electronic) CHF sight deposit. From 2015 on, holding high sight deposits above a threshold will be punished by a 0.75% “fine”.

Since it not worth leaving francs as cash at the SNB, the Swiss stock market and CHF lending for mortgages become interesting and have strongly improved. Investing in Swiss stocks or Swiss real estate, however, implies that the funds remain in CHF It is also worth mentioning that the M0 money creation via currency inflows is not contained in the< href= http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf “Money creation in the modern economy” that the Bank of England proposed.

The relationship with the balance of payments

When the sum of current account and capital account (excl. central bank) is higher than zero, then central banks must absorb the difference. A second effect, a "supply and demand effect" is that the currency appreciates. The major reasons for a stronger currency are hence- Positive current account: Local companies have higher profits than foreign companies - reflected in a trade surplus.

- Positive capital account: more foreigners buy local assets, invest in the local country or pay back loans or lend to locals than the opposite (i.e. locals acting abroad). Hence capital inflows are higher than capital outflows.

Between 2009 and 2012, both current and capital account were strongly positive, hence the SNB had to intervene heavily. Since 2013 the difference has become small (slightly negative or slightly positive) because more capital is leaving Switzerland, while the current account is still strongly positive. The table shows the major entries of the SNB balance sheet.

The interventions were the results of failed monetary policy between 2004 and 2008 when the SNB tolerated a weak franc despite strong current account surpluses and the financing of real estate bubbles with "cheap francs". (see more).

Between 2009 and 2012, both current and capital account were strongly positive, hence the SNB had to intervene heavily. Since 2013 the difference has become small (slightly negative or slightly positive) because more capital is leaving Switzerland, while the current account is still strongly positive. The table shows the major entries of the SNB balance sheet.

The interventions were the results of failed monetary policy between 2004 and 2008 when the SNB tolerated a weak franc despite strong current account surpluses and the financing of real estate bubbles with "cheap francs". (see more).

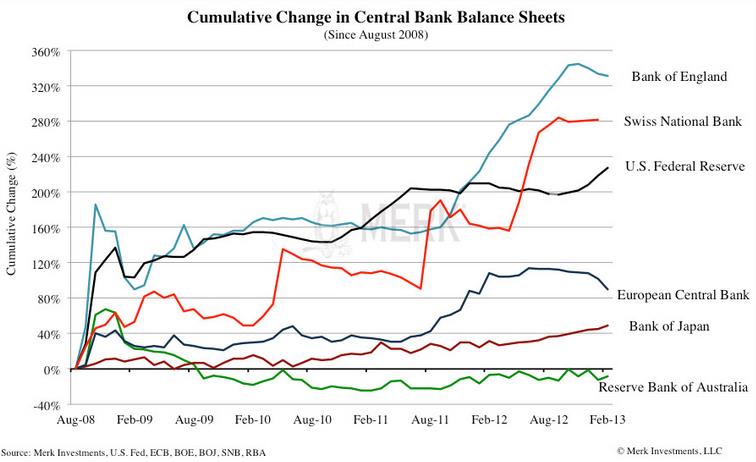

| Even if Switzerland counts only 8 million inhabitants or 30 times less than the United States, its central bank has a balance sheet that is only 8 times smaller than the one of the Fed. The risk and volatility is even higher, the Swiss possess nearly exclusively foreign assets; the Fed or the Central Bank of Japan mostly own local government bonds, the two do not have a currency risk.

This link to the SNB website gives insights into how many francs the Swiss National Bank requested commercial banks to deposit, here our detailed overview of the weekly change since the beginning of 2012. Whenever somebody anywhere in the world wants to buy a Swiss asset, a Swiss house, a Swiss stock or just francs in cash and the price comes close to EUR/CHF 1.20 or the equivalent in other currency, then the SNB says: “You can get it cheaper than the usual market price, I will give you francs, you give me the foreign currency.” All central banks obey to simple accounting procedures. With more foreign currency aka assets, the central bank increases also its liabilities. The increase of debt is sometimes called “money printing”. Money printing is just a technical accounting process, but not printing real bank notes. It means Minus (or liability) for the SNB, Plus (or more assets, more reserves) for the banks. Keep in mind that in the case of interventions the central bank is the initiator of rising bank reserves, and not as usually the lending process. If the SNB had not intervened the whole process would not have touched the SNB balance sheet, but the EUR/CHF price would have been far lower than 1.20. |

|

| The following graph from UBS confronts the increase of SNB assets with the rise of liabilities.

Between summer 2011 and autumn 2012, sight deposits at the central bank have increased very strongly. Until summer 2011, the SNB converted sight deposits into SNB bills and reverse repos, it sterilized them, i.e. it fixed them to an interest rate in a “bill contract”. But now nearly the whole debt is unsterilized, the interest rate is variable. Only thanks to low inflation and “favorable” market conditions this rate is currently zero percent. If there were sufficiently profitable lending possbilities around, then banks could use retreat the funds from the SNB and obtain a higher interest rate with another bank or change them into cash. This is valid in particular when the interest rate were negative. About 75% of deposits are at local banks (more details here). |

SNB Assets vs. Liabilities src. UBS SNB Assets vs. Liabilities Source: UBS - Click to enlarge |

The causes of the rise in sight deposits are:

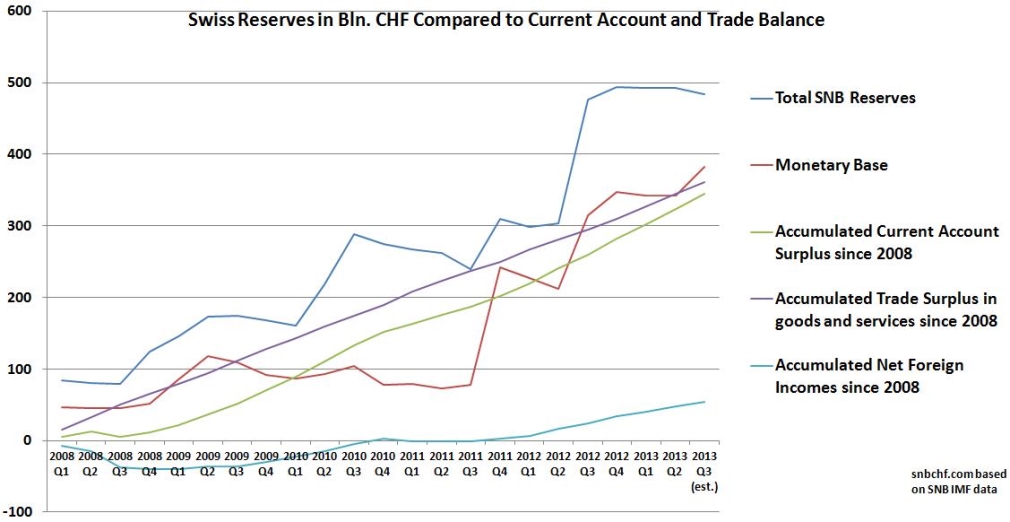

The safe-haven flows under 2) that after some months or years look for a new destination. But the risk-on flows can be dangerous for the SNB, when this mass of deposits are mirrored at least partially by new loans and mortgages, more see below. More details are available in our section on the Swiss balance of payments. If the SNB gave up the peg and the EUR/CHF fell to 1.00 in line with other currencies, then the Swiss would lose around 60 billion francs, 10% of the GDP (details here). In September 2012, the Thomas Jordan said that the main reason for the strong franc is the conversion of Swiss foreign incomes into francs. The graph shows that this is not the case. The main drivers of SNB reserves is the continuing trade surplus. A history of SNB sight deposits during this year is available here. |

SNB Reserves vs. Current Account Trade |

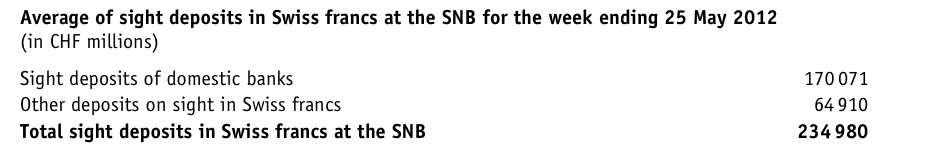

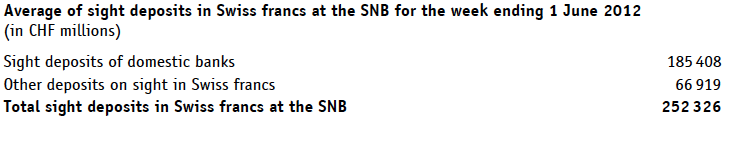

What does increase of sight deposits or M0 mean?M0, central bank money or monetary base (MB) are sight deposits of domestic banks at the central bank plus the bank notes. In 2012, the total amount of Swiss bank notes increased quite slowly, as opposed to sight deposits. Sight deposits are often called “reserves” from the point of view of commercial banks, they are assets for the banks and liabilities for the central bank. Since economists are not strong financial accountants, they also called assets of central banks “reserves”,too. Hence central banks possess “FX and gold reserves”, but they owe “minimum and excess reserves” to banks. In Switzerland reserves owned by banks are far higher than the SNB reserve requirements, they are hence mostly “excess reserves“. As opposed to the Fed or BoE, the SNB does not pay interest for these excess reserves. Since 2012 even the ECB does not pay interest in its deposit facility. Therefore, the increase in sight deposits should correspond, roughly, to the same increase in FX reserves, when changes in prices are excluded: for example, 2.6 billion more money at the central bank (M0) printed to buy 2.6 billion more FX reserves.1 More details in our detailed explanation of money supply. An example for the monetary data is given here. Sight deposits rose by nearly 18 billion francs in one week in June: |

|

| The increasing SNB liabilities are visible in the balance sheets of commercial banks, here the one of Credit Suisse, the net assets to central banks have increased to 68 bln. CHF.

While in 2005 Credit Suisse was lending to foreign central banks (e.g. in 2005/2006 to the Fed) in order to profit on higher interest rates; but now the SNB is the principal borrower. |

|

How do price changes affect money supply and FX reserves ?When the EUR/CHF rises by 1% and deposits are increasing, then the SNB must pay more for one euro than previously. A number of 18 billion CHF more Euro reserves – e.g. in the week ending in June 1, 2012 as above – would imply that the SNB had to pay 1% more, namely 18.18 billion francs. Given that Swiss inflationary pressures will rise one day, any pip paid more implies inflation and more potential losses. It is clear for us that the SNB does not want to pay more than 1.2000 for one euro.

The Limits of Money PrintingTheoretically banks could tell the SNB not to credit their accounts any more or even withdraw the funds. They will hesitate in particular when other banks offer higher short-term CHF interest rates (CHF Libor rates) – possibly when inflation rises. At that moment, the SNB would need to compete with these banks. This would prevent the SNB from printing. If high inflationary pressures show up, then banks could require a clearly higher interest rates than nearly zero percent. This would lead to quasi-fiscal deficits caused by the central bank. Most banks think that the SNB is able to get rid of most of their currency reserves one day or is able to reduce sight deposits and sterilize the funds in SNB bills. SNB’s Dewet Moser writes in this paper how easy it was to sterilize during 2010 and 2011. However, he does not speak about the fact that the Swissie was strongly rising during this sterilization process.

Money Printing in the Euro SystemInside the euro system, ECB money printing via deposits at the ECB means debiting the account of the ECB and crediting the accounts of the National Central Banks (NCBs) of the euro system for their participation in the ECB. This method, as used in the ELA (emergency liquidity financing), is done according to the following schema: 30% of the ECB capital belongs to non-euro states like the UK, Sweden, Denmark, Poland or other non-euro EU member states. Printing money means that the ECB increases its debt towards the NCBs in the ratio of the euro system participation, namely Bundesbank 27%, Banque de France 20%, Banca d’Italia 20% and Banco de Espana 12%. If the ECB buys peripheral bonds with this money, it implies an implicit transfer from the Bundesbank and the Banque de France and other Northern states to the periphery. The Bundesbank will refinance this money via increasing its debt at German commercial banks, if it does not collect the liquidity again by repurchase agreements. Increased liquidity results into more reserves which they might invest via the money multiplier to give more loans to German firms and housing. Apart from more and more debt due to Germany, this operation will increase inflation over the medium and long-term. The ECB often employs tenders (via SMP, MTO, LTRO or OMP) to allow commercial banks to refinance her directly. In this the case banks’ reserves at the central bank do not increase; therefore, it is also called sterilized. Since these lending banks mostly come from Germany and other Northern states, it is just another form of money transfer from the Northern states to the periphery. |

|

Further Readings

The article “Definitions of money supply in the context of the SNB” gives the basic understanding of the underlying concepts.

The paper “Quantitative Easing, its Indicators and the Swiss Franc, Update FOMC September 2013” shows why in the United States and Japan the monetary base is rising far more quickly than money supply and why Quantitative Easing, i.e. the relentless increase of the monetary base (without FX transactions) is becoming useless; it cannot increase money supply and inflation.

The article “The Risks on the Rising SNB Money Supply” explains why in the Swiss case a rise of the monetary base may increase money supply and inflation.

Read the full details about the differences in money printing between the SNB, ECB and Fed in our article “The big Swiss Faustian Bargain” which also appeared on Zerohedge

- The SNB has not employed swaps or repos since April 2012. Swaps or repos may distort the picture. [↩]

3 comments

Stefan Wiesendanger

2013-01-01 at 14:57 (UTC 2) Link to this comment

You claim that 80% of the increase in SNB reserves was due to foreign capital streaming into the CHF, and that only 20% can be attributed to a refusal post 07/2011 by Swiss entities to reinvest the current account surplus abroad. This interpretation focuses on the flows but what about the investment stock abroad? More precisely, what are the effects of a reallocation of foreign holdings by Swiss entities into the CHF? Think of the asset heavyweights: pension funds (reassessment of risks in foreign currencies), insurance companies (same as pension funds) and banks (balance-sheet reductions, unwinding of investment banking positions).

A different interpretation of the \”foreign capital streaming into the CHF\” would therefore be \”repatriation of foreign holdings\” as a consequence of a disillusionment of domestic investors with foreign assets, wouldn\’t it? Add to this a sell-out by banks to shorten their balance sheets and reduce risk in what remains. In this view, the SNB is taking the risks that everybody else is shedding on its own books in the unwanted role of benevolent parent. After all, it needs to protect the export industry from a skyrocketing CHF which is the argument used in public.

Why does the SNB take the unwanted role of a risk dump? The catch-22 for the SNB is that if it as a regulator asks the big banks to reduce their risks, could it very well object to these same banks selling assets and exchanging the proceeds for CHF (which will then show up as sight-deposits on the liabilities side of the SNB balance sheet)? By the way, this is an argument for a clear separation of tasks between SNB and Finma.

Additional thoughts1. The argument of the SNB to look at the current account is probably not to be taken as a full explanation for the increase of foreign currency reserves. But it is IMHO a good tool for proving to a wider audience that the current peg is unsustainable (something dangerously neglected by the current focus of the discussion on PPP), and prepare for a higher CHF and large losses at the SNB. If the current account surplus is 80bn (13% of GDP) and this capital is not reinvested abroad by the private sector, the SNB will ultimately have to call it quits and let the CHF appreciate.2. Following the thoughts above, it is also understandable that the SNB refuses to create a SWF. Why should the SNB with a handful of employees start up a SWF when there are thousands of underemployed investment professionals in the private sector? How could they do a better job? It is time for the private sector to start investing abroad again, preferably in the productive infrastructure. And it is time for the CHF to appreciate by which parts of the competitiveness of Swiss products and services are socialized. 3. The blame game pointing a finger at the SNB for the risk it is taking is not really fair. What real alternative is there? They are taking on the risks and later the inevitable losses in lieu of private sector actors like pension funds, insurances and banks. Of course one is entitled to question if such a private-to-public transfer of risk is right or not. I\’d personally favor mechanisms that would entice, even force, private actors to go out of their way to find profitable investments abroad, even now. But the real question is 4. 4. The key question is: how can a capital exporter like Switzerland safeguard the value of foreign investment? The answer is: sometimes not, often only partially and always with extreme difficulty in turbulent times. The history of Bank Leu is exemplary. Already in the 18th century, Zürich was a surplus economy at a loss for domestic investment opportunities. Bank Leu stepped in to invest this surplus abroad and through 2 and a half centuries sometimes won but several times almost lost all of it.

Stefan Wiesendanger

2013-01-07 at 14:32 (UTC 2) Link to this comment

Nice chart, thanks. I withdraw my earlier suggestion that the growth of SNB reserves might be due to large-scale repatriation of portfolio investment abroad. It rather seems to be caused by the unwinding of the investment banking positions of CS and UBS. With their combined balance sheets worth 500% of Swiss GDP at their 2007 peak, they constitute by far the biggest part of the Swiss financial system and any change in their structure must have huge repercussions on Switzerland. In retrospect, it is not surprising and probably a good move that they hired a central banker to head UBS. Mssrs Weber, Rohner and Jordan must have a lot to talk about.

In more detail: The chart shows clearly that up until 2008, the current-account surplus was reinvested abroad by companies in companies (direct investment component) and in securities (portfolio investment component), the latter mostly by pension funds and insurances. There are no signs of significant repatriation by pension funds and insurances after 2008, and there is sustained direct investment as you point out in your reply. In sum, we can safely say that the outflow of investment has slowed down and since 2008 contributes to the growth of SNB reserves since it does not balance the inflow due to the current account surplus. But the dominant effect by far is the large-scale reduction of bank loans. I’d hypothesize that this is due to a reduction of lending by CS and UBS to their investment banking subsidiaries. The Big Two have reduced their balance sheets by 900 bn CHF after their 2007 peak of 2.3 trn CHF (*). Surely, the unwinding of the investment banking positions must have enabled some head office loans to be repaid? Not that this is the precise mechanism but it seems altogether plausible that the investment banking party was backed by exported capital which is now partly coming home to the tune of a Western version of the Beresina…* , page A2

Can Sandikcioglu

2015-07-20 at 10:40 (UTC 2) Link to this comment

Hey George, thank you very much for your quite informative article. It is indeed quite helpful in trying to understand monetary system. I was just wondering about one more thing. How does inflow of foreign currency into local banks increase the M1 without any Central Bank intervention? I have one framework on my mind but I will understand it clearly and best if it is depicted by accounting entries. For example; when an american wants to buy swiss bonds, does he simply swap its holdings of USD deposits held with a US Bank for swiss francs from a swiss commercial bank? If so, this will increase the US Dollar nostro balances of the swiss commercial bank (asset item for Swiss banks) and it will also increase Swiss Bank’s swiss franc deposit liabilities to our American guy which just purchased swiss franc in Exchange for USD. Now this guy, will probably use this newly created M1 fund (deposit at Swiss Commercial Bank) to buy bonds from the financial markets. Is this accounting logic I described above correct? Is this how M1 is created whenever there is inflow of foreign currency into the country assuming no CB intervention? Does the same loic I described above also apply to trade surplus inflows as well? (I think it does) I would be pleased if you can help with the answer to that. Thank you in advance.