Since the financial crisis central banks in developed nations increased their balance sheets. The leading one was the American Federal Reserve that increased the monetary base (M0, often called “narrow money”), followed by the Bank of Japan and recently the ECB. In most cases the extension of narrow money did neither have an effect on banks’ money supply, the so called “broad money” (M1-M3), nor on price inflation.

For the Swiss, however, the rising money supply concerned both narrow and broad money, while price inflation remained low. Broad money in Switzerland rose until summer 2014 as strong as it did in Spain or Ireland before the financial crisis. With the crisis in China and other Emerging Markets, this rise of broad money has stopped, in particular when the SNB removed the euro peg.

The Monetary Base

M0, central bank money or monetary base (MB) are sight deposits of domestic banks at the central bank plus the bank notes. In the year 2012, the total amount of Swiss bank notes increased quite slowly, as opposed to rapidly rising sight deposits at the SNB.

Is more and more “money” dangerous?

![]() This is the ordinary theory:

This is the ordinary theory:

If a central bank prints more money, then domestic banks have more funds available to give loans and mortgages. Via the money multiplier they are able to generate far more money than the central bank actually provides with M0.

This is the old text book approach. Nowadays things are different in Western economies. The times have finished when banks were “fully loaned up”, meaning that they hit the limit of minimum reserve requirements. But this was still the case in China or other Emerging markets (EM).

Quantitative Easing and QE Spillover

Nowadays things are a bit different in Western countries: Via Quantitative Easing (QE), central banks purchase back their own government bonds from insurances or pension funds, in the hope that those investors convert these holdings in more risky assets. But what they forgot – or not officially mentioned – was that investments are global nowadays. The QE effect spilled over into (risky) assets in Emerging Markets.

The final consequence was that investments and wages in EM rose and the currency of the concerned QE country depreciated. The combination of a weaker currency and higher wages in EM was finally good for the QE countries. It reduced the competitiveness gap.

By June 2014, the competitiveness gap appeared to have closed. QE finally helped the United States. Home prices but also manufacturing has recovered since 2013, even if many claim that the American recovery is mostly based on part-time jobs.

The QE effect also spilled over from the U.S. to Switzerland and it helped to push up Swiss asset prices and the Swiss franc. The SNB had the choice between a stronger currency and, secondly, an excessive appreciation of Swiss asset prices. With the introduction of the euro floor, she opted for the second alternative and increased its monetary base massively in order to absorb foreign currency inflows. Therefore the SNB helped to push up asset prices and honored also foreigners that bought Swiss homes.

But there are risks.

The first risk: Swiss broad money supply rose until 2014 like it did in Spain or Ireland before

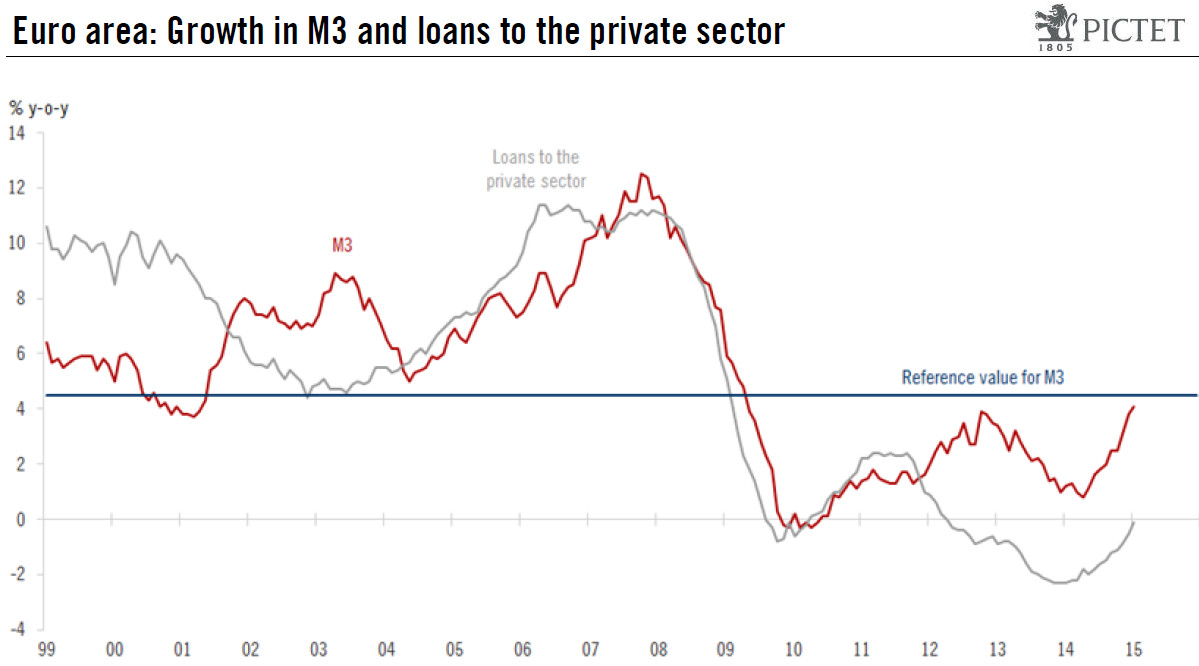

Countries like the US, Spain, the UK or Ireland saw monetary aggregates rise quickly between 1999 and 2007. M3 and Credit in the European monetary union increased by 8% per year. The rise was above nominal GDP growth, that was at around 5%.

Slow Credit Growth in European Monetary Union since 2009

Since 2009, both money and credit for the EMU rise only slowly. In 2015, M3 recovered slight. The higher M3 is not fully reflected in credit growth. The so-called “euro glut” led to money leaving the country, recently towards the United States.

Source: Pictet

Normal Swiss Credit and Money Growth until 2008, Rapid Rise between 2009 and 2014

The following graph shows, that credit to the Swiss private sector rose in line with nominal GDP growth between 1994 and 2007. Especially monetarists and Austrian economists think that money and production should grow as quickly as the other. Hence when M3 and GDP rise with the same pace, then the credit growth is considered healthy.

The SNB printed a lot of money especially after the 09/11 attacks, to weaken the franc and the “presumed slow” Swiss growth. Finally the central bank increased interest rates and reduced money supply between 2006 and 2008.

Between 2009 and 2014, things changed: M3 was rising with an average of 7.9% per year, while before 2009 it was 3% per year. Bank lending to the private sector was increasing by 3.7% per year while it was only 1.7% between 1995 and 2005. Some say that the reason for more loans and mortgages were the bilateral agreements between Switzerland and the EU that allowed for more immigration and higher credit demand. But these agreements date from 2004 and the effect would have shown up already before.

In both 2010 and 2015, there was a slowing in credit growth. A major reason was that the SNB removed the euro floors, in 2010, the floor of 1.40 and in 2015 the floor of 1.20.

The SNB is aware of the risks

In the graph below, SNB’s Danthine shows the sharp increase of the credit to GDP ratio in several countries (source). For him the reasons were:

- Improved credit access due to structural reduction of supply side constraints (financial liberalization, innovation)

- Structural increase in credit demand (e.g. growth opportunities, cultural changes or demographic shift)

- Extended period of low interest rate

- Overconfidence and misjudgement of borrowers and/or lenders (behavioural biases)

source SNB

The second risk: cheap Swiss money lending to foreign countries

With the crisis in the China and the Emerging Markets in 2014, money supply M3 slowed its pace from 7.9% per year to around 3%.

We explained before that the Feds’ Quantitative Easing translated in higher lending in dollars, dollars that found their way into emerging markets. The same thing happens in Switzerland with newly created Swiss francs. Not all of them remained in the Swiss economy, but they were loaned out to Swiss companies that invested abroad or to bank clients from Emerging Markets.

Hence the second risk does not directly concerns the Swiss economy and the euro, but the relationship between its banks and emerging markets and the risks of a stronger franc for banks’ balance sheets.

From the Wallstreet Journal on Credit Suisse:

Much of this new money is from Asia and other emerging markets. One of the things attracting these clients is Credit Suisse’s willingness to make large loans to the ultrawealthy. Such loans have grown by CHF3.9 billion over the first nine months of this year versus CHF1 billion in the same part of 2013. They are often backed by the borrower’s illiquid wealth in the form of equity in their companies, for example, or warrants for future ownership.

Such lending can be hugely profitable. Yet any investor who has seen more than one cycle in countries such as Indonesia knows it can also be quite risky. (source WSJ)