Published in December 2012.

In 2007, the SNB leaders knew about the strong franc’s undervaluation despite the very strong Swiss trade surplus. There were many warnings that the global real estate bubble was likely to explode, and this would lead to a rapid franc appreciation. But SNB leaders continued to weaken the Swiss currency. Still in 2007 Swiss inflation pressures were low and SNB leaders could still identify an output gap (see more in our history section on the undervalued franc).

The same picture for the European currency, the euro. From the very beginning European leaders knew that they were building an ill-constructed currency. That’s at least what the Swiss papers now think about the European system. The papers ignore that a similar situation occurred with the valuation of the Swiss franc between 2005 and 2008.

Diem Markus Meier and Tina Haldner from Finanz and Wirtschaft wrote:

Diem Markus Meier and Tina Haldner from Finanz and Wirtschaft wrote:

“Today we know it, the Euro zone with its current institutions can not function. But its planners knew already exactly 23 years ago.”

We reckon that the Swiss National Bank was similarly aware that the franc was strongly undervalued in 2007 and 2008 given the huge current account surpluses together with huge capital exports from Switzerland.

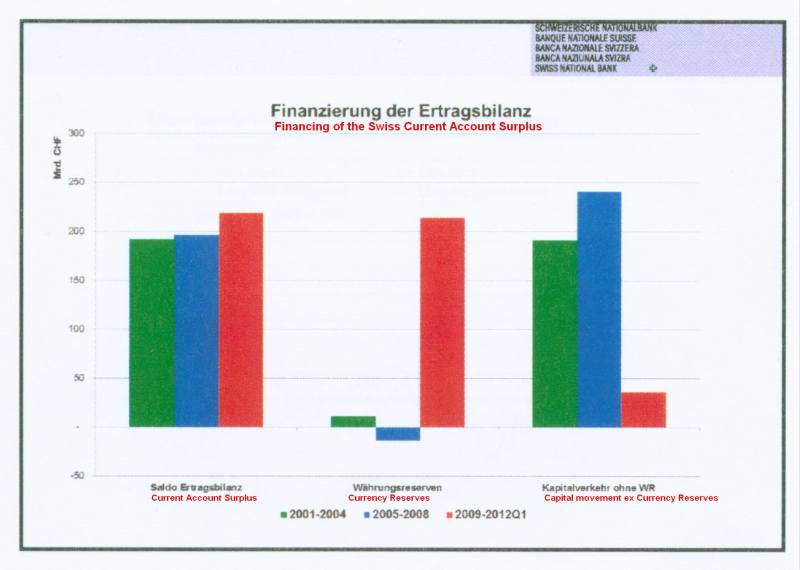

110% of the Swiss current account surplus was exported between 2005 and 2008 via capital transfers to the European periphery, Eastern Europe and other countries that were promising a higher return than Switzerland. A nice parallel to the Target 2 balances.

Financing of Swiss Current Account Surplus

Austrians and Eastern Europeans signed mortgages in francs, thus weakening the Swiss currency even further. Swiss companies kept on holding their profits in foreign currencies.

Already in 2007/2008 the OECD was saying:

Switzerland has had a long-standing surplus on its current account. But over the past 15 years that surplus has surged to levels unmatched by nearly any other OECD country at any point. This paper looks at the surplus from a balance of payments vantage point as well as from the optic of the excess of national saving over domestic investment. It then seeks possible explanations for the uptrend and assesses whether it results to any extent from market, institutional or policy failures that could call for reforms. A number of important measurement issues are raised. But the key recommendation is that the authorities should prepare for a possible sharp increase in the value of the Swiss franc if and when investors engaged in the “carry trade” unwind their positions. To that end they should examine labour, capital and product markets with a view to ensuring they are as flexible as possible and that factors are as mobile as possible, both geographically and sectorally. This will allow any necessary adjustment to a higher exchange rate to be smoothly accommodated. This Working Paper is largely extracted from the 2007 OECD Economic Survey of Switzerland (www.oecd.org/eco/survey/switzerland).

Source OECD

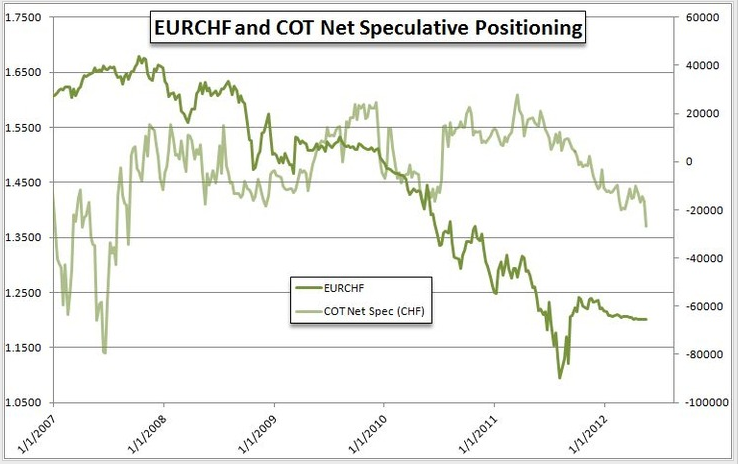

This was not the only warning that the global real estate bubble was likely to explode, and this would lead to a rapid franc appreciation. Many used the CHF as the financing currency in carry trades. The following graph shows the carry trade between euro and Swiss franc, visible in the COT Net Speculative Positioning. Till summer 2007 speculators were strongly short the franc in order to invest in high-yielding currencies, one of them was the euro. Still in 2007, speculators were short CHF with up 80000 contracts with 100K CHF contract size each.

But SNB leaders continued to weaken the Swiss currency in 2007 and 2008, leaving the Swiss Libor far lower than ECB rates, despite the huge export surplus and stronger Swiss GDP growth than in the euro zone. The consequence was that the SNB was forced to perform interventions at still undervalued levels of EUR/CHF of 1.50 in 2009 and 1.40 in 2010, and that the 1.20 level is now close to fair value.

UBS Real Effective Exchange Rate Franc

Since 2009, a big part of the Swiss current account surplus has been invested by the central bank, but not in gold at a fixed price, like in the Bretton Woods system, when Swiss gold reserves were constantly rising. In 2012, the SNB invested the Swiss surplus mostly in fiat currencies and to about 10% in gold that is in real terms far more expensive than the 35 US$ during the Bretton-Woods period. Moreover, these investments in fiat currencies, in US or German government bonds yielded close to 0% per year and were priced at record-highs, in particular when most interventions were done in 2012.

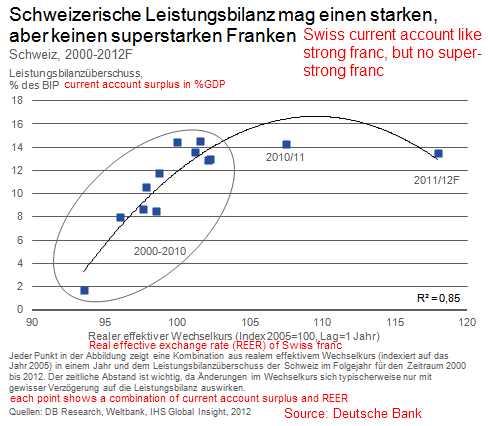

The most interesting thing is that the Swiss current account became bigger between 2009 and 2012 despite the ever rising franc. Clearly a situation that is not sustainable in the long-term: one day the peg must be removed.

Recently Daniel Gros put it in “An overlooked currency war in Europe” as follows:

Capital outflows are considered an equilibrium phenomenon during the upswing of a credit cycle, but capital inflows during the downswing are ‘speculative’ and must thus be neutralized.

We think that at a later point in time, in maybe 5 or 10 years, with the start of Swiss inflation, all these issues will be discussed in detail, perhaps in a parliamentary commission. Then it will become clear that:

Similar to European leaders who knew what they were doing, it will be shown that the SNB exactly aware what they were doing between 2005 and 2008,

namely the absolutely wrong thing.

The former created a common currency for completely different peoples. Between 2005 and 2008, the latter allowed the huge Swiss current account surplus to be used as a means of financing the global carry trade and “cheap” mortgages within a huge European real estate bubble.

Read about the second huge mistake of former SNB chairman Roth, selling the Swiss gold reserves for far too cheap. It resulted in an unrealized gain of 42 billion CHF. It the SNB had kept its gold reserves then the bank would have survived the franc appreciation after 2008 without any losses.

Further Reading: