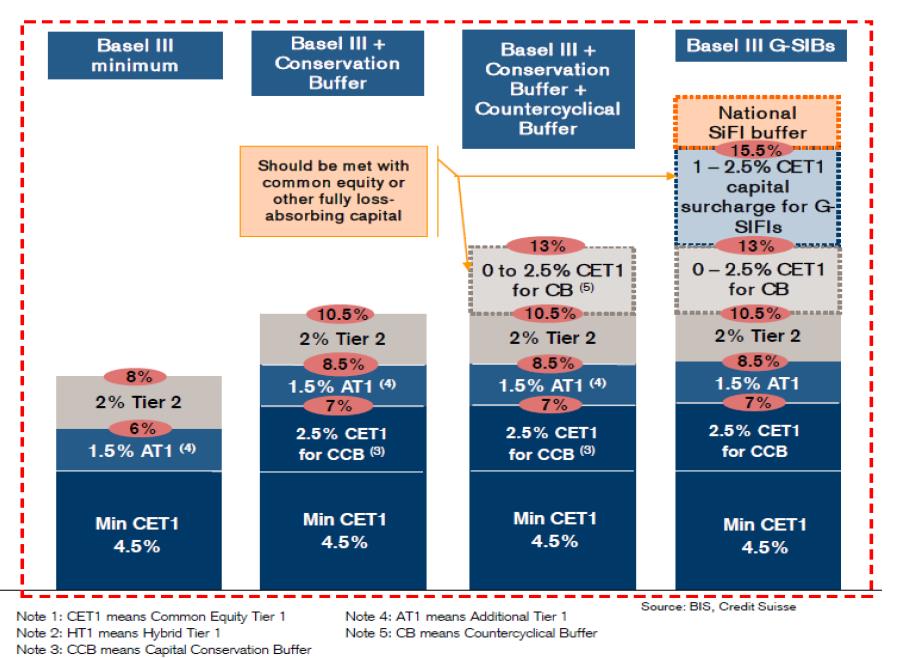

The following graph describes the regulatory minimum capital requirements that come in force with Basel III.

The following categories are part of the “core Basel III” requirements, to be realized in 2019 globally.

- Common Equity Tier 1 (CET1), usually ordinary shares.

- High Tier 1 (HT1), contigency capital (CoCos) that trigger at a higher threshold level of equity to risk-weighted assets (RWA). The capital is converted from debt into equity e.g. at 12%.

- Additional Tier 1 (AT1), or low tier1, CoCos with a lower threshold, e.g. 10’%. They are hence more secure.

- Tier 2 capital, subordinated debt, converted into equity at point of non-viability, e.g. 5%. The regulator decides about non-viability.

The following pieces are the so-called Swiss finish, that is purely based on CET1, but not HT1 and AT1.

- Additional CET1 for the Countercyclical Capital Buffer (CB), as proposed by the SNB in 2014: 2%.

- CET1 surcharge for globally systemically important financial institutions (G-SIFIs)

- An additional buffer for G-SIFIs.

The Swiss finish is only valid in certain economic conditions and therefore called “macroprudential measures”. They depend on the macro environment, e.g. like currently when interest rates are low and real estate prices and number of mortgages are quickly rising.

Swiss banks are able to raise so much equity only over time:

References:

SNB proposes to raise counter cyclical capital buffer to 2% of CET1.

Presentation from University Zurich, it gives a very good overview of RWA, Basel 3 and Swiss Finish.

Swiss National Bank: Financial Stability Report, July 2014

FAQ of the Swiss Regulator FINMA on the countercyclical capital buffer.

See more for