Blog entries on the SNB that got last updated in 2014

Posts about the SNB balance sheet risks

- On the SNB balance sheet and sight deposits, the means of financing currency interventions:

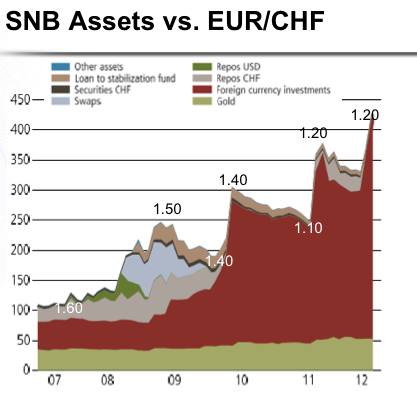

- SNB Balance Sheet Expansion

- IMF Sees Considerable Risks on SNB Balance Sheet

- Target2 Balances and SNB Currency Reserves. They are Both the Same Concept

- Swiss National Bank Monetary Policy Mandate – 2007 version vs. today

- SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

- SNB’s history of balance sheet: Monthly bulletin

- A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

- How Switzerland Implicitly Joins the Eurozone: SNB Obliges each Swiss to Invest 73% of 2012 income in Euros

On SNB results and its future profitability, posts from 2014 and 2013 that predicted the end of the peg

- 2014 Results: SNB expects profit of CHF 38 billion

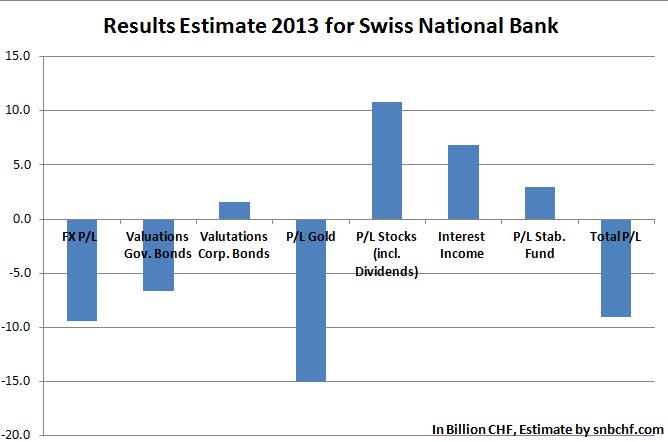

- 2014 Q1 and 2013 Results …. 2013: SNB Gains 10.8 billion CHF on Stocks, but Loses 30 bln. on Gold, FX and Bonds

- SNB has Won the Risk Aversion Battle, When Will the Inflation Battle Start?

- What Ernst Baltensperger Got Wrong: Why SNB Losses Might Not Be Recovered By Income on Reserves

- Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

- Because They Knew What They Were Doing: The Parallels between European and SNB Leaders

- Why the SNB will not Imitate Hong Kong, but Potentially Singapore

- The “Get Stress in May and Relax in October Effect” for the SNB

Important SNB publications: