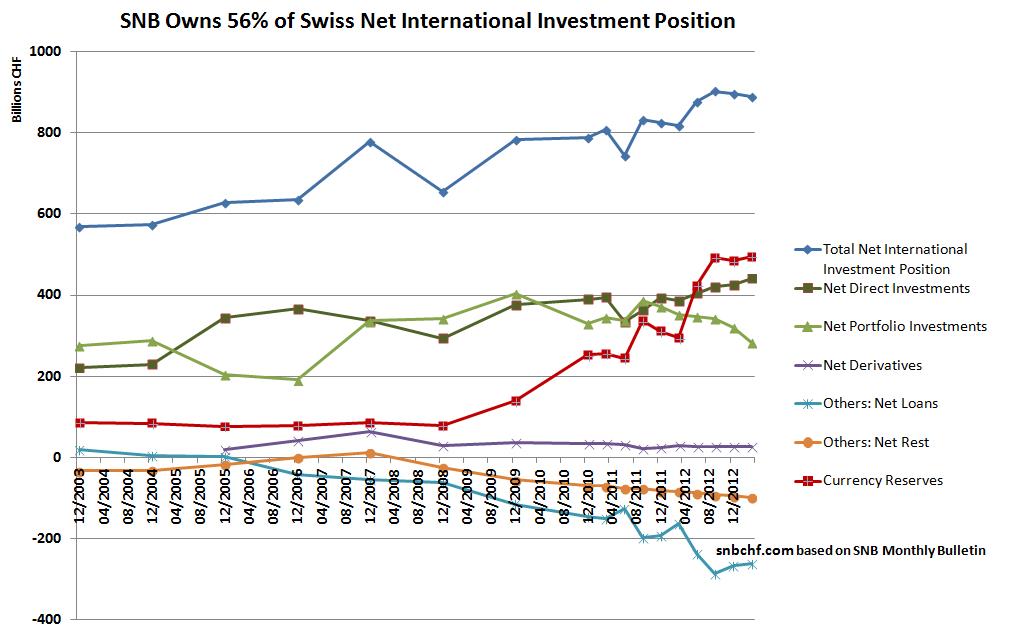

By early 2013, the SNB held 56% of the Swiss net international investment position (“NIIP”), but in the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies? Or is rather a form of de-nationalizing the Swiss public, given that the stock owners of Swiss multi-nationals are more and more foreigners and less Swiss?

Update September 2014:

In 2013 and 2014 the size of SNB balance sheet remained constant but the Swiss as a whole improved their investment position. Therefore the ratio should have fallen a bit.

More insights:

- Probably it is not a nationalization but rather a transfer from the Swiss tax payer to the Swiss multinationals and to their share holders, who happen to be foreigners more and more. This in case that EUR/CHF falls under 1.20, the SNB will have losses, the firms continuing profits. Or maybe a genius strike if the euro remains above 1.20 forever….

- Net Direct Investments Rising: Swiss multinationals are profitable despite the stronger franc. By nature, direct investments yield fairly more than portfolio investments.

- Foreign reserves are just portfolio investments, done by a national entity. Often they are invested in a more conservative manner than typical portfolio management. Both China and Singapore have state funds that invest more in equities, recently the SNB increased the equities share to 15%.

- Net Portfolio Investments Shrink: Foreigners are buying more Swiss equities than Swiss purchase foreign equities. By far the biggest part of Swiss portfolio investments (both inbound and outbound) are equities, far less are fixed income.

- The rise of the Swiss franc has nothing to do with hedge funds or speculators. Most foreign investors are long-time investors that bought Swiss equities.

- Net Loans are negative and were falling: Net Swiss Borrowing is heavily increasing. It is the traditional two-step banking model: Wealthy (foreign and local) clients lend to Swiss banks, Swiss banks lend to Swiss consumers and firms via mortgages / other loans.

- The SNB must counter three effects if she wants to maintain the 1.20 EUR/CHF:

- Someone must restrict the success and the high profits of Swiss multinationals: This sounds like a joke, but the Swiss left is preparing a so-called “1:12 wage initiative” This referendum initiative wants to limits top salaries to 12 times the lowest salary. Glencore might leave Switzerland if the referendum passes. An exit of a multinational from Switzerland would weaken the future NIIP growth, but reduce the implicit transfers from the tax payer to these companies.

- She must buy more foreign equities or bonds (if the latter yielded enough…) than foreigners buy “net” Swiss equities.

- The most difficult task, however, is to stop the (net) lending to Switzerland and in the long haul inflation. The latest monetary policy assessment has shown that the bank is very nervous.

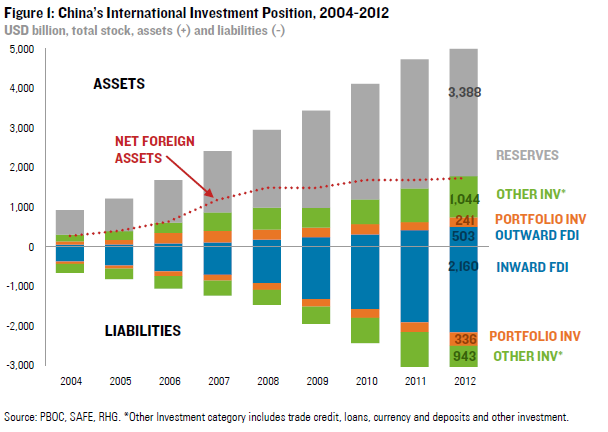

- In summary, the SNB is getting into a similar situation as China, where the state owns 300% of the NIIP. Already the number of 56% is most astonishing for a developed economy like Switzerland.

On most of the reserves, i.e. US Treasuries, China earns very poor income, but foreign companies earn a lot more on inward direct investments (FDI), e.g. Americans 33% in 2008.The Chinese decision to quickly strengthen the Renmimbi was probably a good choice.

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies? - Click to enlarge

The difference between China and Switzerland is the following:

China runs current account surpluses of only 2-3% of GDP, outwards FDI and portfolio investments are rising. The profitability of inwards FDI has fallen because salaries have heavily increased.

The biggest part of the 14% Swiss current account surplus are profits in trade of goods and services, implicitly profits of Swiss firms. With continuing profits, however, the inflow of portfolio investments to Switzerland, purchases of Swiss equities by foreigners, should not stop.

Are Swiss investors able to achieve higher foreign yields than the yield on Swiss investments?

In order to weaken the Swiss franc, capital outflows must counter the continuing Swiss current account surpluses. The essential question herewith is : “is the yield Swiss investors are able to achieve abroad considerably higher than the yield received at home (or paid if the franc is used for leveraging)?”

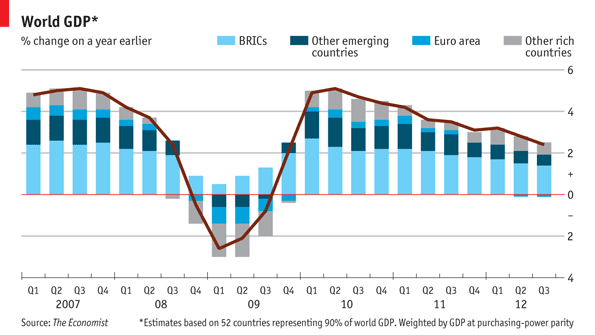

The first thing we need to remember are global growth expectations: while until 2007 the franc was used as a funding currency for investments in foreign assets a big difference of 3 – 4% GDP growth between Swiss and the global economy persisted. However, the expected Swiss growth rate of around 1% in 2012 and 2013 (source UBS) is only a bit lower than global growth of 2.5%. Investments in Swiss real estate have achieved 5% per year since 2008.

Prices for owner-occupied apartments have risen 5% a year on average since 2008, with rises of 6.2% in Zurich and 8% in Geneva. source WSJ

Especially for Swiss foreign portfolio investments, the question arises if these foreign investments are justified in a risk-return perspective, given that higher foreign growth will be obtained in emerging and less developed countries with substantial political risks and downside risks in the case of a recession.

See full details in Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

Read also: The Swiss Balance of Payments, 2012 and History

See more for