Found 1,868 search results for keyword: label

Zinsspekulation – DJE-plusNews Juli 2023 mit Dr. Ulrich Kaffarnik und Mario Künzel

#zinsen #china #fed #konjunktur #markt

In dem monatlichen DJE-plusNews reflektiert Mario Künzel, Referent Investmentstrategie, das aktuelle Marktgeschehen zusammen mit dem Kapitalmarktexperten Dr. Ulrich Kaffarnik.

Themen:

▶ Zinsspekulationen beeinflussen die Börse.

▶ Chinas Außenhandel bricht ein. Was bedeutet das für Europa?

▶ Die Markttechnik zeigt aktuell ein sehr gemischtes Bild.

► Webseite: https://www.dje.de

► Podcast:...

Read More »

Read More »

Mercantilism: A Lesson for Our Times?

Mercantilism has had a "good press" in recent decades, in contrast to 19th-century opinion. In the days of Adam Smith and the classical economists, mercantilism was properly regarded as a blend of economic fallacy and state creation of special privilege. But in our century, the general view of mercantilism has changed drastically: Keynesians hail mercantilists as prefiguring their own economic insights; Marxists, constitutionally unable...

Read More »

Read More »

Fondsporträt: Dr. Jens Ehrhardt über den FMM-Fonds

Der FMM-Fonds hat einen flexiblen, vermögensverwaltenden Ansatz. Er investiert überwiegend in Aktien, kann aber auch in Anleihen investieren oder seine Cash-Quote stark erhöhen, wenn es die Marktsituation erfordert. Dr. Jens Ehrhardt managt den Fonds seit dessen Auflage im Jahr 1987. Im Video stellt er seinen bewährten Investmentansatz vor. Außerdem erläutert er, warum für den FMM-Fonds sowohl substanzstarke Unternehmen als auch aussichtsreiche...

Read More »

Read More »

Konsumgüter: Kaffee schmeckt immer – auch kalt – Podcast mit Sebastian Hofbeck und Manuel Zeuch

#Konsumaktien gehören zu den Evergreens bei Anlegern und erfreuen sich auch in konjunkturell schwierigem Fahrwasser großer Beliebtheit.

Sind #Aktien aus dem #Sektor auch in der aktuellen Lage eine gute Wahl fürs Portfolio?

Das diskutieren wir in unserer aktuellen Podcast-Episode mit zwei Experten aus dem DJE-Research: Sebastian Hofbeck und Manuel Zeuch. Im Podcast teilen sie neueste Erkenntnisse von ihrem Besuch der wichtigsten...

Read More »

Read More »

Paleoconservatives Need Better Critics

Paul Gottfried is no stranger to criticism from “conservative” gatekeepers. Like his friend and colleague Murray Rothbard, Gottfried has been a target of Buckleyite conservativism ever since he was ousted from the National Review in the 1980s. Also, like Rothbard, Gottfried’s ideas have continued to inspire new generations of Americans sincerely interested in grappling with societal issues as neoconservatism has waned everywhere outside of...

Read More »

Read More »

To Smoke or Not to Smoke: The Cigarette Economy in Postwar Germany, 1945–48

During the three years after World War II, Germans—facing a ruined economy and wildly depreciating currency—turned to cigarettes as a medium of exchange on a massive scale. Allied occupation authorities strictly forbade this black-market currency exchange, but it literally saved the lives of many German civilians—and inadvertently made many American GIs rich.

The cigarette had already made its appearance during the war as a currency in both the...

Read More »

Read More »

When Slave Owners Chose Federal Power over Local Sovereignty

A recurring theme in American politics is the cynical use of federal power by those who simultaneously pretend to favor "states' rights" or "local control." We see this today when Republicans one minute say they favor local control with gun laws or Obamacare—and then demand the federal government impose nationwide drug prohibitions. We see it among Democrats who want local control over "sanctuary cities" for illegal...

Read More »

Read More »

Why Regimes Want to Rule Over Big States with More Land and More People

When the Soviet Union began its collapse in 1989, the world witnessed decentralization and secession on a broad scale.

Over the next several years, puppet regimes and states that were independent in name only broke away from Soviet domination and formed sovereign states. Some states which had completely ceased to exist—such as the Baltic states—declared independence and became states in their own right. In its heyday, the Soviet Union had been...

Read More »

Read More »

Unraveling the Fallacy of Natural Monopolies

Most cartels and trusts would never have been set up had not the governments created the necessary conditions by protectionist measures. Manufacturing and commercial monopolies owe their origin not to a tendency immanent in capitalist economy but to governmental interventionist policy directed against free trade and laisser-faire.

—Ludwig von Mises, Socialism

The concept of natural monopolies has often intrigued economists and policymakers, serving...

Read More »

Read More »

DJE-Halbjahresbilanz Kapitalmärkte 2023: Webkonferenz mit Dr. Jens Ehrhardt und Markus Koch

Für Dr. Jens Ehrhardt, Gründer der DJE Kapital AG, heißt das Motto für das restliche Jahr 2023 „Mit Vorsicht voraus“.

✔ Ist die #Bärenmarkt-Rallye vorbei?

✔ Geht es abwärts und wenn ja, wann?

✔ Welche Titel tragen eigentlich die aktuelle #Performance z. B. des S&P 500, und sind das zu wenige?

Auf der #Halbjahresbilanz beleuchtet Dr. Jens Ehrhardt die Lage an den Kapitalmärkten: gewohnt fundiert, klarsichtig und ohne zu beschönigen. Dabei...

Read More »

Read More »

Radical Decentralization Was the Key to the West’s Rise to Wealth and Freedom

It is not uncommon to encounter political theorists and pundits who insist that political centralization is a boon to economic growth. In both cases, it is claimed the presence of a unifying central regime—whether in Brussels or in Washington, DC, for example—is essential in ensuring the efficient and free flow of goods throughout a large jurisdiction. This, we are told, will greatly accelerate economic growth.

In many ways, the model is the United...

Read More »

Read More »

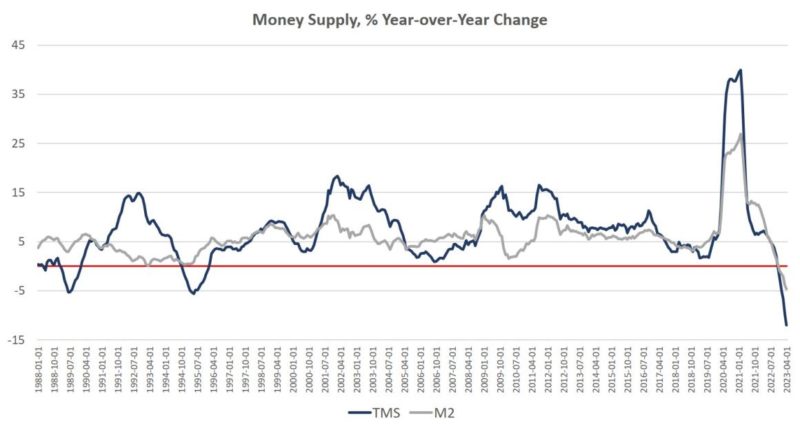

The Money Supply Keeps Falling After Its Biggest Drop Since the Great Depression

Money supply growth fell again in April, plummeting further into negative territory after turning negative in November 2022 for the first time in twenty-eight years. April's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years.

Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply repeatedly contract—year-over-year— for six months...

Read More »

Read More »

Unleashing the Power of Greed: How the Free Market Propels Progress

The free market system has faced its fair share of criticism, often being labeled as a breeding ground for greed and self-interest. However, let’s take a closer look and see how greed, when properly channeled and regulated within a free market framework, can actually bring about positive outcomes for society.

One fascinating thought experiment that showcases the positive role of greed in the free market is Adam Smith’s concept of the “invisible...

Read More »

Read More »

How Capitalism Redefined Masculine Virtue

In the pre-industrial world, aggression and physical domination were often labeled as "masculine" virtues because they were useful for survival. The rise of the cooperative market economy changed all that.

Original Article: "How Capitalism Redefined Masculine Virtue"

Read More »

Read More »

Wie fällt die Halbjahresbilanz aus? – Podcast mit Dr. Ulrich Kaffarnik

Marketing Anzeige

Nach sechs Monaten Börse in 2023 ist es höchste Zeit für eine Zwischenbilanz:

✔ Welche Assetklassen haben geliefert, welche enttäuscht?

✔ Wie sieht es bei den Währungen und Regionen aus? Nicht fehlen darf natürlich der Ausblick aufs zweite Halbjahr.

✔ Wo können Anlegerinnen und Anleger positive Überraschungen erwarten?

✔ Wo lauern Herausforderungen?

Das und mehr diskutieren DJE Vorstand und Kapitalmarktexperte Dr. Ulrich...

Read More »

Read More »

Dem Markt fehlt die Breite – Marktausblick Juni 2023 mit Markus Koch & Stefan Breintner

#energie #rohstoffe #technology #konjuktur

Marketing-Anzeige:

Für den Juni und die kommenden Monate ist weiterhin Vorsicht angesagt. Der Fokus liegt auf defensiveren, weniger zyklischen Bereichen. Nach der guten Entwicklung an vielen Börsenplätzen in den ersten fünf Monaten des Jahres 2023 könnten nun die nächsten Monate schwieriger werden.

Was das aktuelle Umfeld für Investorinnen und #Investoren bedeutet, diskutieren Wall Street-Journalist...

Read More »

Read More »

Is the Banking Crisis Being Orchestrated?

As a banker and economist, I am riveted by the expeditious demise of Silicon Valley Bank and other institutions. Were these crashes due to bank mismanagement, as many pundits as well as regulators have posited? Were they due to not managing risk, not hedging, and unfettered exposure to sectors of concern? Or maybe something else is afoot, a movement that may have begun a decade ago.

Recall the Great Recession (2008–10), buoyed by a housing and...

Read More »

Read More »

FMM-Fonds – DJE-plusNews Juni 2023 mit Mario Künzel (Marketing-Anzeige)

DJE-plusNews mit Mario Künzel zum Thema Optimismus vs. Pessimismus.

✅ Auf und Abschwünge entstehen durch Optimismus und Pessimismus und nicht durch Nachrichten.

✅Nachrichten bilden lediglich die Grundlage für das optimistische und das pessimistische Lager und damit für die Stimmung am Markt.

✅Stimmung braucht aber auch Liquidität.

✅Ohne Liquidität ist selbst der größte Optimismus wertlos.

✅ Fonds im Fokus: FMM-Fonds

Das nächste DJE-plusNews...

Read More »

Read More »

Current Socialists Should Support Government Default: Their Forebears Certainly Did

Bernie Sanders, in a recent opinion piece, attacked Republicans for trying to get concessions out of the Biden administration under threat of debt default, stating, “Defaulting on our nation’s debt would be a disaster.” Writers at Jacobin echo Bernie’s sentiment.

Unfortunately, it seems like modern socialists are against default; however, historic socialists are not on the same page as our contemporaries. Karl Marx, Vladimir Lenin, and other...

Read More »

Read More »

How “Squatter Democracy” Created America’s First Welfare Program

With the rise of homeless camps and tent cities in many American cities, the issue of squatting has become a cause for alarm among many residents and policymakers. In many cases parks, sidewalks, and other public rights-of-way have been taken over by people living in tents or makeshift shelters, rendering the areas unusable to most area residents. In other cases, some of these homeless people have taken over empty businesses and homes that were...

Read More »

Read More »