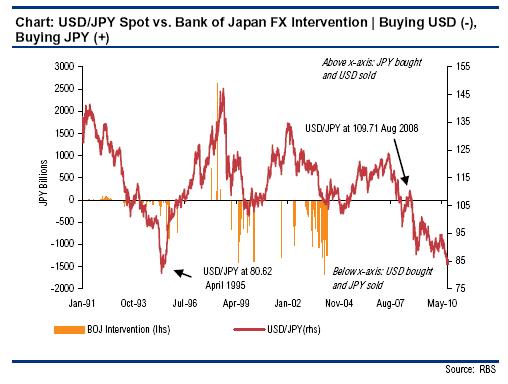

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.

As opposed to the Swiss National Bank, the Japanese only talk, they do not fight.

2016 Japanese interventions thread

Once the Fed finally reduced rate expections, the USD/JPY depreciated from 120 to 108 in a single quarter.

H(via Reuters and investing.com) Gains for stock markets and a warning of the chances of intervention from Japan’s finance minister knocked back the yen on Friday after a week of startling gains.

The yen surged at one point by as much as 2 percent against the dollar on Thursday, and Minister Taro Aso responded early on Friday by warning rapid currency moves were “undesirable,” that the yen’s were “one-sided” and that Japan would take steps as needed.

That is language that Tokyo has used in the past to flag intervention, and the yen’s run to 17-month highs against the dollar has required investors to believe that it would hold fire at least until after next week’s G20 meetings in Washington.

“Of course there is some fear in the market,” said Manuel Oliveri, a strategist at Credit Agricole (PA:CAGR) in London.

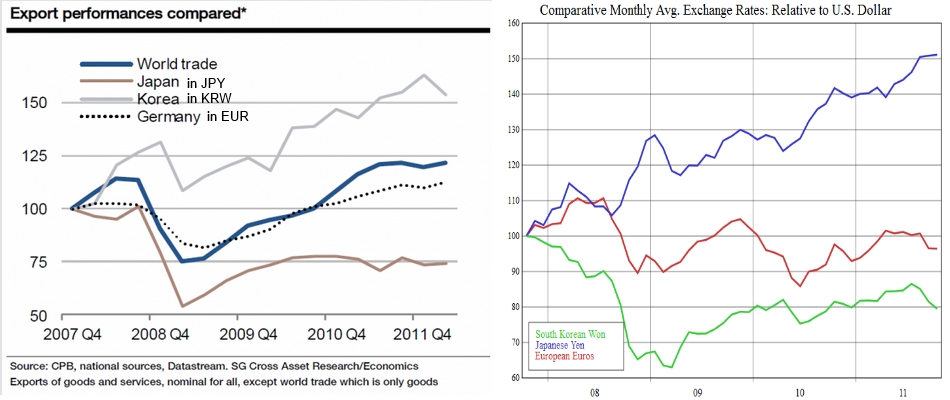

BoJ Interventions 2009-2011:Japanese exports had clearly been harmed by the strong yen in the years 2009 to 2011, visible in the weak export performance, especially compared to its competitor Korea. Still it seems that most of the bad performance vanishes when the export values are translated in US dollar.

|

Japanese Exports and Exchange Rate(see more posts for Japanese Exports and more for USD/JPY)

|

Interventions 2009 and BoJ Assets“All investors know that intervention will not stop the yen strength,” Yuuki Sakurai, chief executive officer at Fukoku Capital Management Inc. in Tokyo, which manages $7.3 billion of assets, said in a telephone interview on May 30. “Intervening at this stage would be unwise and a waste of money. As long as Europe remains in a state of confusion, yen will continue to be bought for its relative safety.” Japan sold 14.3 trillion yen ($183 billion) last year, the third-most on record, Ministry of Finance data show, to slow the currency’s gains after the country was struck by an earthquake and the worst nuclear crisis in a generation.“All investors know that intervention will not stop the yen strength,” Yuuki Sakurai, chief executive officer at Fukoku Capital Management Inc. in Tokyo, which manages $7.3 billion of assets, said in a telephone interview on May 30. “Intervening at this stage would be unwise and a waste of money. As long as Europe remains in a state of confusion, yen will continue to be bought for its relative safety.” |

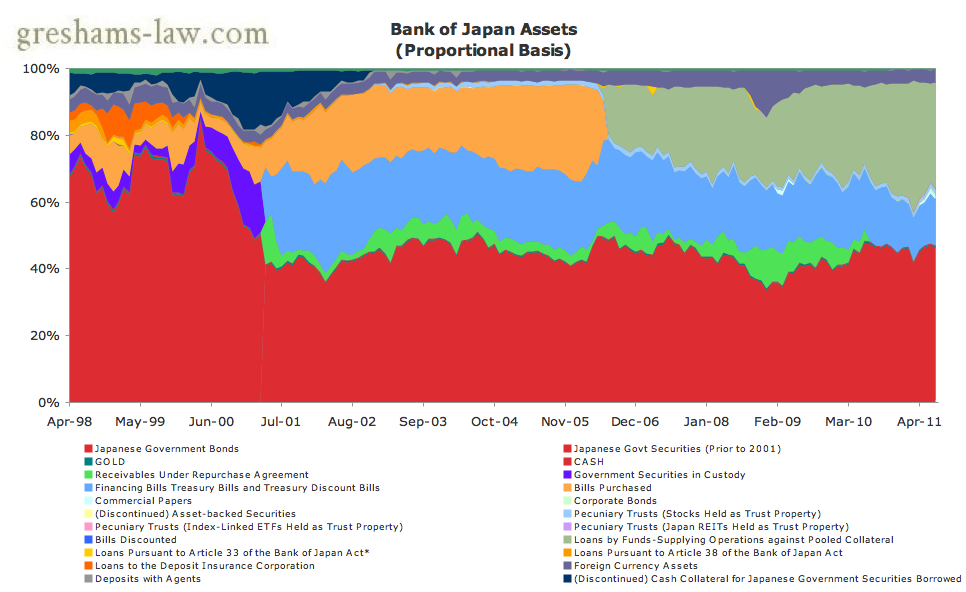

Bank of Japan Assets(see more posts for BoJ Assets) |

Ridiculous intervention threadLooking at the history below, the intervention is pretty ridiculous. The Bank of Japan did interventions only when USD/JPY was under 80. With interventions at USD/JPY of 105 or more, the central bank risks its solvability. |

Bank of Japan Interventions 2001-2011 |

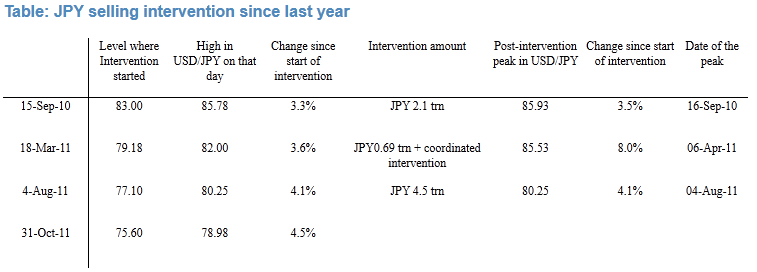

| Zerohedge gives an overview about BoJ interventions

during 2010 and 2011. |

Bank of Japan Interventions in 2011(see more posts for BoJ Interventions)

|

March 2011: TsunamiThe FT shows the series in time when the Bank of Japan intervened, the biggest one in March 2011, when all major central banks helped the BoJ.

|

Dollar Yen 2007 to 2011(see more posts for Dollar Yen)

|

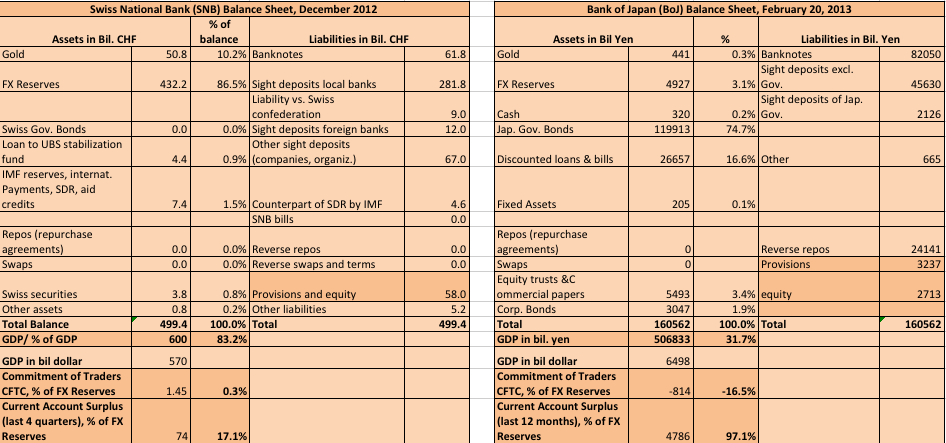

SNB does FX Interventions still todayBut the Japanese did far less FX interventions than the Swiss National Bank: In 2013 FX reserves accounted for 3.1% of the BoJ Balance Sheet. They were far more afraid than the Swiss, as we showed in SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

|

See more for

1 comments

Zankoo abbaspour

2016-04-10 at 20:48 (UTC 2) Link to this comment

Dear Dorgan, as a part of the term paper for applied econometrics course I’m aiming to run GARCH analysis on USD/JPY pair. I was hoping you can help with finding some data pertaining the timeline of BOJ fx intervention in the form of spreadsheets. would you have any idea as where I can find such data?