The easy solution against financial crises: Do not grow too much, money supply targeting

Southern Europe could well remain in a balance sheet recession but it may improve exports thanks to weaker (real) salaries. Similarly to the phase between 1982 and 1992, global growth could remain lack-luster; with the important difference that interest rates were high and money supply low in the 1980s in developed nations but it is the opposite now.

On the other side, all the money supply will need to be invested or spent, prices must rise somewhere. If one country is in a balance sheet recession and people want to reduce debt, then there are enough other countries that can absorb the liquidity and expand because they do not have a debt issue.

However, the possibly quicker recovery in the United States, based on easy Fed money, higher consumer spending and additionally sustained by weakness in the emerging markets, might show that the next inflationary shock and a financial crisis will surely come, we just do not know when.

Slow global growth would be the easy and best solution. Targeting – possibly global – money supply instead of price inflation is the one that avoids any financial crisis. If growth really remains subdued for another ten years, this would mean that Koo’s balance sheet recession theory can overlay traditional monetarist theories.

Will emerging markets overtake the monetarist cycle in developed nations?

Due to the symptoms of the balance sheet recession, the business cycle in developed economies might be far slower than we described above.

Due to the symptoms of the balance sheet recession, the business cycle in developed economies might be far slower than we described above.

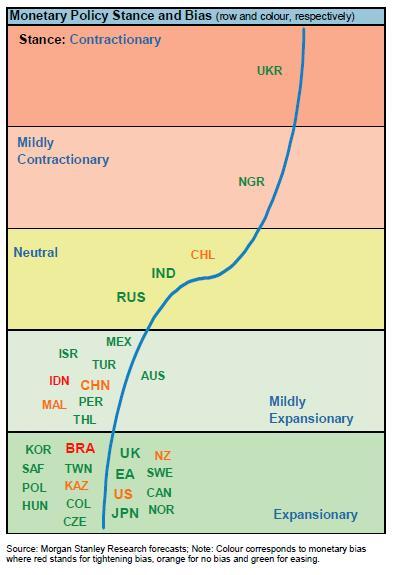

Wages in emerging markets are still low enough; current account surpluses and cheap US funds might help them to overtake the cycle in developed economies with their own far quicker monetarist cycle. In many of them, monetary policy has become accommodative again, as the red or orange colours indicate, despite high inflation pressures.

Dow 116200 in 2040?

Talks about the Dow 116200 by 2045, i.e. a yearly excess return for stocks of 7% over treasuries, will be possible only if US firms are able to avoid salary increases. The gains in the Dow were possible thanks to cheap labour, new demand overseas as well as no US salary hikes since 2008. This might continue for a couple of more years, but definitely not until 2045. Workers will demand higher salaries, especially when the wage gap between developed and emerging markets has shrunk and the dependency ratio (nonworking vs. working population) has risen to levels over 40% and labour will become a scarce good.

Forecast for Dependency Ratios in Different Countries

At that moment, not only workers, but also inflation, will strongly strike back!

See more for