This free portfolio is offered to help investors understand that what they may have learnt about risk and return do not correspond to the realities of investing today.

COMMENTS ON THE PORTFOLIO

Unfortunately Sketchers (SKX), which lost more than 12% has not yet bottomed out. There is a theory, which says that the market is always right, but I believe that the market is always wrong. SKX’s data indicates the latter:

| Q1 EPS

Forecast |

Q2 EPS

Forecast |

Current Year

Forecast |

Next Year

Forecast |

P/E Ratio | PE to Growth

Ratio |

| 43% | 14% | 37% | 20% | 16 | 0.38 |

The company has an aggressive growth policy to expand internationally, targeting 1650 points-of-sale this year, especially in Europe and China, which will depend of its brand acceptance and the product mix, with Under Amour, and Nike as their main competitors. Although the Year-on-Year EPS growth is declining, the above forecasts indicate an encouraging improvement. If the stock does not beat consensus forecasts on 27 April its price will however take another beating, but if it outperforms, it will breakout into a wholesome intermediate trend. I recommend you see how the stock reports, before you take any (further) position is it.

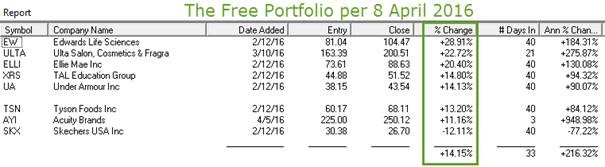

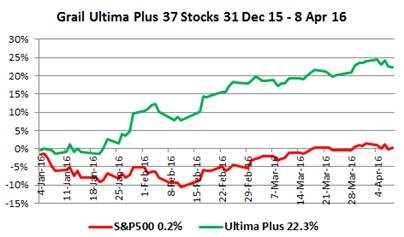

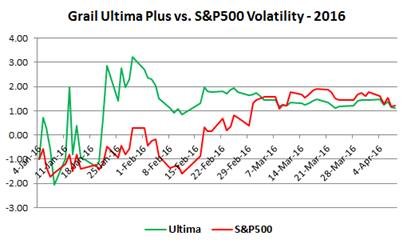

At 14.15%, the Portfolio’s performance is very close to the 15% set to be achieved in the two months from 12 February, i.e. in just two trading days. The Ultima Plus portfolio is testimony like no other of the high performance the Grail Equity Management System (GEMS) achieves and defies the conventional assumptions of Modern Portfolio Theory that higher returns require the taking of higher risks. This fallacy is verifiable in several ways, but is established beyond doubt by the Value at Risk Volatility graph of the portfolio, measured by daily standard deviations, and shows that the S&P 500 has inherently more risk. This is only common sense, since the index’s daily price movements are very close to its average, whereas the Ultima Plus’s price graph shows a strong expansion of its margin of safety. This clearly argues that investing only in the market risk premium over the last two years has generated losses, since from 31 December 2014, the S&P 500 is marginally negative, without portfolio costs, at -0.15%!

One must appreciate that this index-performance is the new normal in this Age of the Alpha Stock. Recognition and thus change is difficult to accept, since behavioural finance teaches us that our biases for the old theory have emotional hurdles to be overcome, since entrenched habits and beliefs have been moulded by decades of accepting the old finance theory. On the other hand, this free portfolio and all Grail Portfolios, strongly exhibits high Alpha-generated returns, because of its vigorous methodologies to find the highest grade market leaders. Ignoring the New Normal will only produce the most mediocre of returns, if any, with higher risk of losses the closer a portfolio’s return is to its surrogate index.

I would of course welcome you as a valued client, but your choice, like this portfolio, is free, on the understanding that as the poem “Invictus” states:

‘It matters not how strait the gate,

How charged with punishments the scroll,

I am the master of my fate:

I am the captain of my soul.’

I look forward to answering any queries you may have.

See more for