Economic news often leads to virtuous and vicious cycles: good news is often followed by better business and consumer sentiments, which helps to achieve better economic data. On the other side, bad sentiments follow bad news that causes economic data to become worse: a vicious circle. Longer virtuous and vicious cycles are reflect in so-called “business cycles”, cycles that are far shorter than the typical 14 years of a typical financial cycles.

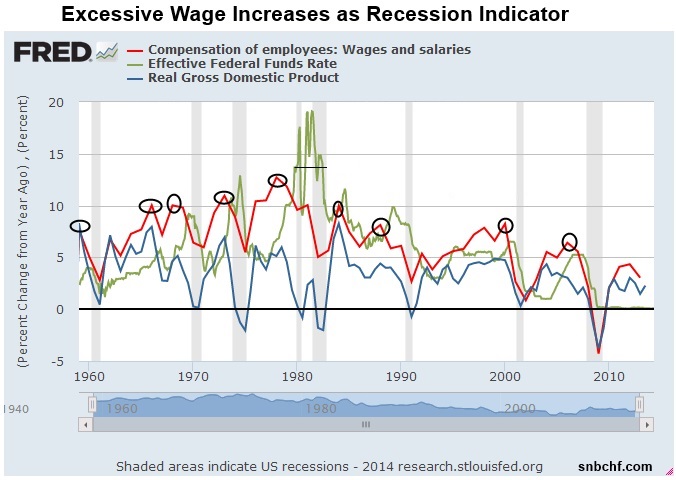

The typical backstops of all improvements in business cycles are high oil prices and inflation. Inflation is mostly caused by local effects: High so-called “core inflation” represents the symptom that wages rise quickly and are translated in higher sales prices. Higher prices of oil are often caused by rising global demand and sometimes by geopolitical issues. Oil prices caused by global demand are also an indicator to which country global investments flow; if prices are high then the target is often not the United States. Higher inflation and higher oil prices are often able to stop U.S. expansion and with it a stock market rally.

Central banks try to limit inflation and hike interest rates, aka “tighten”, with the effect that investments (including investments in human capital) are reduced and boom phases end. Business cycles were characterized by deviations from the long-term trend growth in Gross National Product.

Stock market cycles were mostly caused by Fed tightening, an increase of interest rates to prevent inflation. The cycle ends in recessions.

As we will see in other chapters, business cycles are smaller than financial cycles. The latter often take 14 years, 7 years of expansion (boom) and 7 years of contraction (bust). As opposed to business cycles, they are not concentrated on company investment cycles, but on saving behaviour of the household sector.

<– Back to Financial Cycles Overview

See more for