Since March 2015, Keith Weiner of the gold standard institute, United States, contributes on snbchf.com. This post is another great insight for a simple fact that traders often forget.

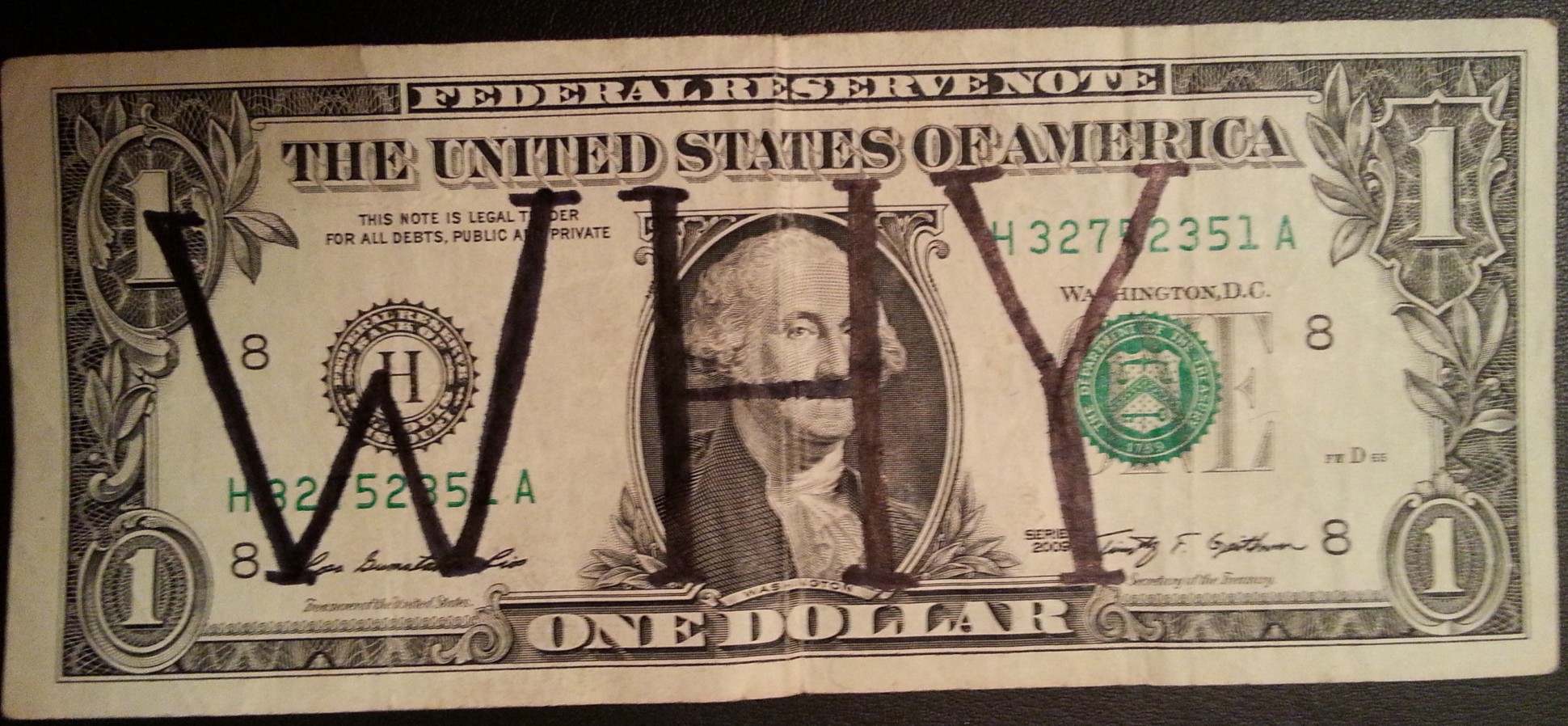

Do you really want to know why we have a paper fiat currency? The reason is simple, but not obvious. Let’s make a few observations and then form our conclusion.

When you talk to people about the fiat dollar, you encounter three reasons for their acceptance. One, most people are apathetic. They don’t really know what money is, and they don’t care. So long as they have food and shelter and a little to spend, they put the monetary system out of sight and out of mind.

Two, most people who have studied economics have been indoctrinated in the ideology of central planning. Whether the issue is automotive fuel efficiency, wages, or healthcare, they have been programmed to believe that a free market leads to a bad outcome, but socialist planning improves the result. Centuries ago, it took geniuses such as Adam Smith and Frédéric Bastiat to explain why that’s untrue. Today, a smart middle school student can debunk it, but its popularity lives on. This leads us to the third reason.

Three, many people like to get something for nothing. No one really believes that printing money leads to wealth and prosperity. They just want to be a beneficiary. Tens of millions of people receive transfer payments of one sort or another. Millions more work in the transfer system at a government agency, private contractor, law firm, lobbyist, etc. Whole sectors of the economy now depend on the monetary scheme, like hogs feeding at a trough.

For example, consider the real estate sector. Development and construction would immediately cease if the Fed allowed the interest rate to rise substantially. Buyers would balk if the cost of financing skyrocketed. For example, MetLife Real Estate Investors just bought a 22-story office tower in Houston. They paid almost $300 per square foot. Rental rates in that area are about $24 per square foot per year. After expenses, the owner will be lucky to get a 5% return on its money, not counting the risk of a drop in real estate. This building would sell for a lot less, if interest rates were higher.

Another case is the municipal sector. Most cities have perpetual budget shortfalls. They sell bonds to raise cash so they can spend more than they get in taxes. They depend on artificially low interest rates. If the rate goes higher, their game will be up. Municipal workers and contractors will be laid off. Local bars and even artists have all become dependent on endless city spending. Light rail, downtown art projects, stadiums, and other public spending have numerous beneficiaries.

The biggest deficit spender of all is the federal government. Makers of electric cars like Tesla receive government subsidized loans. Tesla also benefits, as do drug makers like Merck, from subsidies to their customers. Over 47 million people get food stamps. Millions get a subsidy for college. There are countless programs that give money to people, including welfare and Social Security.

Spending is very popular. However, few people want to lose more to taxes on their income, property, or purchases. Government borrowing is the magic that lets them eat their spending cake and have their low (well, less high) taxes too. It seems like a good deal. Modern economics provides a cover, letting people feel that it’s really OK.

Endless borrowing is simply not possible in the gold standard. With each increase in borrowing, the interest rate goes up. This restricts the flow of credit, especially to borrowers who have neither the means nor the intent to repay. Governments are the biggest borrowers, and they lack the means to repay. This is why most people oppose the gold standard. It is a threat to the gravy train.

While the gold standard may not be a panacea for every government ill, it certainly imposes some discipline on spending. This restraint is decades overdue, and sorely needed, even if it upsets those on the take.

See more for