Since March 2015, Keith Weiner of the gold standard institute, United States, contributes on snbchf.com. This post is another great insight for a simple fact that traders often forget.

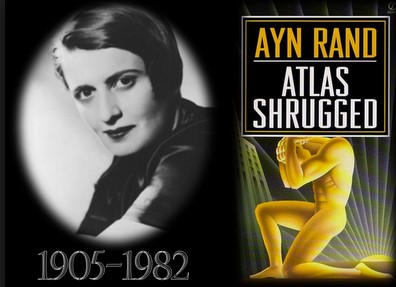

Do you think that there is an inherent conflict of interest between people and businesses? One view holds that in every trade (especially between a big business and a small customer), there is a winner and a loser. The novelist and philosopher Ayn Rand summarized this view when she said, “It is the Communists’ intention to make people think that personal success is somehow achieved at the expense of others and that every successful man has hurt somebody by becoming successful.”

Do you think that there is an inherent conflict of interest between people and businesses? One view holds that in every trade (especially between a big business and a small customer), there is a winner and a loser. The novelist and philosopher Ayn Rand summarized this view when she said, “It is the Communists’ intention to make people think that personal success is somehow achieved at the expense of others and that every successful man has hurt somebody by becoming successful.”

Another view holds that people work together for mutual gain. In this theory, wealth is produced by marrying a good idea to hard work, making win-win deals, and producing more than you consume. Everyone benefits by participating in society, no matter his skill or intelligence.

The great economist Ludwig von Mises, summarized this view in Human Action. He wrote, “The member of a contractual society is free because he serves others only in serving himself.” He was keenly aware that throughout history, people were forced to serve by brute force.

Today, there seems to be evidence for both theories. There are certainly examples of someone getting rich unfairly. For example Goldman Sachs received a multibillion dollar loan through a government bailout in 2008, and $25B in 2009. Plus it avoided $22B in losses when the government bailed out AIG. Perhaps because of this taxpayer largesse, the company was able to pay out over $11B in employee bonuses in the first half of 2009. The CEO Lloyd Blankfein was so smug, he actually insisted that the company is doing “God’s work.”

On the other hand, there are numerous cases of mutually beneficial trade. For example, Apple iPhones make the lives of their owners better in innumerable ways. The cost of buying one is not robbery or extortion. Yet Apple earns hundreds of dollars on every unit and it has sold well over 500 million of them.

So which view is correct? Is it possible for people to cooperate in mutually beneficial trade? Or are there cronies who don’t deserve their riches, who are really just looters?

Nowadays, both views are right. We have what economists call a mixed economy—which has elements of both free trade and crony profiteering. For every Facebook, which gets no subsidies, there is a Tesla. At one point, this company was taking $35,000 per car. It got this money from its competitors, thanks to California environmental regulation.

The mixed economy is not the end state, but an intermediate step along the way. It is progressing, evolving into something else. It could become freer. If not, it’s inevitably moving towards more government control.

For example, recently, the Federal Communications Commission voted to impose 300 pages of fresh regulation on the Internet. I predict that companies which had been exclusively focused on serving customers, will increasingly turn their attention (and budgets) towards Washington. The only thing that beats earning money from satisfied customers is taking it with help from the government.

Of course, in this column my focus is not on regulation per se, but the regime of central banking. No subsidy or regulatory ruling against a competitor can possibly match the sheer magnitude of the plunder made possible by what we euphemistically call monetary policy.

In one fell swoop, the Federal Open Market Committee—the closest thing we have to the Soviet Politburo—can bid up bonds, which tends to ripple into other assets such as real estate. This gifts the asset owning class with free gains, while pushing others down.

If the goal of the Communists’ propaganda was making people think that getting rich impoverishes others, then what can we say about the goal of the Fed’s quantitative easing? The central bank’s every act over 6 years has been to force markets towards the opposite outcome that free people would choose.

The Fed is making that old Communist lie come true.

See more for