On November 3, the Manhattan Institute hosted the fall meeting of the Shadow Open Market Committee (SOMC). This is a 40-year old group, with many illustrious economists among its membership, starting with its founder, Allan Meltzer.

The SOMC is not shy about criticizing the Federal Reserve, though they remain committed Monetarists. These students of the Chicago School make a great show of their dispute with the followers of John Maynard Keynes. Monetarists lean more towards free markets, but both schools share one key idea: fiat currency.

It’s interesting that most people assume that former Fed Chairman Ben Bernanke and current Chair Janet Yellen are cut from the same cloth. That’s because their policies have been indistinguishable in practice. However, Bernanke is a Monetarist who openly credits Milton Friedman and Yellen is part of the New Keynesian School.

Distinguished Professor of Economics at Rutgers University, Michael Bordo spoke on a panel at the SOMC meeting. In his remarks, he made an offhand dismissal of gold. The SOMC had considered the gold standard, but rejected it.

During the Questions and Answers period, I had an opportunity to ask a question. I began by noting that the Fed is the central planner of money and credit. I asked why the SOMC didn’t favor gold and a free market in money. Professor Bordo didn’t want to respond, so the panel moderator, Carnegie Mellon economics professor Marvin Goodfriend, responded. He told the audience and me that we could revert to the gold standard as a last resort. But, he said, he is an “optimist” (his word) and believes that the Fed can do better.

Forget the endless debasement of the value of the dollar. Forget the economic alphabet soup of GDP economy, CPI inflation, M0 money supply, and U6 unemployment. Eyes glaze over when these technical topics are debated, and they’re just a distraction from a timeless question. Can men be trusted to conduct their own affairs voluntarily? Or should some be appointed to rule the affairs of others by force?

In other words, free markets or central planning.

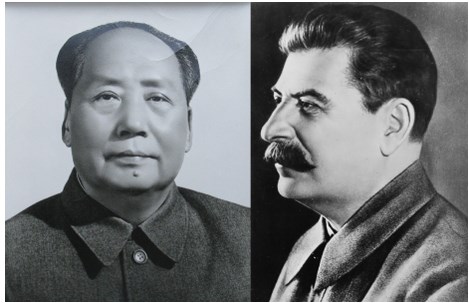

Philosophers and armies have battled over these two opposite visions for millennia. Through most of the 20th century in much of the world, central planning won. So did the Grim Reaper. The socialist experiments in Russia, China, and so on racked up a body count of well over a hundred million. America isn’t there yet, but it’s trending in that direction. Just ask the family of Eric Garner, a man recently choked to death by the police, in an incident that began over a cigarette tax.

The Russians and Chinese didn’t die merely because the wrong people were in charge. However, if central planning puts the Stalins and Maos in control, then that’s a compelling argument against central planning by itself.

They died because central planning cannot even deliver food. Food requires plowing, planting, harvesting, and distribution. These are simple activities, yet socialism is unable to organize them. The socialists inherited food-producing countries, and made it impossible to produce food.

Most countries are smart enough not to again attempt central planning of food. Instead, they think they can make it work with something much more complex: money and credit.

I want to shine a spotlight on that curious word of Professor Goodfriend. Optimism, he said, was the basis for his belief in central planning. I think we are way past the point where that claim deserves any serious merit. Whatever word one may use to describe a belief in central planning, it is not optimism.

Let’s not get distracted with debating the details of central banking, such as the ideal money supply growth. Central banking is the monetary system of socialism, which is why Karl Marx included it in his ten planks. By contrast, gold is the monetary system of the free market.

That’s the issue. Freedom or socialism. Gold or fiat currency. A free market or the Fed’s central planning. Life and happiness, or poverty and death. Take your

See more for