Since March 2015, Keith Weiner of the gold standard institute, United States, contributes on snbchf.com. This post is another great insight for a simple fact that traders often forget.

The godfather of modern economics, John Maynard Keynes, dismissed the concept of gold as money—the gold standard—as a “barbarous relic.” Another economics titan, Nobel Prize-winner Milton Friedman, conceded that gold is good in theory, but opposed gold in practice, arguing that a return to a gold standard is “neither desirable nor feasible.”

Both Keynes on the left and Friedman on the right got it really, horribly wrong.

The gold standard is neither barbaric nor impractical, and it is more urgently needed every day. This is because the standard of paper money is failing. It has set in motion an accelerating series of crises, each worse than the previous. The nation cannot continue to borrow to infinity, nor can the U.S. endure zero interest much longer.

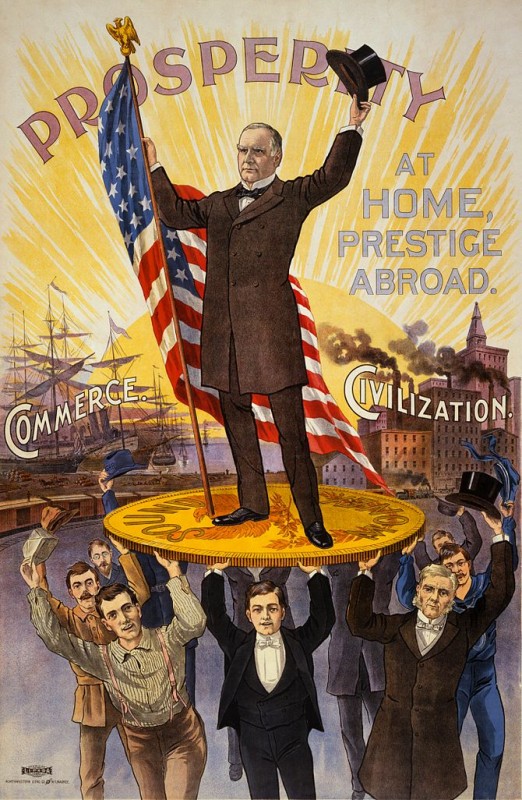

Campaign poster showing William McKinley holding U.S. flag and standing on gold coin “sound money”, held up by group of men, in front of ships “commerce” and factories “civilization”. (Photo credit: Wikipedia)

Campaign poster showing William McKinley holding U.S. flag and standing on gold coin “sound money”, held up by group of men, in front of ships “commerce” and factories “civilization”. (Photo credit: Wikipedia)

An examination of history supports the case for gold. Under the gold standard in the 19th century, the quality of life of most people improved faster than ever before, or since. It didn’t last because, unfortunately after the turn of the century, war preparations required huge expenditures.

Waging what was later called the Great War could only be financed by one means: debt. And there was only one way to borrow. In most countries, a central bank was already established, and by 1913 even the freest country had created a central bank. They called it the Federal Reserve.

Central banking is simply central planning—government interventions—applied to money and credit. The gold standard is simply a free market in money. Intervention conflicts with a free market, and gold lost the battle. It’s no coincidence that economies collapsed one by one after the war.

All too soon, men were marched off to war again. By the end, much of the world was reduced to rubble and desperate political leaders sought credit to finance postwar reconstruction. The U.S. named its terms: other countries had to treat the U.S. dollar as if it were gold. The Allies signed the treaty, at Bretton Woods in New Hampshire.

But the U.S. dollar was not as good as gold. It was merely Uncle Sam’s promissory note. Perversely, the greater the world’s demand for money, the more debt the U.S. government could issue, which enabled more spending. The crisis came to a climax in 1971, when President Nixon’s gold default created the current system. By Nixon’s decree, the dollar became an empty promise, backed by literally nothing.

Since then, we have had a worldwide regime of irredeemable fiat money. Debt has exploded, doubling about every eight years. The interest rate skyrocketed until 1981, and then went into free fall. The financial system will soon collapse, though when is hard to predict.

Gold, because it empowers savers to keep debt and interest in bounds, can prevent catastrophe.

The main argument against gold is that we need loose monetary policy to get out of recessions. The crisis of 2008 debunks this. Our monetary planners didn’t see the crash coming, and their short-term patches—stimulus and bailouts—have fixed nothing. The next crash looms.

The practical argument against gold is that we don’t have enough of it. This is simply untrue. The 19th century gold standard was run with just a few hundred tons of the metal in London, a tiny fraction of what the US has today. The argument is also frivolous. If the market is allowed to set the value of gold, no particular quantity is necessary.

There is also an argument against a lone country adopting gold. Currency devaluation encourages exports, lifting employment and the economy. It is true, so far as it goes. A falling currency cheapens export goods in world markets. But to fixate on this point ignores destruction of business capital and rising cost of imports, including raw materials. Japan’s economic history confirms this. The yen rose along with exports for decades. Since 2012, the yen has fallen. Japan’s balance of trade is falling with it.

Everyone is better off under gold. Even if other countries remain tethered to failing paper currencies, America should adopt the gold standard. Stable money will allow Americans to thrive. A major component of prosperity is the discipline gold imposes on government spending.

Keynes was wrong that gold is barbarous. Indeed, without gold, the world is now careening toward barbarism. Friedman was wrong that gold is impractical and the West’s teetering economy proves it. What we need more than ever, with the U.S. leading the world, is a path toward adopting gold as money.

See more for