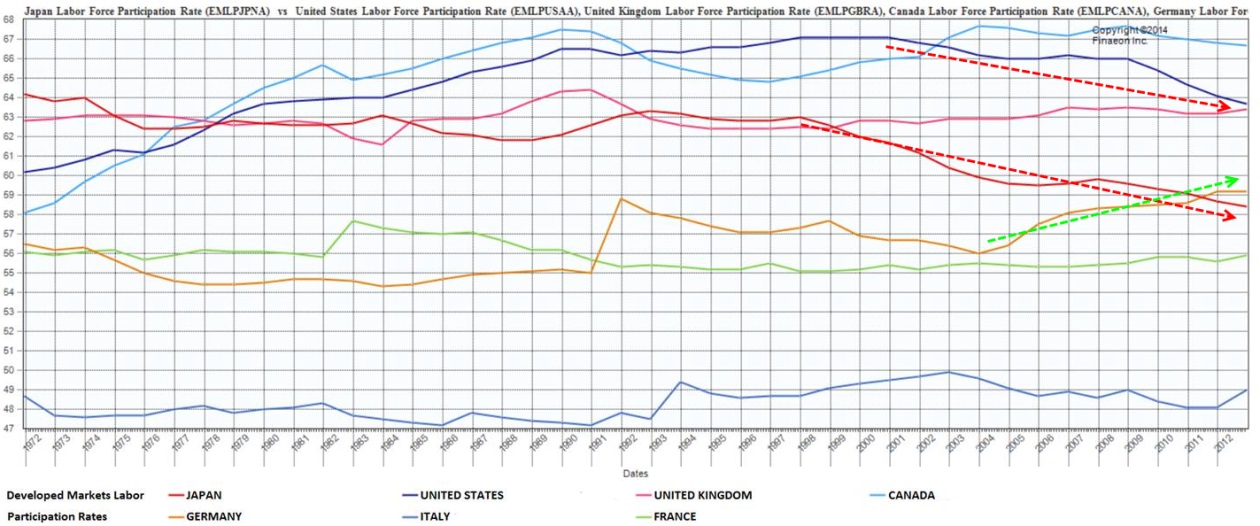

The most effective way of measuring employment is by looking at the Labor Participation Rate. We compare the participation rates of the United States, Canada, the U.K., Germany and Italy.

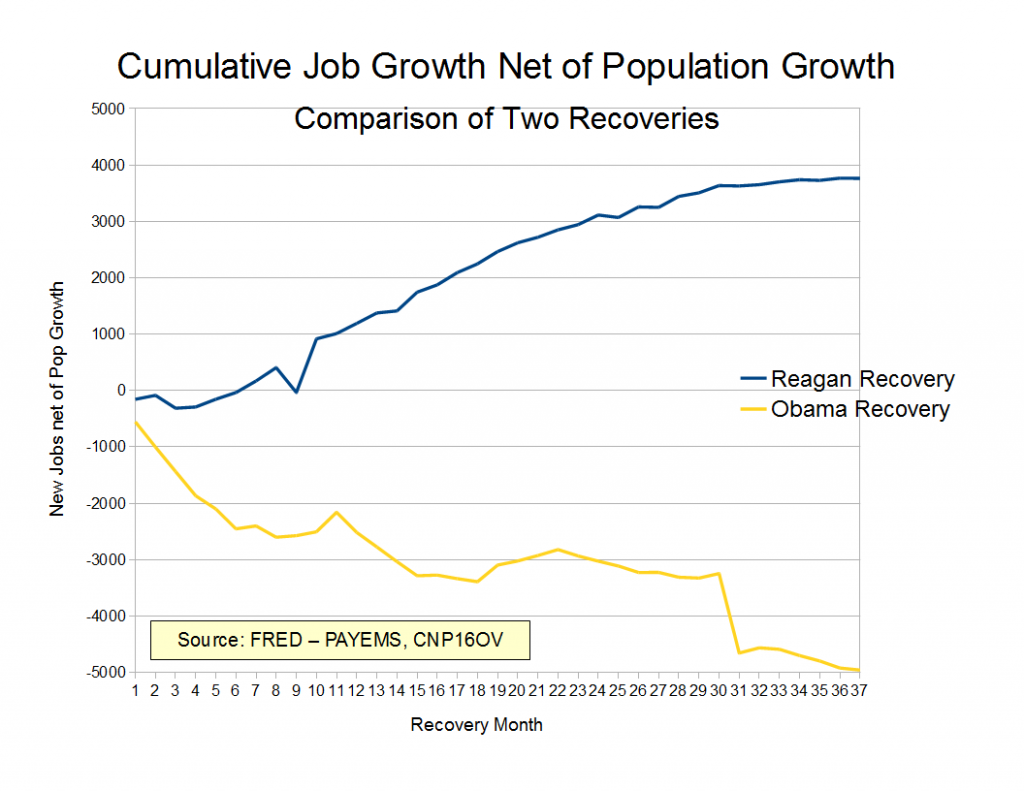

Republicans, Liberals or Austrian economist often criticize the Obama Administration with job growth figures adjusted by population changes like in the following. But this does not show the full picture, because it compares apples with oranges as for demographics.

Click to expand, source

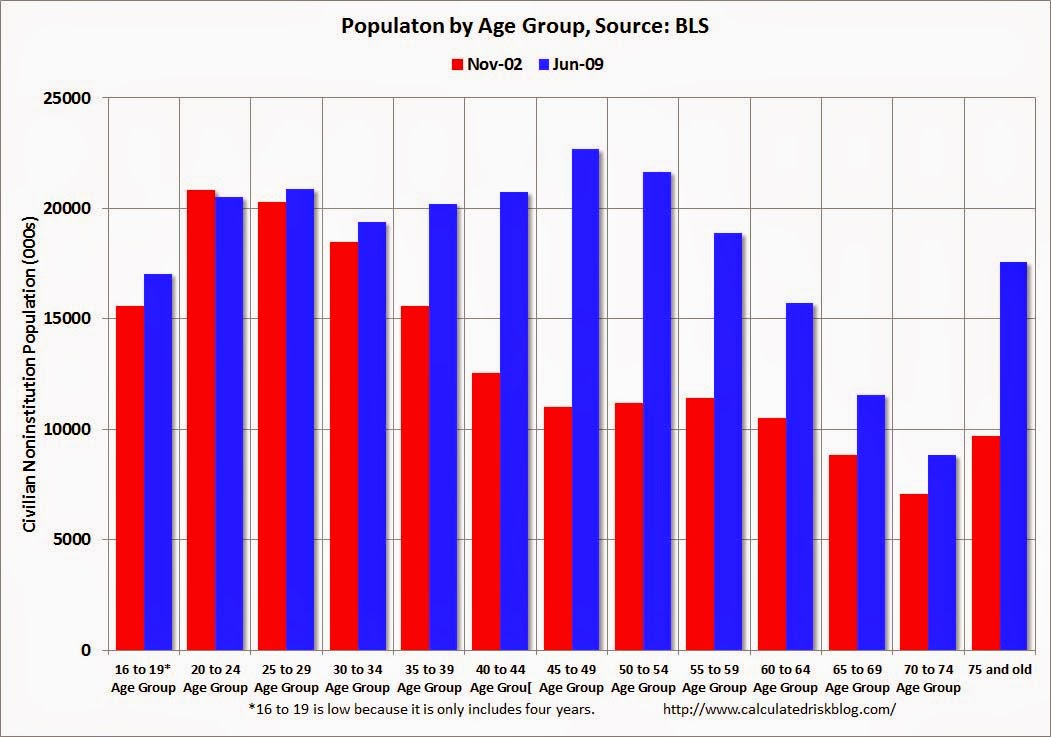

On the other side, some economic sites eg, Calculated Risk like to promote the feeling of a U.S. recovery and ignore the global picture. They explain the falling US participation rate with demographics. This is certainly only partially true.

Given that the demographic effect not only concerns the United States, it makes sense to compare participation rates globally. This helps to know if with an ageing population, participation rates must necessary fall. It might be even possible that the participation rate in younger age ranges or among women must rise to make up for the higher number of pensioners.

Some interesting charts from Credit Suisse this morning are testing the idea that eurozone unemployment looks particularly awful.

Adjust for the rising number of people participating in the workforce in the eurozone, and the falling number willing to work in the US, and unemployment is just about the same in both.

This chart shows the unemployment rate in the eurozone’s 12 pre-2007 members, and in the US, adjusted for the changing willingness to work:

Broadly speaking, Europeans are increasingly willing to work, while Americans are less willing. This is usually interpreted negatively in the US, as Americans giving up looking for work because there are so few jobs available – combined with retirement.

CS thinks there’s more going on than simply the demographic issues of the baby boomers drawing their pensions; there’s been a much bigger drop in the participation rate of the 25-54 year old men who used to make up the core of the workforce.

Among 25-54 year old women the US participation rate is flat, but interestingly is now lower than in the eurozone.

From an investor perspective it bodes well for the eurozone that people are more willing to work, and badly for the US that fewer are willing to work. Central banks have their fingers crossed that the participation rate changes are purely temporary, and that as economies recover those “discouraged workers” will start looking for jobs again.

Even if they do, the similar participation rate-adjusted unemployment figures suggest similar disinflationary pressures on wages in both the US and eurozone from the number of workers (although other factors, such as currency and capital investment, are extremely important for the outlook for inflation too).

Here’s how the willingness to work, the participation rate, has changed:

Click to Expand, Labor Participation Rate 15-64: source Global Financial Data

The following graph from Ralph Dillon at Global Financial Data helps to give that missing piece of the puzzle. While participation rates in the U.S. and Japan are falling, they are rising in Germany. The age group used is 15-64 years.

Most interestingly the rate is relatively stable and recently up in Italy despite rising unemployment. Possibly the best comparable data for Labor Participation Rates come from the World Bank. It is mostly in line with Ralph’s data.

The choice of the age group is a bit problematic. Traditionally Germans or Italians studied longer and started to work later, due to long study time. In Italy also because younger people had difficulty finding a job, respectively. The U.S. seems to follow this tendency of starting work later.

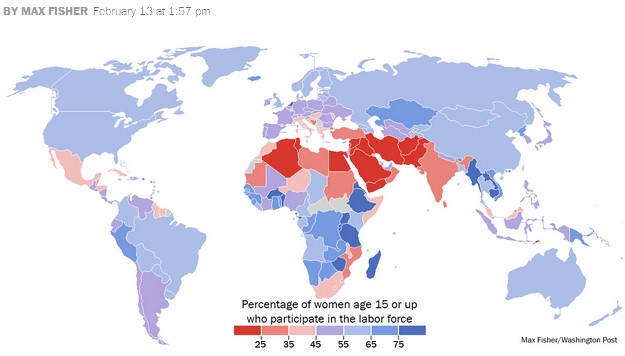

Source Washington Post

The reason why participation rates for Italy are so low, but not falling like in the U.S., can be found in the rising participation of women in the Italian labor force. Many nations in less developed countries show still weak participation by women.

Read also Wall Street Journal:

Is U.S. Unemployment Really Much Better Than the Euro Zone’s?

See more for