Market participants have to confront a stark asymmetry. There are many ways to lose money, but there appears to be only three ways to make money. Nearly all strategies seem to come down to some variant of momentum or trend following, mean reversion, and carry trades.

Trend Following

Foreign exchange traders use these virtuous and vicious circles to follow trends in foreign exchange markets. Elliott wave theory is a more sophisticated form of explaining these circles. Often FX traders and algos “overshoot”, they let an exchange rate rise or fall very strongly in a short period, so that exports and the current account balances of the concerned country are strongly affected over a longer view. The result is that currencies that overshoot need to perform a “trend inversion”, a trend in the opposite direction. FX traders never hold positions for a longer time, the closing of positions/profit taking accelerates the inverse trend. There is one exception to this rule, namely when FX traders are joined by carry traders that use big interest rate differentials and swap rates.

Overshooting: Trend Following May Distort Fundamental Data

FX trading can be thought of as similar to “groupon” deals, often traders follow a master, that indicates where the trend is going. Followers imitate the master’s strategy, even if FX rates get completely distorted from fundamental reality in a short period of time – I am not saying that you should not imitate this trend following strategy.

This is exactly what happened in July 2012, with the huge depreciation of the euro to 1.21 USD and in January/February 2012 with a strong appreciation to 1.36 and more. Thanks to reduced risk aversion and verbal Japanese government intervention, the euro rose from 97 to 129 yen in only 6 months. Japanese production costs are now 30% cheaper than German ones; big Japanese car makers are shifting from European to Japanese part producers. Lower car demand helps to intensify the European unemployment crisis.

While the Japanese take profits from lower production costs with deflation over many years, Germans see inflation and therefore higher costs (see more on the effect of inflation/deflation on productivity, the “real mean reversion“).

Fundamental data, especially current account balances, have not changed that much during these six months. The typical surplus and deficit countries remain the same. An inversion of credit cycles happens rarely, the latest inversions were the Lehman event in 2008 and possibly the recent upwards trend in U.S. housing. This inversion leads to completely different investor perceptions of risk, but is often corrected again by the reality of fundamentals.

Traders often have a short memories. They replicate recent developments into the future. One example is that in 1999 after the Asian crisis, everyone bet on a Japanese recovery. The yen was the strongest performing currency, even if the Japanese actually needed to still de-lever from their housing bubble for another 10 years or more.

The appreciation of the euro to 1.36 in January shows that traders remember the strong euro from the year 2011 that was driven by strong Chinese construction and investments as well as exports of German machines to China in the absence of European austerity.

Momentum Trades

Each is associated with different market conditions and require different behaviors and tactics. In momentum trades, one wants to buy what is going up and sell what is going down. The use of trailing stops may be more beneficial than exiting a trade at a pre-determined level. This seems to be the most common of the three strategies.

Mean Reversion

Mean reversion is the picking of market extremes. It is the opposite of trend following strategies. It requires selling that which has been rising and buying that which has been falling. The mean used can by dynamic, such as a 20- or a 200-day moving average. The mean also can be more stable, such a purchasing power parity. Since picking tops and bottoms is difficult, the win-loss ratio tends to be less advantageous. This in turn requires strict money management discipline. The losses associated with a few failed attempts to pick an extreme need to be limited so the time it is successful more than pays for the failures and more.

Central Bank Interventions are based on mean reversion

Central banks often intervene when the currency severely deviates from the mean.

The main SNB argument is Dornbusch’s “overshooting” model

During speculative attacks, currencies can get into strongly overvalued or undervalued territory. This was effectively the case in August/September 2011.

When the Swiss franc was severely strengthening, the SNB moved the real effective exchange rate from an 25% to a 13% overvaluation, recently this has come down to 11%. The EUR/CHF did not change a lot but other currencies fell.

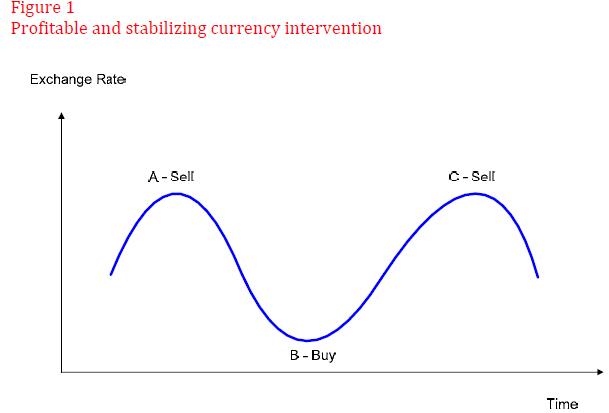

“An early contribution to the debate was Friedman’s ‘Profits Test’ , which assumed central banks that were trying to minimise fluctuations in the exchange rate behaved like speculators when intervening. As a result, they tend to buy local currency / sell foreign currency the when exchange rate is low, to support the local currency, and sell local currency / buy foreign when the exchange rate is high to depreciate the local currency. The combination of ‘buying low and selling high’ implies that if the central bank succeeded in stabilising the exchange rate, then its operations would be profitable (Figure 1).

Carry Trades

Carry trade strategies are deceivingly complicated and most controversial. They entail the selling of a low yielding asset to fund the purchase of a higher yielding asset. Such strategies require three conditions: sufficiently wide interest rate differentials, stable funding rate, and low volatility.

This last condition might not seem so obvious, so permit a brief explanation. The goal of the strategy is to earn the interest rate differential. If the currencies are too volatile, they threaten to overwhelm the carry. Indeed, foreign exchange prices are often more volatile than interest rate market.

So typically what happens is one makes a little money (from the carry), makes a little money and then loses a lot of money on an abrupt move in the currency market. This is why many traders and observers have compared carry trades to picking up pennies in front of a steam roller.

Recently a large investment house (and one that should know better) issued a report that the FT and Dow Jones jumped on claiming the carry trade is dead. It was killed by unconventional monetary policy, under which, as one journalist wrote, “global interest rates have gravitated toward zero” and such policies make currencies more unpredictable.

Ironically, other articles in the same publications disprove the claim by offering examples of carry trades. In fact the persistence of carry trades is why some suggest it is the second oldest profession.

It is not really true that interest rates are gravitating toward zero. Carry trades are not simply interest rate arbitrage, but also can have a temporal component. Consider a carry trade in which one sells a three-month US dollar deposit, paying 0.4%, and buys a six-month Australian deposit yielding 3.75%.

Japanese investors can borrow funds even cheaper. The US-Japanese 10-year yield differential stands near 90 bp, which is above the 100-day moving average. This may be one of the reasons why preliminary data may soon show Japan has surpassed China as the largest foreign holder of US Treasuries.Add in a temporal component. Consider investors that borrowing 2-year Japanese money for around 10 bp and lend to the US Treasury for 165 bp (10-year yield). If one believes Japanese rates will not rise (reasonable) and the US Treasury 10-year yields will not rise much, and might actually fall, within one’s investment horizon, it may be an interesting carry trade. It does still require that the yen does not strengthen, or it can quickly eat away the carry.

With a notable exception of Americans, typically when people invest outside their home country, fixed income investments are clearly preferred over equity investments. Currency variability has a larger role in the total return of fixed income investments than equities. This means that a low volatile foreign exchange environment is more important to carry trade strategies.

Within the G10, there are four countries that are typically used as the long-leg of carry trades: Australia and New Zealand dollars, the Norwegian krone and Swedish krona. Their short term interest rates are some multiple above the lowest yielding G-10 currencies.

Investors, of course, are not confined to G10 currencies. Mrs. Watanabe has shown a new interest this year in Turkish lira denominated uridashi bonds and Australian dollar and South African rand samurai bonds. Or consider the attractiveness of the Brazilian real. The dollar has been confined to a BRL2.00-BRL2.05 range for more than three months. If one expects that range to more of less hold, selling dollars and buying the real may offer an interesting carry opportunity.

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

See more for 4.) FX Theory