George Dorgan extends the previous discussion on trade surplus countries. Now he explains the Penn and the Balassa-Samuelson Effect. He applies these principles to Germany, to Greece and to Switzerland.

Please read as introduction the page on trade surpluses and on the “real mean reversion”, the reversion of currencies to the inflation-adjusted mean.

The Penn Effect

The Penn Effect explains that goods and services have a different price elasticity in global comparison.

Entirely tradable goods cannot vary greatly in price by location (because buyers can source from the lowest cost location). However, most services must be delivered locally (e.g. hairdressing), and many manufactured goods have high transportation costs. The Penn effect usually occurs in the same direction: where incomes are high, average price levels are typically high (see in Wikipedia).

The Balassa Samuelson effect

The Balassa Samuelson effect finally translates the concept of trade surplus into productivity growth, something we only partially discussed in the real exchange rate mean reversion.

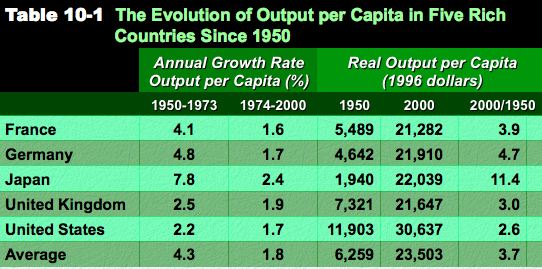

In 1964, academics Bela Balassa, a Hungarian economist, and Paul Samuelson, a Nobel-Laureate economist, independently observed that countries with higher levels of productivity growth experienced rapidly rising real wages and so appreciating real exchange rates. Academic studies since have suggested the picture is not as simple as Mr Balassa and Mr Samuelson first thought and that many other factors can also influence the model. However, until 2012, many long term investors in emerging market currencies, have been able to benefit from the appreciation of those currencies which is arguably due to the Balassa-Samuelson effect. (via the Financial Times)

The Balassa Samuelson effect states that productivity growth-rates vary more for a country’s traded goods than in other sectors. This implies:

- Workers in some countries generate greater productivity than those in other countries and this acts as the source of income differences.

- For some labor-intensive jobs productivity innovations will have smaller effects. No matter their education or location a burger flipper will manage the same number of burgers/hour.

- Fixed-productivity sectors produce goods that cannot be transported (e.g. haircuts, the hairdresser has to be able to physically touch the hair to cut it).

- For local wages to be equalized the same job might be worth more in one location than another (e.g. flipping burgers in Zurich and Nairobi).

- The CPI is local goods (will be more expensive in rich countries) and tradables (same price in all countries).

- PPP (purchasing power parity) is used to peg the exchange rate for tradable goods (this is testable).

- Money exchange rates vary related to productivity of tradable goods (more than average productivity); and, for real goods the differential is less than for money.

- Productivity becomes income, meaning real income is not affected by changes in money as much.

- This is like stating that real income can be exaggerated by money exchange rates. Alternatively, items will cost more in richer countries.

The Financial Times discusses the combination of FX rate appreciation and productivity growth more in detail here.

Tradable goods, manufactured in Switzerland

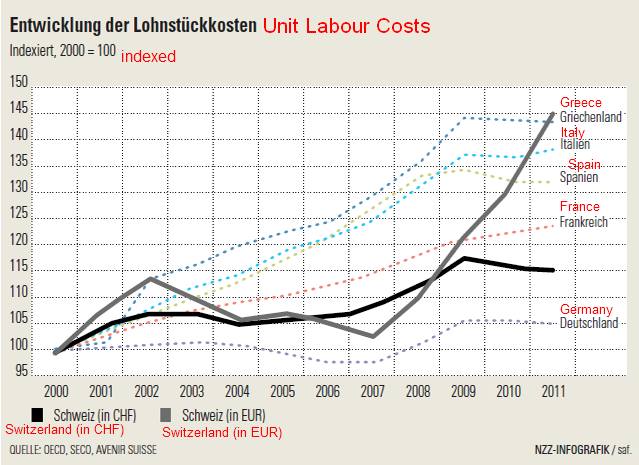

The following graph shows that when compared to the year 2000, manufacturing costs in Switzerland (valued in EUR) rose as much as the ones in Greece, but they remained very low in Germany.

The question is why do the Greeks have big problems and the Swiss do not?

The question is why do the Greeks have big problems and the Swiss do not?

The reason is that the Swiss were able to replace labor with capital, human capital and technology. The products they sell are capital-intensive. Moreover, they use sophisticated production models, where the main part of the production factor “labor” often does not reside in Switzerland (see more details below).

Switzerland might have a competitive disadvantage against Germany for labor costs; but, they have other factors, such as more capital, highly educated workers, that moved from Germany and other countries to Switzerland, or cheaper taxes and a more efficient infrastructure. The stronger Swiss currency and negative Swiss bond yields even improved the Swiss financial position.

Does Germany need a weak euro?

In Germany there is a strong industry lobby suggesting that the (weak) euro only helps the country. The problem is that austerity in the periphery kills some of their exports. Giving the periphery money so that they can pay for the German goods with loans – like before 2008 – does not make sense any more.

Switzerland has maintained a strong current account surplus despite a 25% revaluation of its currency since 2007. Until the 1990s, the German Mark appreciated continuously, but the German current account surplus remained stable. When labor became more expensive, Germans improved the efficiency of the processes and technology. Labor was simply replaced with capital and technology that became cheaper with a stronger currency. New more sophisticated jobs were created. Consumers were happy about low inflation and spent money.

Only a rapid revaluation of a currency imposes a threat, because technology and process improvements cannot match it quickly enough. Therefore the SNB performed interventions in 2009 and 2010 knowing that it would not help in the mid-term.

A (controlled) appreciation of a currency is not a weakness and does not lead to unemployment.

The opposite is the case for a weak currency: when inflation is high, consumers are likely to stop spending. Often companies are too inflexible to use the cheap labor or they lack capital to do new business and projects based on it. Therefore, it generally takes two to three years to see a significant improvement (for example, Argentina). If the euro zone had kicked out Greece in 2010, the improvement phase would have started by now.

As Jim Rickards says:

That you help exports with a cheaper currency is not true. Germany has been an export power house for 50 years and they had a strong currency for 50 years. Education, innovation, investment, technology, good business climate, low taxes counts.

Read the basis for structually strong economies: Ricardo’s Comparative Cost Theory

References

George Magnus, UBS Senior Economic Advisor: “Asia – Is the Miracle Over?”, Online

For German-speakers we recommend the article from Credit Suisse’s Brändle and Vautier that shows more details what Switzerland exports and that a bigger part of the value chain for these sophisticated goods is in Switzerland “Schweizer Exportwirtschaft langfristig gut positioniert”

See more for