In the financial press one word has been discussed for years.

It is the “Euro crisis”. The economic mainstream has the impression that Europe as a whole has an economic problem that essentially stems from the common currency, the euro.

When I look at the long-term economic background, I do not agree that there is anything like a euro crisis, in the sense of a longer term crisis that only concern Europe. Sure, the public sector has accumulated a lot of debt, but this is the same in the United States. Still we need to consider that if the public sector has more debt, then the private sector has more savings. Keith Weiner already anticipates the governments’ desire to get this cash.

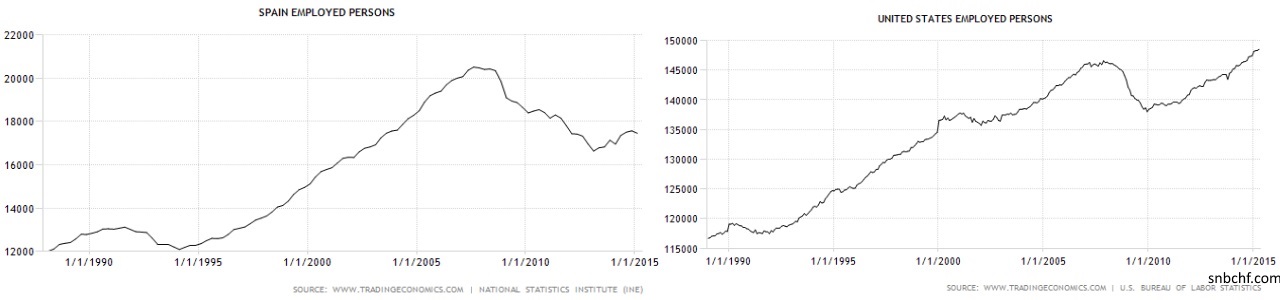

Lets start with a comparison of employed people in Spain, one of the worst hit countries and compare the data with the United States. Between 1990 and 2015 the Spaniards managed to increase employment by 6 million people from 12 to 18 million . This is roughly 50%, compared to an increase of 30% in the United States. On the other side the Spanish population has risen by 21% during these years, compared to 26% for the U.S.

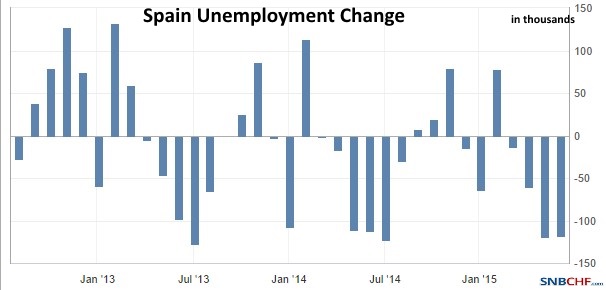

A look on recent data, 2012-2014:

For many months in a row, the Spaniards have been able to reduce unemployment. The monthly average is about 80K people.

The ten times bigger United States creates around 200K jobs per month.

What we see in the long-term Spanish employment numbers, are three things:

- The catch-up in the participation rate from the lower Spanish figures in the 1990 in comparison to the U.S., more here.

- Better and longer possibilities to benefit from unemployment aid in Europe artificially increases the unemployment rate and keeps more people in the work force.

In Spain one is able to receive unemployment benefits if he/she worked for 360 days in the last six years.As a rule the benefit is paid for 1/3 of the period that the unemployed person has contributed. As a minimum the benefit is paid for 4 months and a maximum of 24 months is permitted. (wikipedia)

Moreover, quite a few Spaniards solely work during the tourist season, while they perceive benefits during the rest of the year. The easy availability of unemployment benefits creates the impression of a “Euro crisis” that is visible in an unemployment rates of 25% in Spain.

The unemployment figures of 25% were similar during the 1990s, but at the time the labor force was far smaller.

- Overshooting of economic growth in the years 2005-2008 and a housing bubble. Low interest rates and relatively low inflation led to excessive consumption and an investment bubble, a phenomenon not only visible in Spain, but even more in the United States. Many of the Spanish unemployed from 2009 onwards were specialized in construction.

In the second part, we will examine the reasons for low inflation figures since the early 1990s. The third part will look on the divergence of labor costs in the euro zone and “how long” this crisis will last. The fourth part will connect GDP with savings and spending behavior in Europe and the U.S. The fifth part will try to explain why the dollar could strengthen to close to parity to the euro.

See more for