On the banking union:

But as EU leaders congratulate themselves for nearly completing their so-called “banking union”, many analysts and officials – including at the top of the European Central Bank, which is now responsible for supervising banks in the new system – worry that it has fallen far short of that goal. Instead of setting up a new, pan-European system that will shoulder the financial burden through pooled public funds, most of the burden – especially for the next decade – will continue to be the responsibility of national governments or private investors, Source Financial Times

Update April 2013: European wealth reports

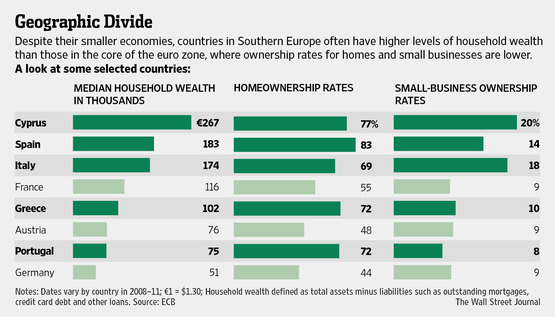

For years the Southern Europeans tried to escape inflation and a depreciating currencies (Lira, Peseta, Greek Drachma). Therefore they increased their home-ownership rate . The stability of the euro the cheap money provided by the ECB helped them increase real estate prices. Full details.

This led to an increase of private wealth in the periphery according to recent ECB reports, Southern Europeans are just richer.

The consequence is clear: There won’t be any Eurobonds, fiscal or banking union for generations. Home owners or owners of deposits in peripheral banks (Cyprus style) will need to pay.

See more for