Essay based on K. Rybinski: “Eurozone crisis, between meurons and zombies”, another former central banker who opposes the central banks

After we (first) missed to mention the former deputy governor of the National Bank of Poland Krzysztof Rybinski in our previous post on former central bankers who oppose the central banks here on Zerohedge, we decided to write a longer essay on Rybinski, based on his article appeared in Open Democracy. Rybinski’s website: Economy of the 21st Century.

Prof. Rybinski: “Imagine a country or a city ruled by morons and populated by zombies. Would you feel safe; would your family feel secure; would you like your kids to grow up in such a neighbourhood?

Welcome to the Eurozone, homeland of what I shall call “meurons” (euro-morons) and zombie-bankers. The zombies, whom I identified at an early stage of the crisis, are still around (see “There is no zombie free lunch“, 19 March 2009). Now let’s meet the meurons. A meuron is someone who, when he or she identifies a problem, does all the wrong things; who a while later screams that the problem has got bigger, only to repeat the mistakes; then, when things have turned even more sour, continues to pursue the same error-strewn course.”

A six-stage collapse

Prof. Rybinski: “In the Eurozone’s implosion, there have to date been six degrees of repetition. The meurons deserve by now to be called mega-meurons. Let me explain how mega-meurons were born, by looking briefly at each of the six stages.”

The first meuron mistake: treating an insolvency problem as a liquidity event

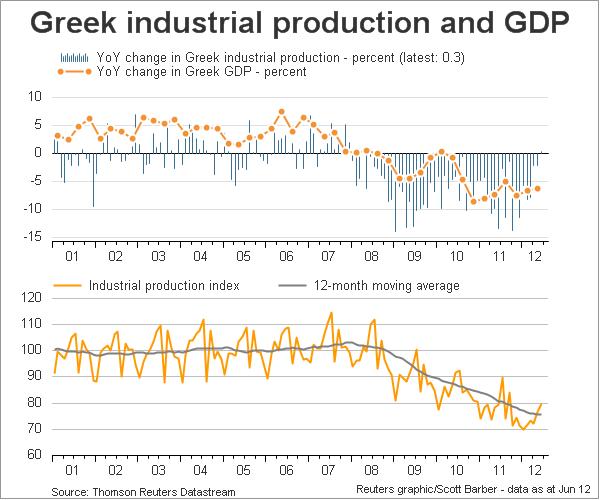

Prof. Rybinski: “The Eurozone first became aware of its problems in 2009 with the revelation that Greece faced financial meltdown. The country had a 120% debt-to-GDP ratio, was heading into deep recession, and was insolvent. I identified this mix and analysed it at least ten times. The meurons, however, stated that Greece had a liquidity problem and repeatedly threw zilllions of taxpayers’ money at it. Guess what, the funds did not land on Greek soil but were channelled back to feed the eurozone’s zombie bankers. My text published in March 2009 explains that meurons believe that zombie bankers must be fed or otherwise they will attack and eat decent human beings. Two years later – and after €200 billion had been sent down the drain – Greece did go bust.”

The following graph illustrates the impossibility of Greece to become solvent again without further bailouts, haircuts or a return to the Drachma.

The second meuron mistake: wasting two years only to take a useless medicine

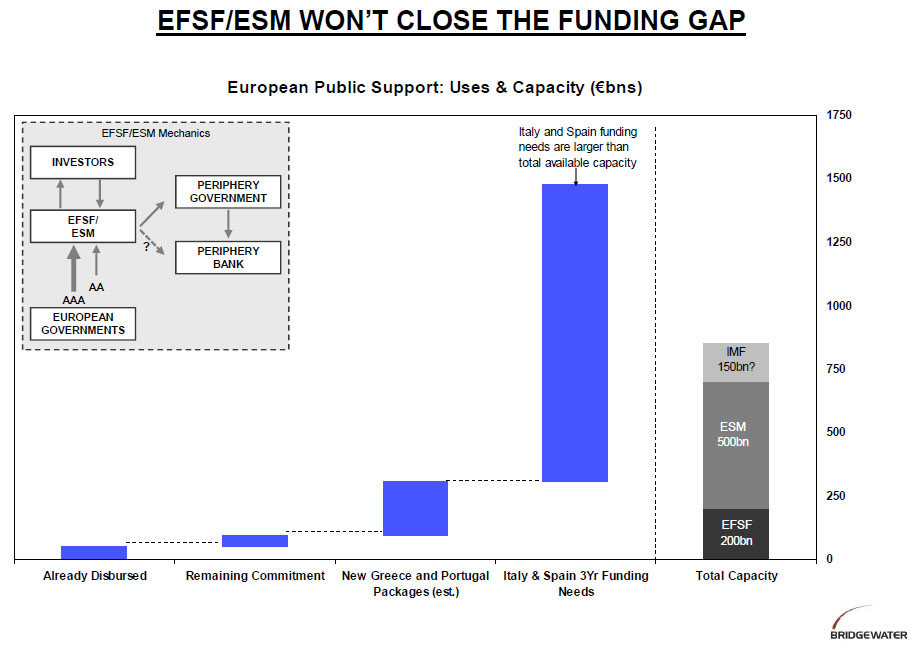

Prof. Rybinski: “The meurons then came up with the idea of a bailout fund that would help indebted Eurozone countries. But because the Eurozone did not have enough money to bail out all the so-called “Pigs” countries (Portugal, Italy, Greece, Spain), the size of the fund was several times too small to make a difference. It might have been able to cover Greece and Portugal, but not Spain and Italy. Yet meurons continue to lie to Eurozone taxpayers by saying that the bailout fund makes the Eurozone a safer place than it was in 2010.

Let me explain this to readers without a background in finance via the following illustration. Two years ago a customer eats in a cheap and unhygenic restaurant where a third of the water is contaminated, and becomes ill. Now he patronises an even cheaper and less hygienic establishment, where all the water is contaminated – this time taking care to use a water-purification tablet, which however is well past its sell-by date. In which visit should he feel more secure? The customer was unwise in the first place, but he had a better chance of avoiding illness two years ago. The Eurozone bailout fund resembles the ineffective tablet.”

ESM funding gap (Source Bridgewater) - Click to enlarge

The picture from Bridgewater illustrates that all bailout funds are currently too small. The German ESM law is however designed that Germany may pay unlimited funds into the fund, provided the governors of the ESM and the German Bundestag allow to pay more than the current 190 bln. €. The unlimited bailout might be stopped by the German constitutional court.

The third meuron mistake: using the central bank to do a job that belongs to government

Prof. Rybinski: “Then came the third idea: because the interest-rate on the Pigs’ sovereign debt shot though the roof, politicians asked the European Central Bank (ECB) to intervene an buy Pigs’ debt on the secondary market. It felt nice for a while as interest-rates on the Pigs’ debt fell; the situation seemed under control. But people soon realised that the ECB’s interventions allowed banks and other financial institutions from around the world to sell Pigs’ government paper (i.e. junk) to the taxpayer (who is behind the ECB) at investment-grade prices.

So the mechanism allowed financial institutions to reduce their losses by transferring them to the taxpayer. The fix was also short-lived because after a few months interest-rates on Spanish and Italian debt started to rise again. Moreover, such action by the ECB probably violates the spirit of the European treaties, which do not allow the ECB to finance governments.”

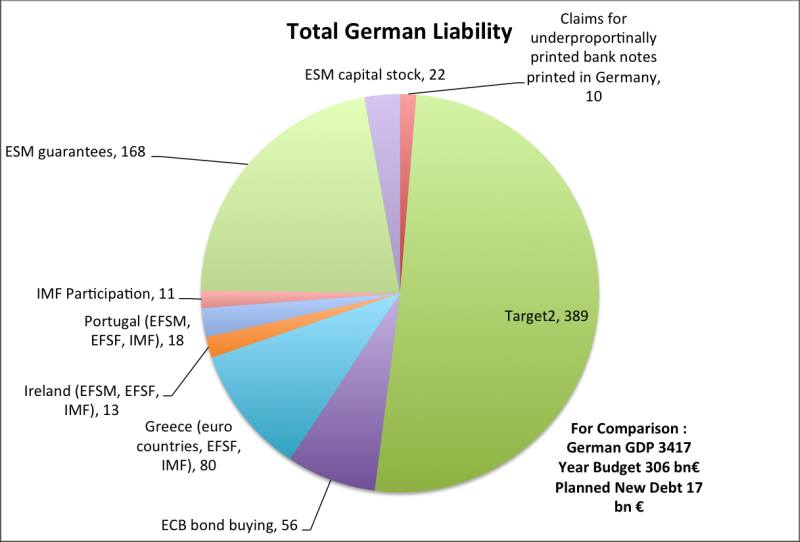

The graph from Scott Barber illustrates exactly how German and other foreign banks managed to offload their PIIGS risk on the German Bundesbank via the Target2 balances.

The fourth meuron mistake: allowing cheap loans to increase the risk of collapse of the banking sectors in Spain and Italy

Prof. Rybinski: “The fourth decision followed: to give banks cheap loans via a method called a “long-term refinancing operation” (LTRO). The ECB offered dirt-cheap three-year loans to Eurozone banks against collateral of dodgy quality. I wrote several articles warning that this decision would lead to pathological outcomes, but nobody listened. The banks in Spain took these loans and bought huge amount of Spanish government debt. Italian banks did the same in Italy. After a few months, banks became much more exposed to the risk of rising interest-rates on (and falling prices of) their national government bonds. The “zombification” process of banks in Italy and Spain accelerated.”

The graph indicates how foreign banks continued the sell-off of Spanish and Italian government bonds. The cheap money of the LTRO caused that Spanish and Italian banks jumped in to earn money on the interest rate differential between government bond yields and the 1% rates received from the ECB. One of the protagonists were Intesa San Paolo. Due to high exposure to italian governments bonds they had take losses on existing positions and were downgraded.

The fifth meuron mistake: wasting time on impractical ideas at crucial moments when time cannot be wasted

Prof. Rybinski: “The fifth choice was to create growth in the Eurozone. It followed the meurons’ noticing that the situation was getting worse by the hour, and that debt-to-GDP ratios would shoot up if GDP continues to shrink. In Poland, students in fifth grade understand a simple fact that it took meurons two years to figure out: if the denominator falls and the numerator rises, the ratio goes up. When the meurons caught on, they concluded: no more falling denominator, let’s go for GDP growth. Fine, but talking will not lead to GDP expansion. The question remained: how can governments generate solid growth without creating more debt at the same time? It is still unanswered, even as meurons lost another few months (and yet more pointless emissions of CO2 at a time of global warming).”

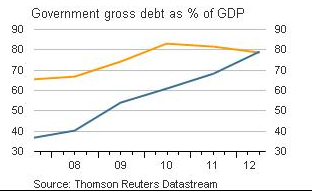

The illustration shows the extreme speed at which Spanish debt as % of GDP grows. While GDP (the denominator) falls, the debt (the numerator) rises.

The sixth meuron mistake: conceiving a banking union which will not cure but rather spread infection

Prof. Rybinski: “The sixth and (to date) latest meuron idea followed: let’s create a banking union. I have written in many newspapers, including the Financial Times, that it is probably the most dangerous idea of all. Now there is a slow-motion bank-run in the Pigs countries (though in Greece it is in fact fast-motion). The result is that scared people, mostly large institutions, transfer deposit from bankrupt banking sectors in the Pigs countries to more credible ones, in Germany for example. If the meurons transform the European Union into a Banking Union, sick banks will immediately infect healthy ones and in no time money will start leaving the Eurozone to land in more stable and credible banking sectors in other parts of the world.

The mechanics of this process will be very simple. The German banking sector is believed to be stable because the German government is (so the argument goes) strong enough to help its banks in the event of trouble. But if the deposit-guarantee scheme is unified across all countries, investors will immediately calculate that Germany is not resilient enough to bail out the entire Eurozone banking sector – and, hey presto, the German banks will be far riskier than before.

I am sure that if meurons take this path, they will more than justify the mega-meurons accolade. The last mistake available to them will be to force the ECB to print money without limits. And once you kill the people’s trust in the currency, you kill the euro itself – and possibly the European Union as well.”

Our translated graph based on the data from the IFO Institute shows that the potential German liability from ESM, Target2, EFSF etc. is more than three times higher than the yearly German government budget. A banking union would even more increase this liability. High liability and a negative growth in Germany could quickly trigger an increase of German borrowing costs and contagion of periphery banking issues to Germany.

The exit strategy

Prof. Rybinski: “More than two years ago I wrote that this crisis can be stopped at a relatively low cost, via two potential strategies. The first postulated that the Pigs countries, which are insolvent if multiyear recession is assumed, should be forced into drastic austerity programmes (much deeper than today); that at the same time a large part of their debt should be written off (it would then have been enough to cancel only 50% of the Greek debt); and that Greece, and possibly some other members, should leave the Eurozone in order to regain competitiveness.

If this were to prove politically impossible, the second strategy proposed the creation of a new euro (where, in short, Greece would exchange old euros for new at a 2:1 rate, Italy and Spain at a 1.5:1 rate, Germany and other solid countries at parity). This way the Pigs countries will get a lot poorer (which they deserve anyway), but because of devaluation will quickly regain competitiveness and start growing again.

Both these recipes would create a short-term mess, but lead to good outcomes. If they had been applied in 2009, the crisis would today be behind us. But politicians hate solutions that create a moderate mess in the short-term, even if they do solve the problem – because in the short term there are always elections to worry about. So politicians prefer decisions that “kick the can down the road” and buy some time, even if they create a risk of much bigger mess later.

This is precisely what has happened in the Eurozone. Mega-meurons have kept kicking the can down the road, until the road ended with a thick brick wall. Even now, the meurons still have a choice. They can hit their heads against the wall in hope that it falls apart and the can-kicking process can continue; or, late as it is, they can follow another route to end the crisis.

Readers will have no problem guessing what the meurons will do. They are morons after all.”

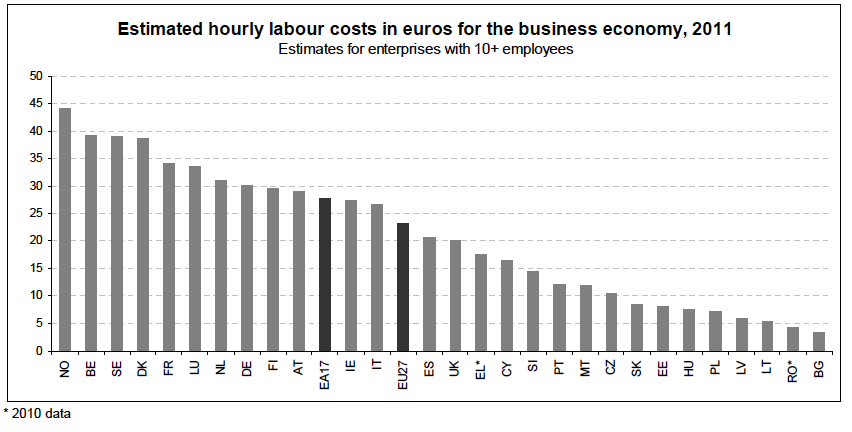

The prove that smaller Unit Labor Costs is not enough can be seen that recently production prices rose more strongly in the periphery than in Germany, even if most unit labor costs were falling in the PIIGS but rising in Germany.

In his Eastern European perspective Rybinski realizes that still in 2011 huge differences appear in hourly labour costs and wages among EU members. He not only says that it is necessary to reduce wages in the periphery. He even claims “that they deserve it”, similar as Slovakia’s libertarian Richard Sulik said:

“The average pension in Slovakia is less than 400 euros (£350). The average pension in Greece is 1,400 euros (£1,200) – three, four times higher” (source)

Hourly Labor costs EU 2011 ( Source Eurostat) - Click to enlarge

Looking at these numbers we understand that foreign capital for new investments is and will not flow into the periphery, but rather in the far more competitive eastern european countries. The slowdown in the periphery should continue until labour costs are more or less similar among periphery and Eastern Europe.