European national central banks released European household wealth reports in Spring 2013. According to that data, “median” German households were far poorer than many of their European counterparts. Based on 2012/2013 data we compared apartment prices and discovered that French prices were strongly overvalued or German ones undervalued.

We wanted to know if this is still the case in 2014 and integrated our 2012/2013 data with the one of 2014. We discovered that German home prices are quickly recovering their delay against French ones. Hence German wealth is ticking up again.

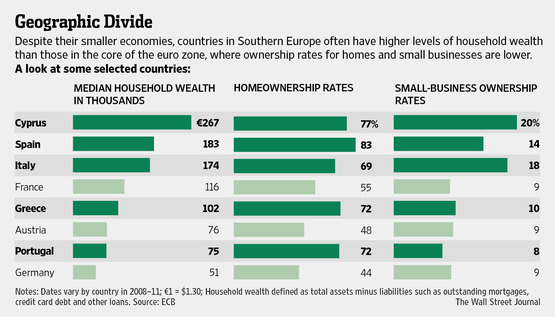

According to the surveys of European National Central Banks (NCB), Germans are one of the poorest countries in European comparison. The question is how accurate the data was and, in particular, how far it reflected recent home price developments, or if survey data was some years old.

Source WSJ and ECB

Still in 2012, home prices were often lower in Germany than they were in other European countries. This happened despite higher German salaries and lower other living costs compared to most of their neighbours. Hence Germans often have a higher “residual income” after rent and rent equivalent. By own experience, prices in France, but also in the French-speaking Switzerland, are often far higher than in Germany or in the rest of Switzerland respectively. Life in Paris is difficult because the gap between salaries and rents/living costs is very slim. Even if the German home-ownership rate of 44% is relatively weak, rising German home prices in the years since the NCB surveys point to rising German wealth.

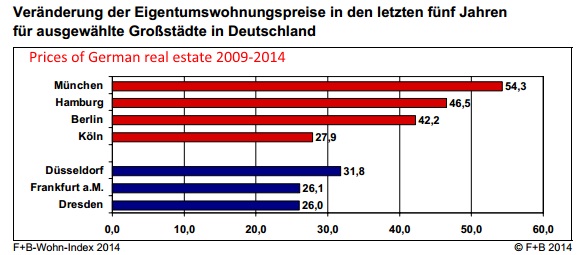

German real estate prices in cities are rising rapidly

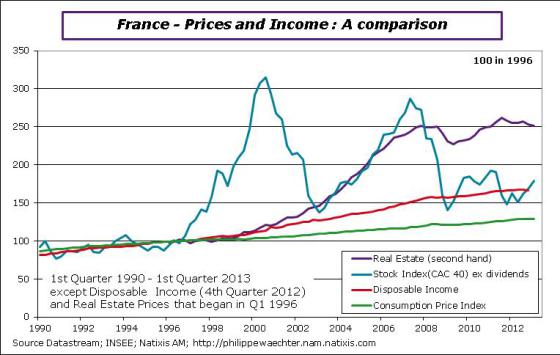

French real estate has not Performed since 2011

Is now a good time to buy French property?

British home buyers are being tempted to purchase property in France thanks to new record low 20-year fixed rate mortgages, and favourable currency swings.

But property remains overvalued in France with some experts suggesting prices are 30pc too high, leading to questions over whether now is the right time to buy.

Falling mortgage costs

Britons with a 20pc deposit can secure a 20-year fixed rate of 3pc, according to broker French Private Finance. The cheapest rate was 3.1pc last month and 3.75pc a year ago.

Source The Telegraph, 2014

French Mortgage approvals drop by a third

They add that the fall in new mortgages approved has seen a 32% plunge since 2011.

The CBRE report states: “While banks have tightened their mortgage lending criteria and are asking for higher deposits, the main reason for the fall in mortgages is because of the slump in demand from home buyers.”

To underline the precarious state of the housing market, the construction of new homes is also heading downwards.

In the first three months of this year, only 83,900 units were started – a drop of 11.2% from last year. (source)

#Paris home prices, up 37% since 2009, sputter as Hollande’s taxes threaten boom Bloomberg , 2013Are real estate prices too expensive in France?

European national central banks released European household wealth reports in Spring 2013. According to that data, "median" German households were far poorer than many of their European counterparts. Based on 2012/2013 data we compared apartment prices and discovered that French prices were strongly overvalued or German ones undervalued. We wanted to know if this is still the case in 2014 and integrated our 2012/2013 data with the one of 2014. We discovered that German home prices are quickly recovering their delay against French ones. Hence German wealth is ticking up again. - Click to enlarge

Real estate price has increased quicker than nominal disposable income and the real estate price to income ratio is currently still very high almost at an historical high. This is really problematic as it means that it is very expensive to buy a house or an apartment specifically when you are a first buyer as you cannot resale a house in order to buy a new one. The market does not work well….

Real estate price is high. But as long as households can wait there will be no downward trend on average but as income is low compared to this price the price will not be able to increase rapidly. The market is probably on an inefficient equilibrium.

Comment G. Dorgan: It is very interesting that the needed price adjustment is so difficult to realize in France. In the U.S., in Denmark or the Netherlands, the needed price correction was far quicker. This missing mobility of workers considerably weakens the French economy.

Real Estate Price in 2014 against 2013

According to Eurostat real estate prices in France fell by 1.1% and in Italy by 4.8% in 2014. They are up in Northern countries that are obsessed with owning a property, but that also have a history of higher inflation rates. Those are Sweden, the UK, Ireland, Iceland and the Baltics, with rises between 5 and 10%. (Source The Telegraph)

According to the German F+B, condo prices are up 5.2% in Germany.

Detailed price comparison: Gap between Germany and France is narrowing

In the following we compare prices more in detail. Therefore we used apartment prices from the site “Meilleur Agents” in France and from F+B in Germany. Both data sets reflect transaction prices and show price in euro per square meter.

“Meilleurs agents” was able to determine the average price per French district (“department”) including villages. This means that prices in a town belonging to this district should be a bit higher. The German data was concentrated on the 50 most expensive and the 50 cheapest ones out of a total of 504 German towns.

Flats in Paris (8294 €/m2) were twice as expensive as in Munich (4120 €) still in 2012/2013, but in 2014 the gap narrowed to 7840 versus 4800€. Under the 25 most expensive towns/districts, only 8 were in Germany as for 2012/2013 data. In 2014 already 12 out of the 25 top entries are in Germany. Based on 2012/2013 data, we counted 17 German towns under the 50 most expensive areas, the other ones are in France. In 2014, this number rose to 25

Geographic Divide between Southern Germany and East, between Paris and the rest of France

The most expensive French districts are Paris, in the Paris area and the Cote d’Azur. Moreover, prices in the areas close to Swiss Geneva, in the departments Haute-Savoie and Savoie are quickly rising. Most expensive German towns are near to Munich in Bavaria or near Stuttgart in the South Western Baden-Wurttemberg and in the Frankfurt area. Prices are cheap in Eastern Germany including some regions near Berlin. Foreign demand helped Berlin to recover quickly, from 1790 to 2100 €/m2.

The 2012/2013 data showed that the cheapest 52 towns/districts were all in Germany except the French departments of Creuse and Nievre. Some Eastern German regions show outright asset price deflation, but most have finally stabilized.

Home prices in Eastern Germany were so cheap in 2011 that Poles from the border town Szczecin (German name “Stettin”) prefered to live in the neighbouring German towns. Quick state-enforced wage adjustment between West and East Germany that left many Eastern Germans without jobs. Emigration from East to West led to a housing oversupply in the Eastern part. On the other side, lower wages in Polish towns helped to create jobs. Biut they created a rapid home price increase, that left prices higher than many are able to afford.

The full data is contained in the following table; the reader is able order the data clicking on header names.

Flat Prices in Germany and France in 2012/2013 compared to 2014

Town/District Region 2012/2013 Avg. Price €/m²

(Q1/2013 France, Q4/2012 Germany)2014 Avg. Price €/m²

(Q4 France, Q2 Germany)

Paris (75) Paris area 8294 7840

92 - Hauts-de-Seine Paris area 5454 5571

München Bavaria 4120 4800

06 -AlpesMaritimes Cote d'Azur 4157 4159

Nice Cote d'Azur 3916 3796

94 - Val-de-Marne Paris area 4104 3749

Garmisch-Partenkirchen Bavaria 3500 3710

78 - Yvelines Paris area 3802 3698

74 - Haute-Savoie Swiss border 3208 3548

Unterschleißheim Bavaria 3120 3500

Dachau Bavaria 3050 3470

83 - Var Cote d'Azur 3245 3451

Germering Bavaria 3080 3300

Freiburg South-West 3040 3300

Lyon 3184 3296

73 - Savoie Swiss border 2651 3291

Konstanz South-West 3140 3280

Freising Bavaria 2810 3210

Fürstenfeldbruck Bavaria 2920 3210

Regensburg Bavaria 2730 3190

2A - Corse-du-Sud 3177 3166

Hamburg 2790 3150

93 - Seine-Saint-Denis Paris area 3473 3146

Erding Bavaria 2730 3100

Erlangen Bavaria 2560 3000

Lille 2913 2904

Frankfurt Frankfurt area 2670 2900

Ingolstadt Bavaria 2400 2880

Tübingen South-West 2620 2880

64 - Pyrénées-Atlantiques 2595 2820

33 - Gironde 2718 2815

Stuttgart South-West 2490 2800

69 - Rhône 2740 2793

Rosenheim Bavaria 2400 2780

95 - Val-d'Oise Paris area 2777 2776

Toulouse 2671 2770

17 - Charente-Maritime 3084 2746

Bordeaux 2930 2728

2B - Haute-Corse 2588 2723

77 - Seine-et-Marne Paris area 2820 2701

91 - Essonne Paris area 2830 2701

Heidelberg South-West 2520 2700

Montpellier 2732 2669

Oberursel Frankfurt area 2530 2620

31 - Haute-Garonne 2677 2610

Düsseldorf 2400 2610

34 - Hérault 2747 2600

Weinstadt South-West 2160 2597

Strasbourg 2287 2597

Landshut Bavaria 2290 2590

Würzburg Bavaria 2300 2580

13 - Bouches-du-Rhône 2731 2577

44 - Loire-Atlantique 2582 2573

Fellbach South-West 2340 2550

Bad Vilbel Frankfurt area 2330 2550

Nantes 2604 2540

Bad Homburg Frankfurt area 2500 2530

Ulm South-West 2300 2520

Münster 2310 2500

Darmstadt Frankfurt area 2310 2490

Ludwigsburg South-West 2270 2490

Friedrichshafen Bavaria 2310 2490

Rennes 2268 2472

Ostfildern 2300 2470

Filderstadt South-West 2190 2460

Mainz Frankfurt area 2300 2450

Köln 2220 2430

Leinfelden-Echterdingen South-West 2380 2430

Kornwestheim Frankfurt area 2220 2420

Hofheim Frankfurt area 2310 2410

85 - Vendée 2640 2410

05 - Hautes-Alpes 2471 2410

40 - Landes 2526 2393

Wiesbaden Frankfurt area 2220 2390

Toulon 2435 2389

Karlsruhe South-West 2180 2380

35 - Ille-et-Vilaine 2254 2365

Marseille 2635 2338

56 - Morbihan 2337 2317

67 - Bas-Rhin 2144 2315

14 - Calvados 2695 2291

Dreieich (2014: not in top 50) Bavaria 2280 2280

Emmendingen Swiss border 2270 2270

Esslingen South-West 2260 2260

Grenoble 2315 2253

Kelkheim (2014: not in top 50) Frankfurt area

2240 2240

Ravensburg (2014: not in top 50) South-West 2210 2210

59 - Nord 2385 2196

38 - Isère 2170 2193

Bamberg (2014: not in top 50) Bavaria 2190 2190

Sindelfingen (2014: not in top 50) South-West 2170 2170

Ettlingen (2014: not in top 50) South-West 2160 2160

Zirndorf (2014: not in top 50) Bavaria 2160 2160

01 - Ain 1957 2128

60 - Oise 2515 2090

66 - Pyrénées-Orientales 2165 2081

37 - Indre-et-Loire 2114 2063

62 - Pas-de-Calais 2211 2034

Dijon 2101 2027

Reims 2143 2019

30 - Gard 2002 2011

80 - Somme 2215 1950

04 - Alpes de Hautes-Provence 1962 1924

84 - Vaucluse 2047 1907

21 - Côte-d'Or 2040 1892

28 - Eure-et-Loir 2129 1850

32 - Gers 1364 1830

51 - Marne 2008 1824

Angers 2007 1820

22 - Côtes d'Armor 1761 1788

76 - Seine-Maritime 1949 1780

11 - Aude 2006 1776

Nîmes 1893 1775

45 - Loiret 1910 1747

63 - Puy-de-Dôme 1774 1707

49 - Maine-et-Loire 1846 1697

27 - Eure 1901 1690

65 - Hautes-Pyrénées 1430 1680

25 - Doubs 1677 1647

50 - Manche 1710 1639

LeHavre 1920 1625

54 - Meurthe-et-Moselle 1680 1603

89 - Yonne 1586 1573

57 - Moselle 1764 1551

26 - Drôme 1594 1531

68 - Haut-Rhin 1679 1523

86 - Vienne 1651 1514

41 - Loir-et-Cher 1565 1473

29 - Finistère 1450 1464

42 - Loire 1304 1463

81 - Tarn 1488 1447

LeMans 1488 1431

46 - Lot 1350 1412

24 - Dordogne 1468 1398

72 - Sarthe 1474 1382

07 - Ardèche 1524 1369

10 - Aube 1448 1359

09 - Ariège 1388 1358

82 - Tarn-et-Garonne 1534 1353

90 - Territoire-de-Belfort 1346 1345

12 - Aveyron 1367 1304

39 - Jura 1244 1264

18 - Cher 1382 1257

53 - Mayenne 1278 1238

79 - Deux-Sèvres 1342 1233

87 - Haute-Vienne 1330 1231

61 - Orne 1146 1226

15 - Cantal 1289 1224

48 - Lozère 1378 1220

02 - Aisne 1395 1218

16 - Charente 1249 1182

47 - Lot-et-Garonne 1269 1173

Saint-Étienne 1284 1157

43 - Haute-Loire 1114 1154

71 - Saône-et-Loire 1279 1143

88 - Vosges 1125 1131

19 - Corrèze 1270 1121

03 - Allier 1113 1117

08 - Ardennes 1160 1117

52 - Haute-Marne 1136 1065

Eisenhüttenstadt (2014 not under lowest 50) East 900 1050

Magdeburg (2014 not under lowest 50) East 920 1050

Springe Hannover area 980 1040

Hameln Hannover area 1030 1040

Hoyerswerda East 900 1040

70 - Haute-Saône 1128 1032

Bernau Berlin area 980 1030

Uelzen Hannover area 980 1030

Riesa East 810 1030

Freital East 1010 1030

55 - Meuse 1052 1029

Neuruppin Berlin area 1020 1020

Fürstenwalde (2014 not under lowest 50) Berlin area 1020 1020

Northeim (2014 not under lowest 50) Hannover area 1020 1020

Arnstadt (2014 not under lowest 50) East 1020 1020

Güstrow (2014 not under lowest 50) North East 1020 1020

Pirna (2014 not under lowest 50) East 1010 1010

Saalfeld/Saale (2014 not under lowest 50) East 1010 1010

Bautzen East 980 1000

36 - Indre 1085 999

Rathenau Berlin area 860 980

Nordhausen East 800 980

58 - Nièvre 981 959

Chemnitz East 930 950

Meißen East 910 940

Brandenburg Berlin area 1000 940

Idar-Oberstein 1030 940

Dessau-Roßlau East 870 930

Delitzsch East 860 920

23 - Creuse 1012 893

Stendal East 1030 890

Altenburg East 920 890

Eisleben East 950 870

Aschersleben East 770 870

Gotha East 850 870

Limbach-Oberfrohna East 850 860

Halberstadt East 760 860

Merseburg East 800 860

Bernburg East 960 840

Sangerhausen East 810 830

Zittau East 910 830

Zwickau East 860 820

Naumburg East 870 810

Pirmasens 760 800

Bitterfeld-Wolfen East 800 800

Köthen East 690 800

Görlitz East 700 790

Staßfurt East 910 780

Schwedt/Oder North East 830 780

Mühlhausen/Thüringen East 870 770

Wittenberg East 900 770

Plauen East 780 760

Gera East 720 750

Zeitz East 700 670

Weißenfels East 660 630

Sources:

F&B report on German home prices Q4 2012

F&B report on German home prices Q2 2014

France: Meilleur agents prices in France

Further references:

Some academics, like De Grauwe, did not trust the national banks’ survey data and elaborated their own statistics. De Grauwe also incorporated the wealth of companies.

European Wealth Reports: Why “Median” Italians are Far Richer than Germans

See more for

5 comments

Skip to comment form ↓

George

2013-05-29 at 19:11 (UTC 2) Link to this comment

Let’s see: 8000 euro/m2 in Paris, 4000 in München. What about Switzerland? 10000euro/m2 in Zürich and Zug, I don’t dare to look at Geneve. Even little town Lenzburg is more expensive than München and rather competes with Paris. So what about it?

My two hours research found an increase of about 50% in the prices of houses from 2007. I looked at Zürich, Aargau and Zug.

I see only two possibilities: CHF is way overvalued or are we witnessing the mother of all bubbles?

Otherwise, good and informative article.

DorganG

2013-05-29 at 20:29 (UTC 2) Link to this comment

The Swiss housing market is currently recovering that what Ireland, Spain, US or UK saw until 2007. With the difference that income to price ratio is still ok (see image attached). 10000 €/m2 in Zürich or Zug is still ok, because Swiss income is twice as high as in Germany or 3 times more than in France.

I judge that the boom has still 10 years to go.

Where else should the Swiss put the current account surplus? In slowing emerging markets or slowing dying US or Europe?

Manu

2013-07-09 at 22:45 (UTC 2) Link to this comment

Living in France close to GE.

Buying a home in Switzerland which you kind of never reimburse lend capital for, where your mortgage interests are tax deductible, similar to the NL (at least until 2012). Does not this taint swiss real estate prices?

Buying a home in France where you reimburse a decent part of capital in a quicker way. Household debt to disposable income is low (I mean, 75% in 2011 maybe). Is not that way of buying healthier ?

Isnt there a risk to see in Switzerland a similar situation than in the Netherlands, which had a similar love of “aflossingvrij” mortgages ? NL Household debt to disposable income in 2011 was 300%. Prices keep dropping since 2009.

Sorry for the naive remark, I am not a specialist, just trying to cross the differents charts I see on diverse sources

DorganG

2013-07-10 at 08:18 (UTC 2) Link to this comment

True that Swiss have high private debt, but they have also high assets. Instead of reimbursing they invest in stocks, bonds, gold, etc. With rising asset prices in recent years, this strategy was successful.

When your economy is better over the long-term, then currency appreciation, better more capital availability and innovation dampens inflationary effects. Since Swiss banks seem to be sure that Swiss inflation is always low they allow not to reimbourse.

Since the introduction of the cap on the franc, things have changed, the currency does not appreciate any more. The risk you are speaking of, exists.

John

2016-03-10 at 15:47 (UTC 2) Link to this comment

Wow, very detailed article. The data is a bit dated, but it is interesting to see a historical perspective.

Interestingly, last year (according to Tranio.com – real estate expert) foreign investors spent €28.1 billion on commercial property in Europe’s leading economy, representing 51% of the total investment amount in the market according to JLL, a global real estate services company. This marks a five-year high for inbound investments, which hadn’t occupied more than 30–40% of the market share in recent years.