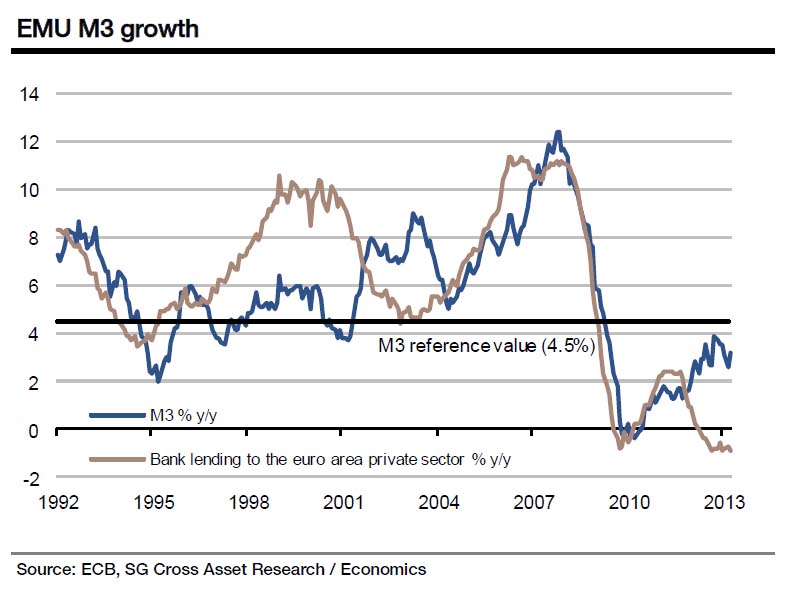

In the July 4th monetary assessment, the ECB promised easy money and “an extended period of rates of 0.5% or below”. The reason is clear: the ECB’s monetary transmission still does not work. M3 is rising at a mere 3% per year, bank lending is contracting.

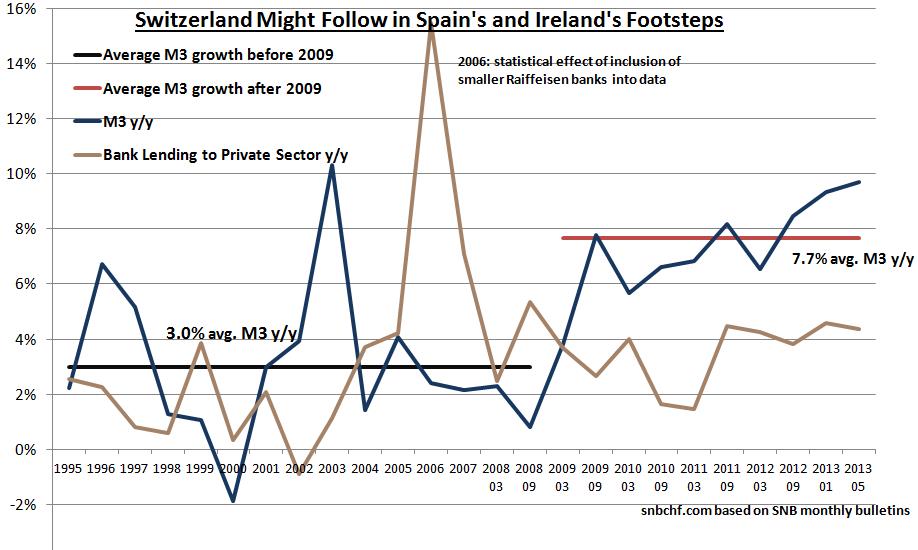

In Switzerland things are completely different:

Swiss bank lending is currently rising by 4.4% per year, M3 is increasing by 10% per year and the pace of M3’s increase is accelerating. The average yearly increase of M3 between 1994 and 2009 was 3.0% per year, after 2009 it has been 7.3%. High M3 increases are often a precursor of excessive lending. Currently, the 4.4% rise in bank lending is still relatively healthy in a historical perspective, but compared to the EU, extremely high. M2 in the United States has risen by 6% per year since between 2008 and 2012.

Since 2009, the Swiss have preferred to invest a bigger part of the persisting current account surpluses into real estate. Given the risks and low incomes from global investments, we are quite sure that this will continue.

A consequence is that Switzerland could follow in Spain’s and Ireland’s footsteps with a huge real estate bubble based on cheap lending. The Swiss home price to income ratio is still weak when compared globally; consequently, Swiss home prices are undervalued, another reason to invest in Swiss real estate.

Despite this undervaluation, the SNB is already on alert, as visible in the latest SNB monetary assessment. The bank has implemented a counter-cyclical capital buffer, that requires 1% more equity from banks, the percentage can be increased.

Investment recommendation

Investors should avoid Swiss government bonds, 10 years yield only 1.063%, the bonds are still too expensive. The American recovery could weaken the franc (FXF); higher money supply typically leads to more spending and investment. This again will trigger higher inflation and higher bond yields.

Last week Swiss statistics reported that the period of Swiss deflation is nearly finished. This deflationary period since 2010 was caused by the strong franc and cheaper imports but not by internal weakness or deflationary pressures often cited by the SNB. Swiss wages are rising by 1% per year.

See more for