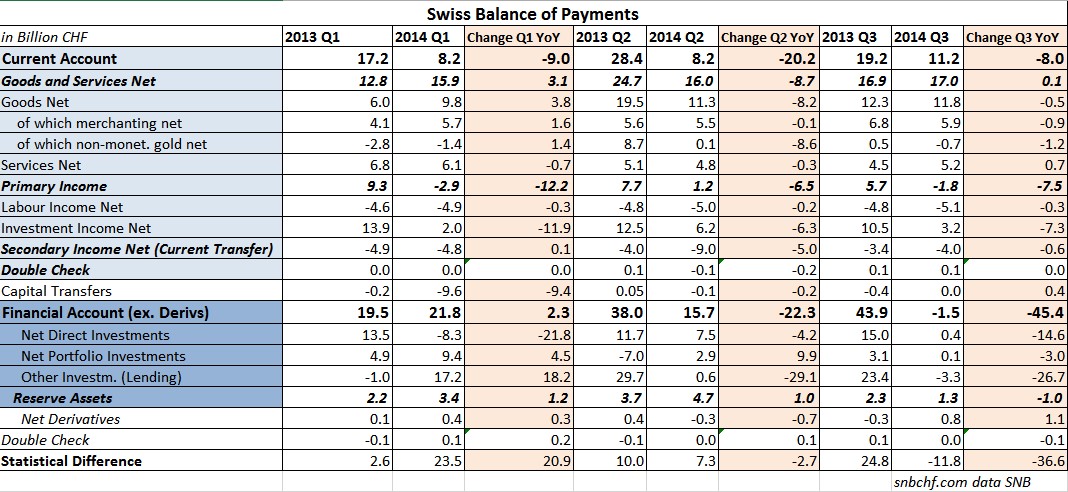

We give details on the Swiss Balance of Payments for the first three quarters of 2014. Switzerland continues to see a strong trade surplus of 10% of GDP, while with the weak global economy, the Swiss investment income has broken down. Therefore the total current account surplus has fallen to 5.7%.

Readers were long waiting for the update on the Swiss balance of payments for the year 2014. The less experienced readers please refer to the Balance of Payments Model on our website to understand the context.

Changed methodology

The IMF changed methodology and so did all central banks (Balance of Payments and International Investment Position Manual, Sixth Edition, BPM6).

The major two changes for Switzerland were:

- Gold used for non-monetary purposes (i.e. not at central banks balance sheets) is now part of the current account and not of the financial account (formerly called “capital account”).

- Merchanting, the trade with commodities, is now part of goods and not of services any more.

The first implied far higher import and exports inside the Swiss current account and less movement inside the financial account. The second meant a weakening of the Swiss surplus in services and strengthening of the surplus in goods.

Moreover, labour income and investment income were summarized as “primary income” and the current transfers (mostly when foreigners send money to their families abroad), was renamed into secondary income. The plus/minus sign on the financial account inverted. The full details on the BPM6 changes can be found on the SNB website.

We were initially shocked with the decision to treat gold not as an investment any more, but as a simple good, just like machines or quickly consumed oil. The SNB, however, clearly identifies the Swiss imports and exports in non-monetary gold and the net value for merchanting. They also restated the 2013 balance of payments with the new method. This helped to understand the changes from 2013 to 2014, both the ones that come with the new method and the ones that come with changing economic data. We focus here on the changed economic data, we base on the revised 2013 figures. The 2013 numbers are therefore different from the ones inside our history of the Swiss balance of payments that does the old method.

Overview

The light blue items represent the current account, the dark blue ones the financial account. Capital transfers, typically financial aid for less developed countries, and net derivatives are outside.

Insights

- With the collapse of the oil price and of currencies in Emerging Markets and weak stock markets in Europe, the Swiss investment income has broken down. This breakdown was reflected on the valuation of investments.

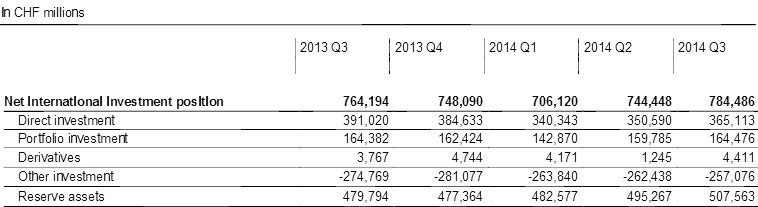

- If we look at the net international investment position (NIIP) of the United States, we see similarly low figures. It has fallen from -29% in 2013 to -35% in 2014. Hence the U.S. lived a substantial weakening of its international income and of its net position. Some foreign nations, in particular the UK or Canada, have improved their NIIP, because they possess many American assets denominated in the now stronger dollar.

- With the decision to buy US Treasuries, most of them in summer 2011 for a weak dollar under 0.80 CHF, the SNB bought a huge put option against a global economic slowing. This measure has had a massive success for now and counteracted the weak Swiss investment performance in 2014. The SNB has managed to improve the Swiss NIIP despite falling valuations of Swiss assets in Emerging Markets and Europe. It has risen to 784 billion CHF in Q3 from 706 billion still in Q1, when the franc was still far stronger.

- The Swiss trade surplus in goods and services remains strong with 10.1% of GDP.

- Merchanting contributes 3.5% to it. Recently the Swiss left parties proposed higher taxes for those companies that are often situated in the canton Zug. Then they might leave the country, with the consequence the Swiss trade surplus will be one third smaller.

- In 2013, Switzerland had a strong performance in non-monetary gold trading. when the companies profited on gold price volatility. In 2014 the performance in the gold-related positions was negative. This reduced the trade surplus slightly.

- Q3/2014: For the first time since the early 1980s and a short period during the financial crisis, the Swiss financial account saw capital inflows. This means that more foreigners wanted to safeguard their money in Switzerland and in CHF than Swiss invested abroad. It also reflects a valuation effect.

- Far stronger outflows via secondary income and capital transfers in 2014. The reason was probably that Russia and other Emerging Markets needed more cash. We will need to look at the huge capital transfer of 9.6 billion CHF in Q1/2014 and get more information.

- The statistical differences, in particular the one in the third quarters, scrambled the picture. The SNB must improve statistics here, something which often happens in revised BoP releases. In third quarter of 2014, these statistical differences were higher then the total current account surplus!

Details

At a detailed by quarter level we obtain the following:

Implication on the CHF FX Rate

In our view, either the Swiss franc must appreciate to cover the 10% trade surplus or wages must rise so that the surplus gets smaller. The second case, however, implies higher inflation.

As opposed to the Swiss leading monetary economist Baltensperger, we do not see a strong economic expansion of both the United States and Emerging Markets, that would justify new massive capital outflows via the Swiss financial account. Wages in Emerging markets have risen too much, so that they are not target of capital inflows any more. Thanks to its massive investments in previous years, China could be an exception for portfolio investments because firms increase margins with falling unit labor costs and less investment costs. This is already visible in strong performance of Chinese stock markets.

Rising American household saving rates and the reduction of debt in combination with the strong dollar should limit U.S. GDP growth from mid 2015 or 2016 onwards. 2014 was still the year when US firms strongly hired, maybe excessively. US companies have superfluous cash, while most American households have not many savings. Readers should be aware that this is the complete opposite of the early 1980s when the first oil glut happened. At the time, US companies did not have cash left for investments, borrowing was expensive, while households and wage earners were rather rich after years of high wage inflation. GDP growth – or “GDC growth” (gross domestic consumption) as we call it – is driven by households and not by companies, in particular in the United States.

References:

The Balance of Payments Model, snbchf

History of the Swiss Balance of Payments, snbchf

Sources:

Swiss Balance of Payments and International Investment Position Q1/2014, SNB

Swiss Balance of Payments and International Investment Position Q2/2014, SNB

The following is the newest release and contains revisions to the previous ones starting from Q3/2013.

Swiss Balance of Payments and International Investment Position Q3/2014, SNB

See more for