The important paper by the Federal Reserve proves that the home prices had a big influence on personal consumption, the PCE component of the GDP.

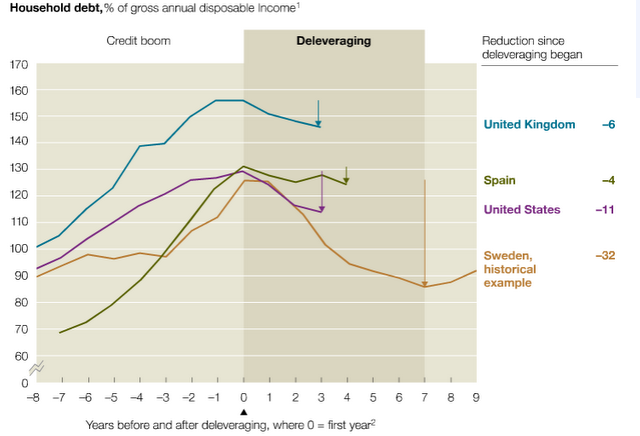

In the beginning of 2013, house prices in the United States have risen and left the bust or deleveraging phase of the credit cycle, earlier than McKinsey expected (see below). This was the main reason why recently risk aversion has strongly fallen.

source: McKinsey in January 2012

By Mark Doms, Federal Reserve Bank of San Francisco

Wendy Dunn, Board of Governors

Daniel Vine, Board of Governors

| doms dunn vine 1008 pdf |

| Found at ebookbrowse.com |

After 2008: House price recovery will not sustain spending when credit is limited

See more forThe wealth effect from rising house prices may not be as effective as it once was in spurring the U.S. economy…

The wealth effect “is much smaller,” said Amir Sufi, professor of finance at the University of Chicago Booth School of Business. Sufi, who participated in last year’s central-bank conference at Jackson Hole, Wyoming, reckons that each dollar increase in housing wealth may yield as little as an extra cent in spending. That compares with a 3-to-5-cent estimate by economists prior to the recession.

Many homeowners are finding they can’t refinance their mortgages because banks have tightened credit conditions so much they’re not eligible for new loans. Most who can refinance are opting not to withdraw equity after the first nationwide decline in house prices since the Great Depression reminded them home values can fall as well as rise…

Others are finding it difficult to refinance because credit has become a lot harder to come by. And that situation could worsen as banks respond to stepped-up government oversight.

“Credit is going to get tighter before it gets easier,” said David Stevens, president and chief executive officer of the Washington-based Mortgage Bankers Association…

“Households that have been through foreclosure or have underwater mortgages or are otherwise credit-constrained are less able than other households to take advantage” of low interest rates, Fed Governor Sarah Bloom Raskin said in an April 18 speech in New York.

(I should note that Sufi et al. previously delved into the relationship between household balance sheets and the economic downturn here.)

A more systematic take comes from the Federal Reserve Board’s Matteo Iacoviella:

Empirically, housing wealth and consumption tend to move together: this could happen because some third factor moves both variables, or because there is a more direct effect going from one variable to the other. Studies based on time-series data, on panel data and on more detailed, recent micro data point suggest that a considerable portion of the effect of housing wealth on consumption reflects the influence of changes in housing wealth on borrowing against such wealth. (source)