Influential main stream economist have a long rejected the balance sheet recession theory. Here an answer from Krugman to Koo’s theory: He disagrees because there must be “also creditors, not only debtors”. Certainly, Mr Krugman, there are now creditors, most of them are in the US or the UK, but they are in the countries with strong trade balances (like China and German) and those with rising real estate prices (Germany or Switzerland or soon Japan). Krugman partially agrees and distinguishes between “patient and impatient market participants”, creditors and debtors.

The White House also looks to be on team balance sheet. See the latest Economic Report of the President (pages 110 to 114):

“The standard approach in economics has been to assume that households consume about the same fraction of the increase in their wealth each year, regardless of its source… The severity of losses experienced during the recession that began in December of 2007 in both national output and in labor markets makes these estimates appear too small…

A growing economics literature highlights the importance of household debt balances in influencing the severity of economic slumps… A series of empirical papers attempts to quantify the effect of such deleveraging on consumption (Mian and Sufi 2010; Mian, Rao, and Sufi 2011). These papers broadly suggest that the levered nature of household housing assets amplified the effect of pure wealth losses from the crash in housing prices.”

And finally Mr Mainstream Keynesian, Paul Krugman:

Mike Konczal has an excellent survey of the recent literature on balance sheet recessions; as he says, there is now a lot of empirical evidence supporting the view that we are mainly facing a slump in aggregate demand, which in turn is largely driven by debt overhang. There are strong implications for, among other things, mortgage relief; and in general, macro policy is different under these conditions.

And this is the presentation from the Roosevelt Institute, the application of Koo’s theory to the United States.

Some first econometric evidence

Here some extracts of institutes and blogs who support Koo’s balance sheet recession theory:

| The Roosevelt Institute | The Capital Research Institute | The Institute of New Economic Thinking | The Real World Economic Review |

|---|---|---|---|

| Blog of the Roosevelt Institute fellow Mike Konczal | The big picture here, here and many more | Even John B. Taylor with this | Zerohedge |

| The Boom Bust Blog | Keiser RT | Economic Times | Pragmatic Capitalism: here and here and here and here. |

| Alternative Economics | The Motley Fool | Bill Mitchell's Blog | Mish's Global Economic Trend Analysis |

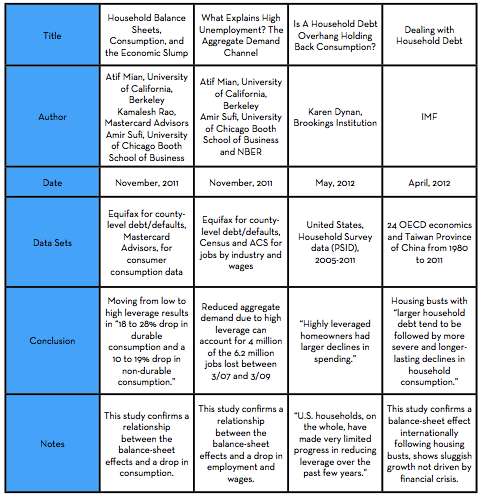

An overview of recent economic papers give this slide from Mike Konczal:

Details and more on recent economic research

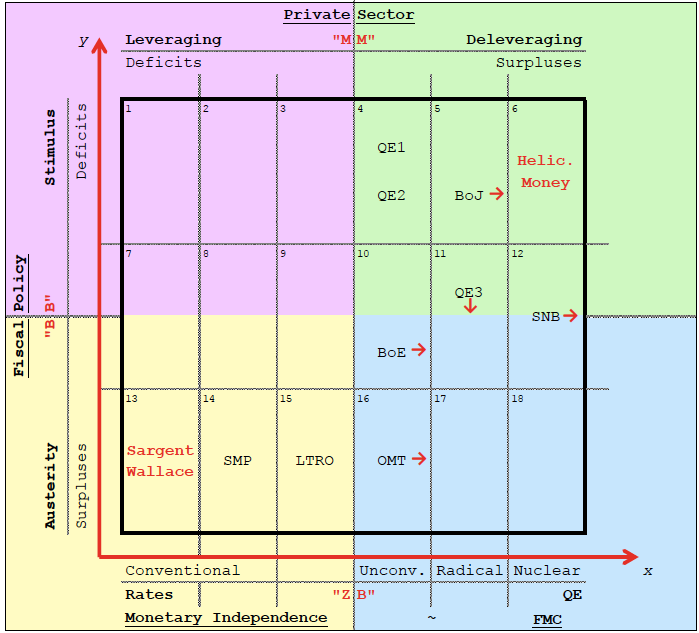

McCulley, Poszan provide a similar division between yin and yang, between de-leveraging and leveraging of the private sector and explains possible solutions. As opposed to Koo they do not claim that monetary policy is useless during a yin phase.

Atif Mian , Amir Sufi: How Household Debt Contributes to Unemployment

Case, Quigley, Shiller (2005): Comparing Wealth Effects: The Stock Market versus the Housing Market

Case, Quigley, Shiller (2011): Wealth Effects Revisited

Mian, Rao, and Sufi (2011): Household Balance Sheets, Consumption, and the Economic Slump

Doms, Dunn, Vine (2008): Changes in Housing Wealth and Consumption: Did the linkage increase in the 2000s ?