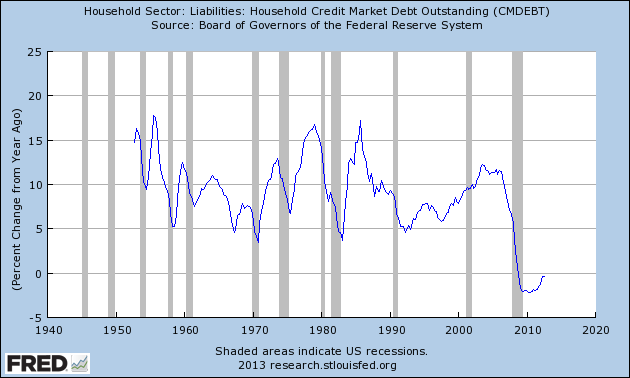

Monetary policy has failed alone to lift the U.S. economy during QE2, because the private sector is obsessed with minimizing debt, they are in a “balance sheet recession”, according to Nomura Chief Economist Richard Koo.

Monetary policy has failed alone to lift the U.S. economy during QE2, because the private sector is obsessed with minimizing debt, they are in a “balance sheet recession”, according to Nomura Chief Economist Richard Koo.

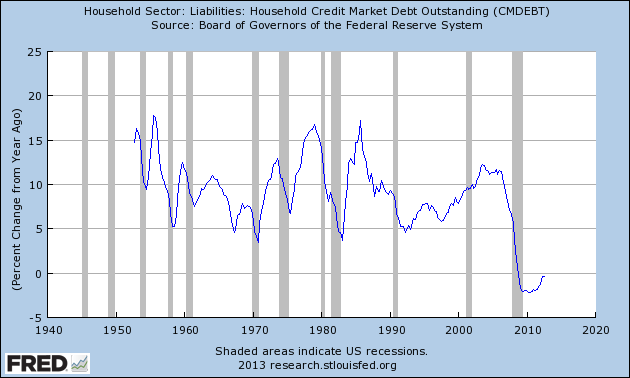

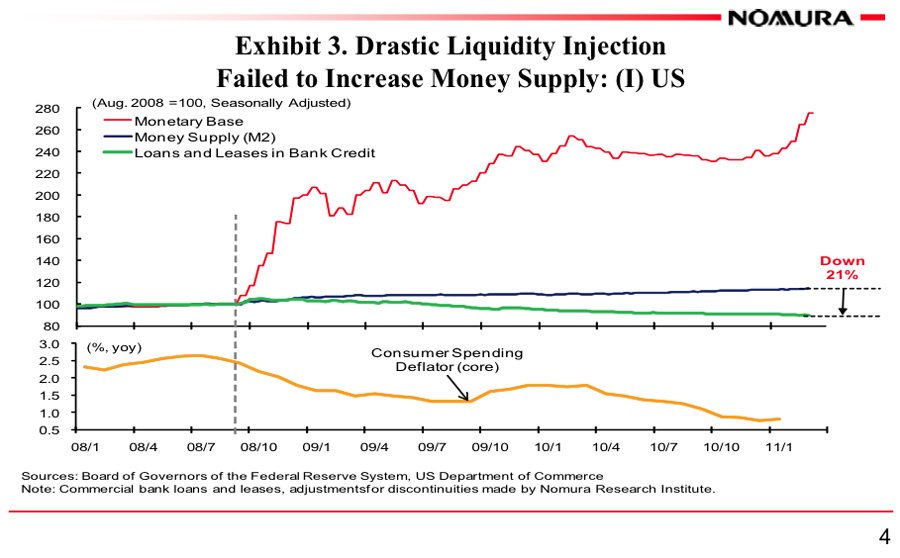

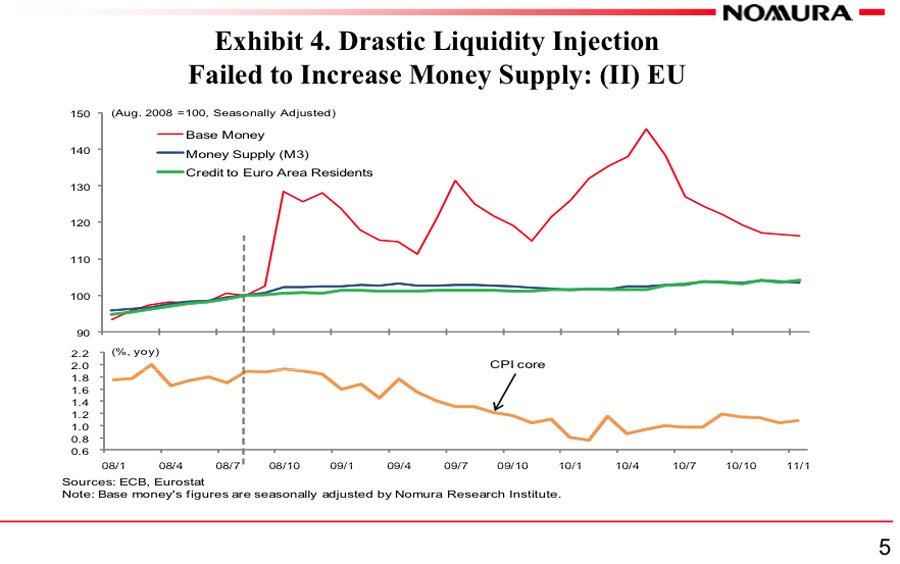

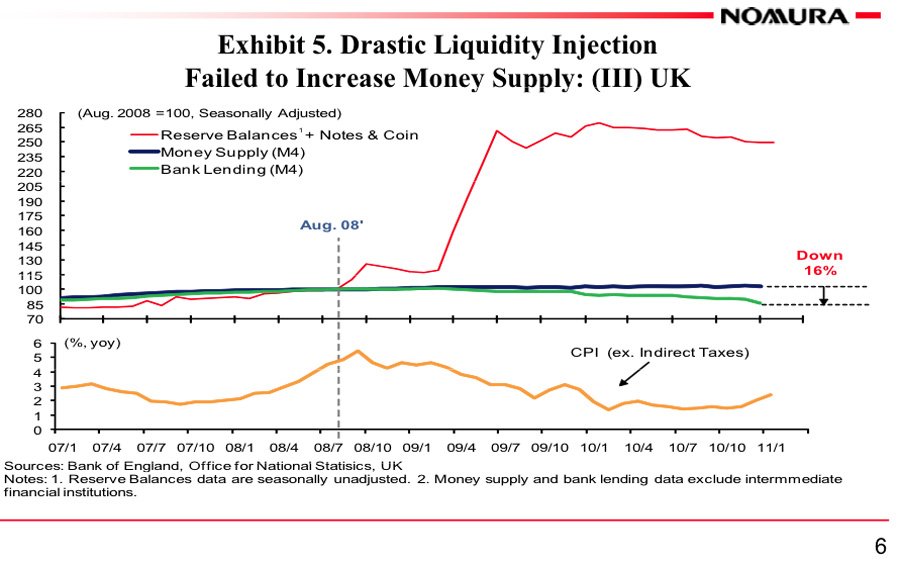

Koo’s presentation explains how the U.S and Europe have expanded their monetary base, but that this flood of cash isn’t driving economic growth because banks, businesses, and people are paying down debt. Koo says that only the government can step in to spend the excess savings in the market.

Things have changed a little in Q4/2012: thanks to slowing gas prices and QE3, the U.S. consumers started do some deficit spending again: salaries rise less than credit. Household debt is due to rise again, while QE3 provides unlimited funding and seems to be successful.

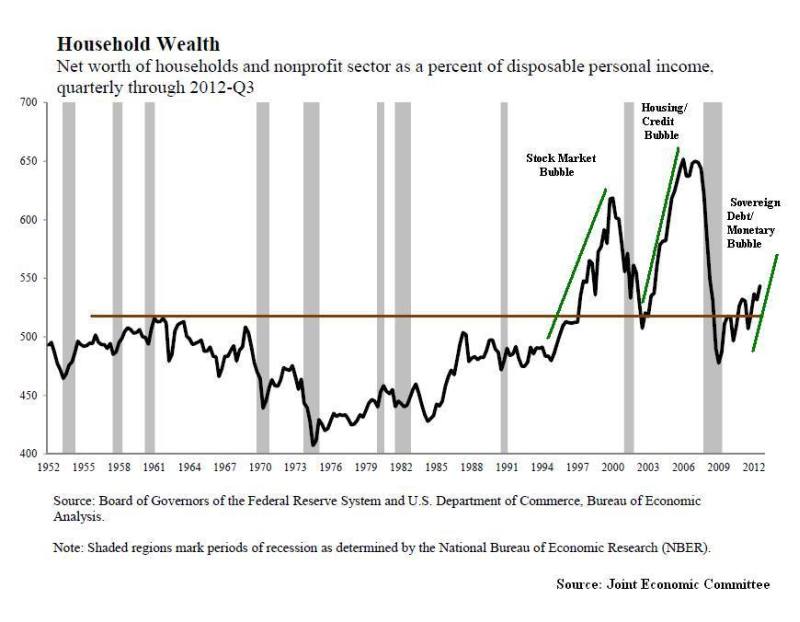

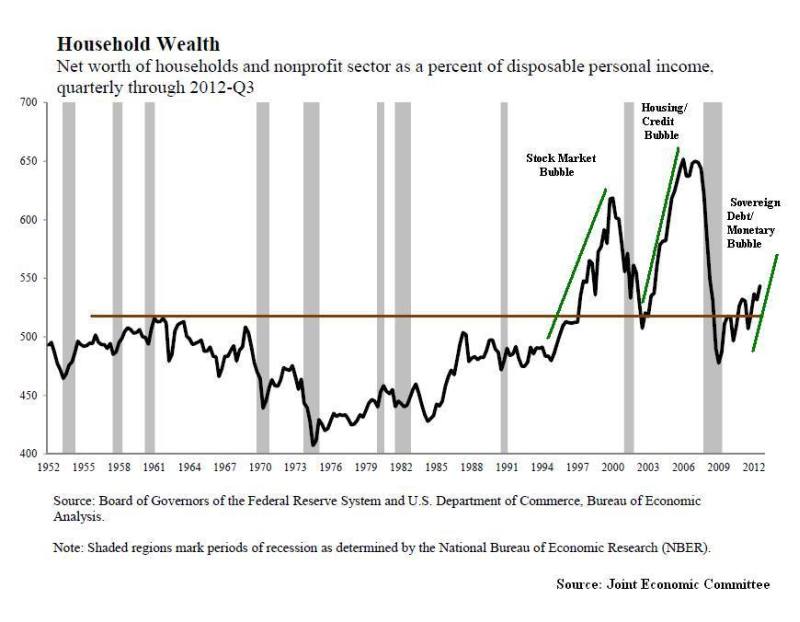

US household net worth 1952-2012 - Click to enlarge

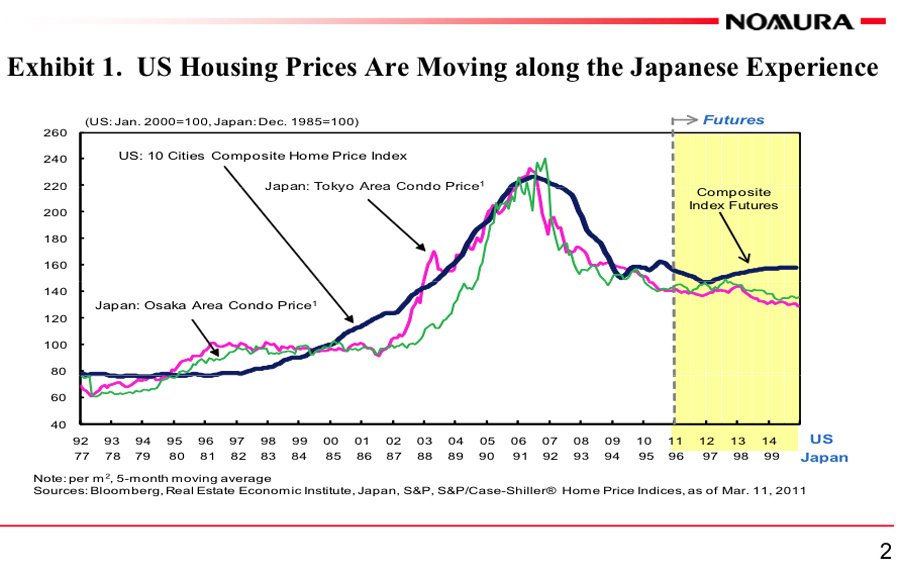

Low savings show that the American mentality is different from the Japanese. The Heisei bubble in Tokyo was far bigger than the US subprime bubble. This bubble could have become a part of the Japanese mentality. Will it in the U.S.?

But in Europe the balance sheet recession has just started, even house prices in Paris get under pressure despite still high demand.

Comparison housing bubble in Japan USA Australia - Click to enlarge

The U.S. housing market resembles that of Japan’s. In 2012, US house prices have recovered a bit.

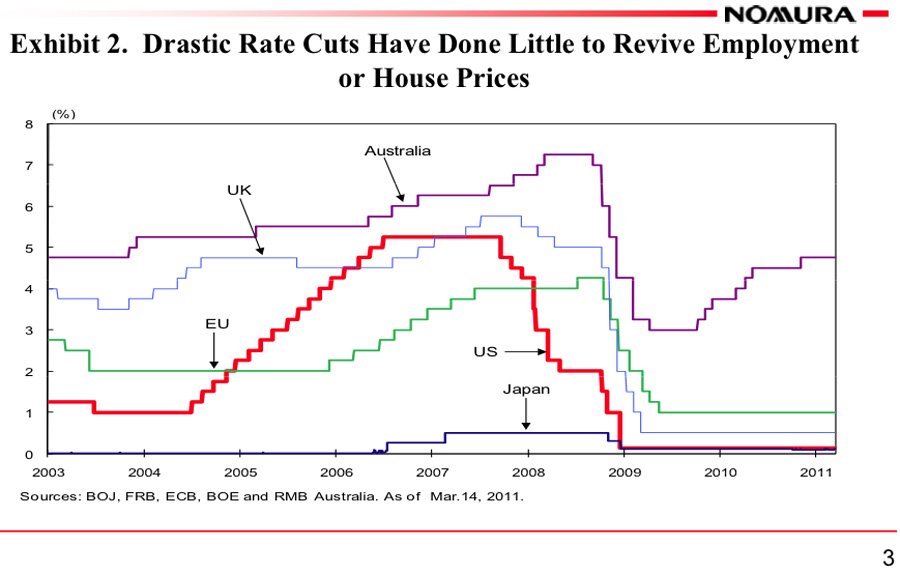

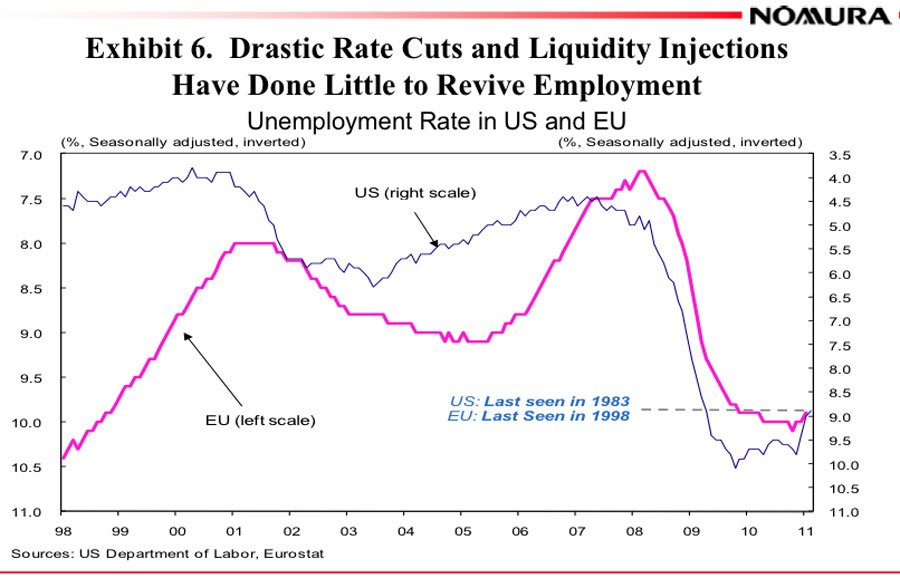

Cutting rate to zero has not cured the unemployment crisis. In 2012, US house prices have recovered a bit. But 150 K new jobs per months is still not enough.

Quantitative easing programs and policy easing have not increased the U.S. money supply

And it hasn’t worked in the EU either. ECB’s OMT in september 2012 helped to increase money supply for the first time.

Monetary policy has been ineffective in reducing unemployment, but 150 K new jobs per months is still not enough. The EU is seeing record-high unemployment in 2012. The need for European deleveraging has just started.

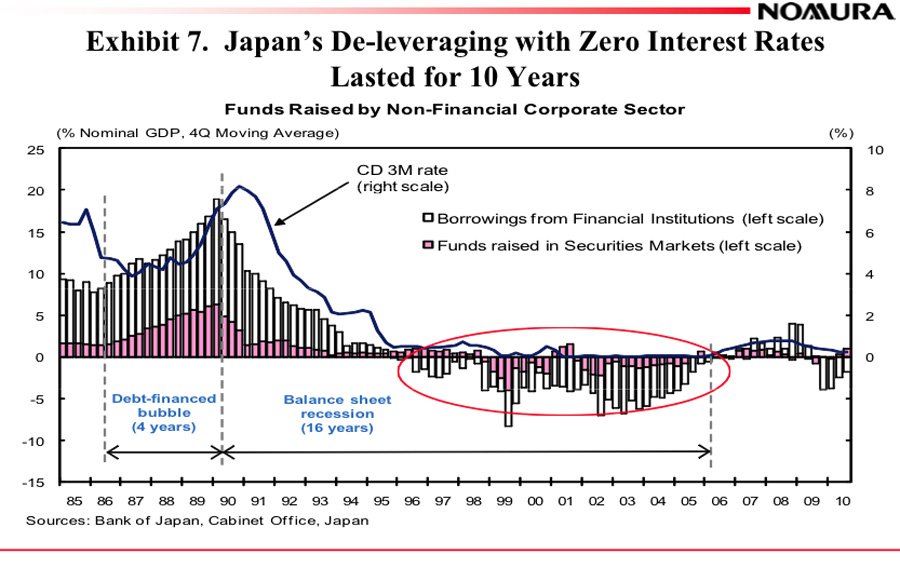

In Japan, it took a decade for businesses to de-leverage.

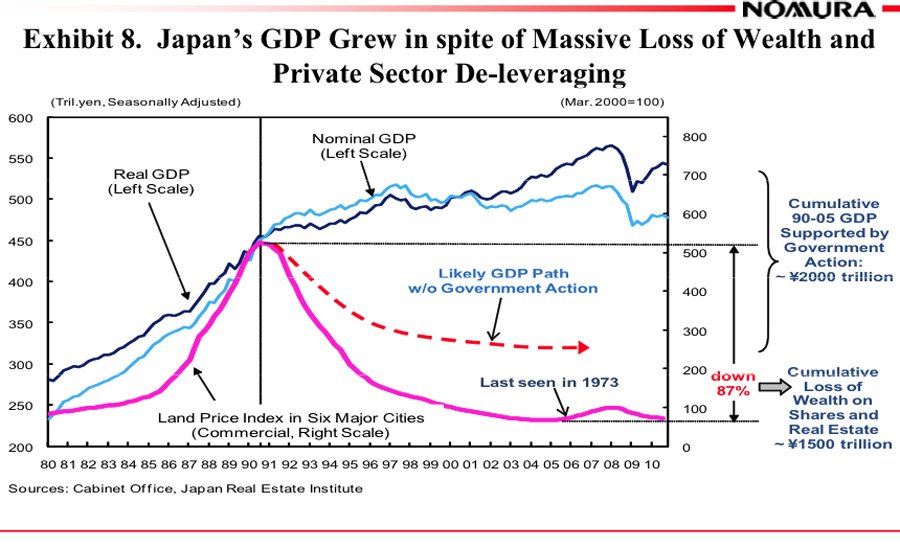

But Japan’s GDP still grew, because the government was willing to spend

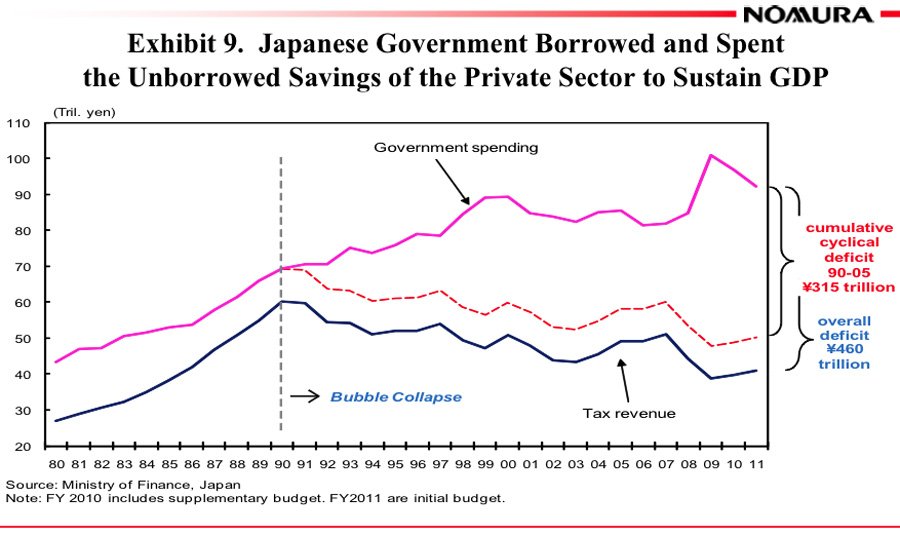

The Japanese government became the borrower, because businesses weren’t interested

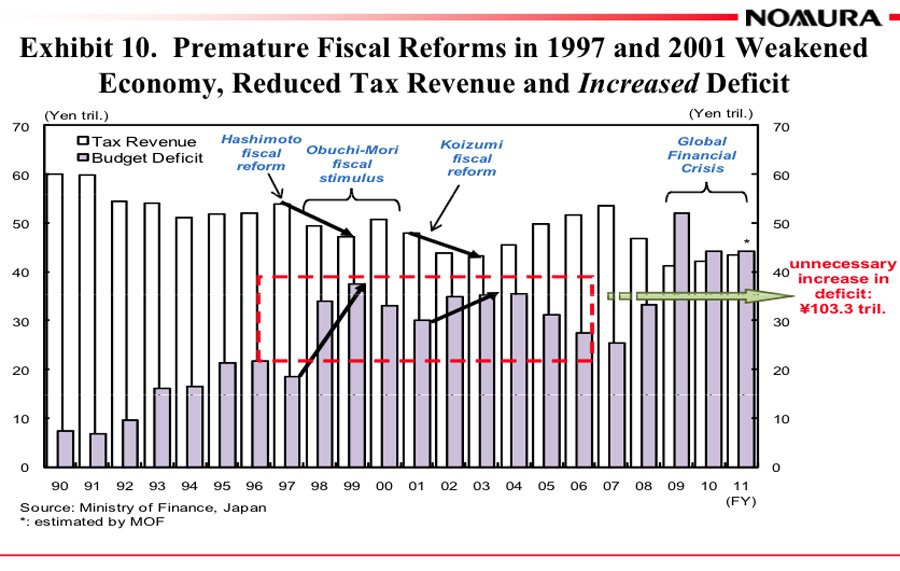

Austerity cuts actually hurt the Japanese economy and increased its government deficit

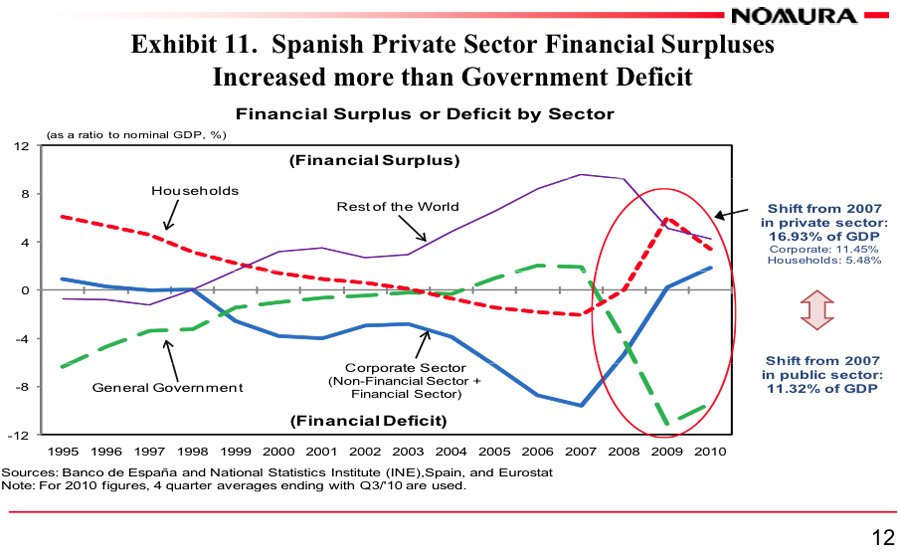

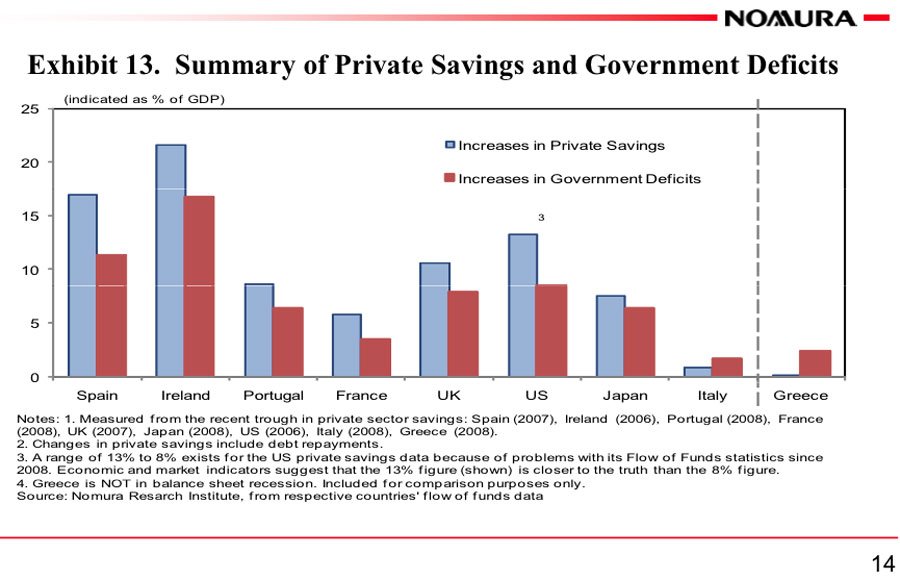

Debt shifts from the private to the public sector in Spain

And the same is occurring in Ireland

Private sector savings are increasing ahead of public sector debt

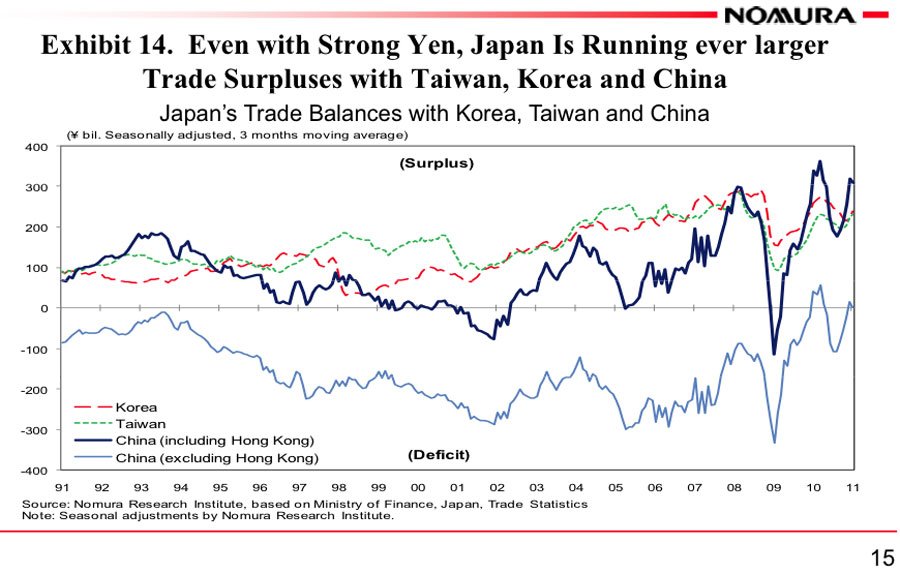

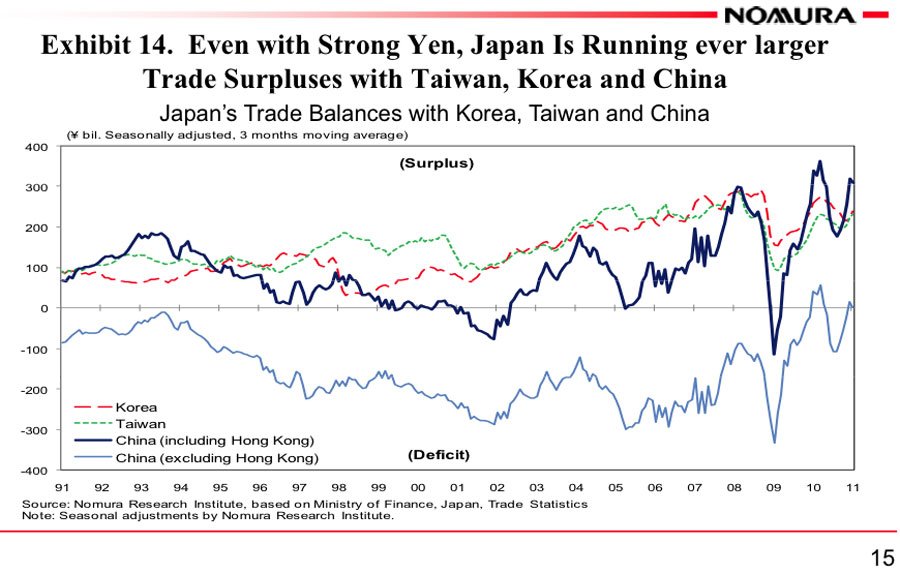

Japan was running trade surpluses in 2011. Due to a smaller use of nuclear power, the slowing in the emerging markets and a raft with China, the current account surplus got nearly erased in 2012.

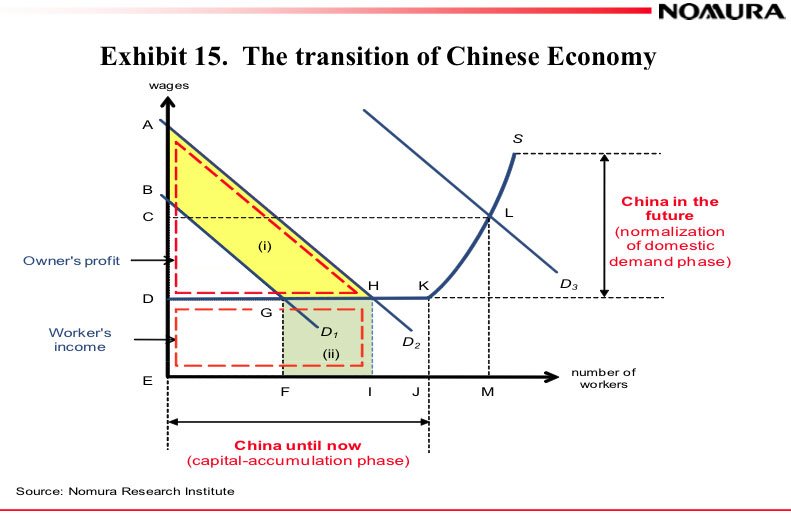

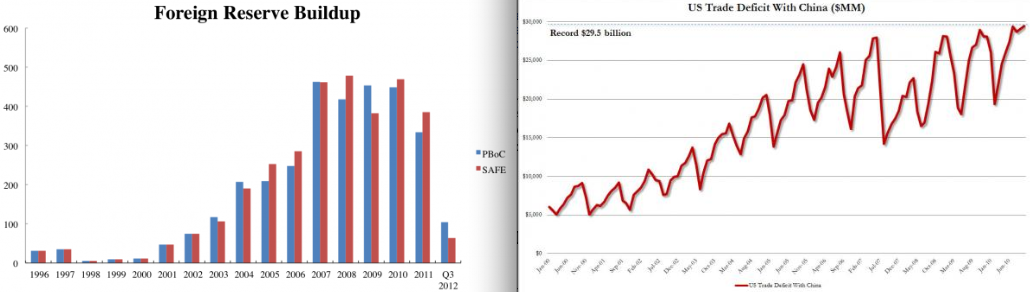

In China, domestic demand is set to rise, and its wages will rise too. Caused by big outflows the capital accumulation phase has ended.

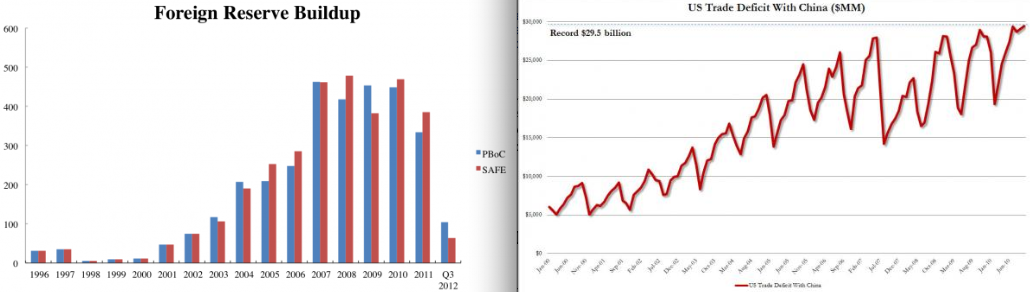

The strong rise of the Chinese current account surplus and FX reserves has finished. The United States remains the only major country that increases its trade deficit with China and Hong Kong.

Chinese FX reserves buildup, trade surplus shrinks, but surplus with the US is rising (sources Peterson institute and Zerohedge)

Others like Germany or Switzerland sell more to China (incl. Hong Kong) than they buy. The Chinese capital accumulation phase is ending.

With the appreciation of Renmimbi by 15% since 2010 and higher earnngs, Chinese average disposable income in 2012 is close to 10% of US average disposable income (38000 US$).

China Disposable income 1980 - 2010 - Click to enlarge

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

See more for 8.) Richard Koo and Sector Balances

Monetary policy has failed alone to lift the U.S. economy during QE2, because the private sector is obsessed with minimizing debt, they are in a “balance sheet recession”, according to Nomura Chief Economist Richard Koo.

Monetary policy has failed alone to lift the U.S. economy during QE2, because the private sector is obsessed with minimizing debt, they are in a “balance sheet recession”, according to Nomura Chief Economist Richard Koo.