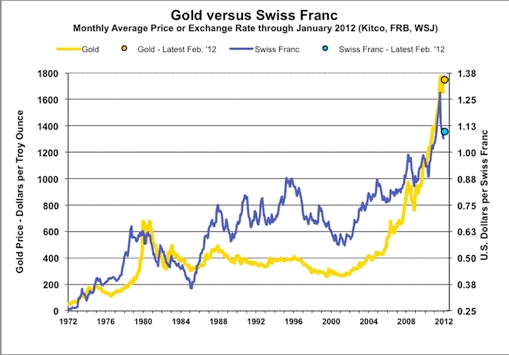

Gold versus Swiss FrancMany people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels. However the strong gold-CHF relationship broke from 1985 to 2007. Between 1985 and 2001: the reasons were the relative weakness of gold and the good performance of the U.S. economy, topping in the dot com bubble. From 2001 to 2007, the carry trade strengthened gold and the related Emerging Markets. but weakened the franc and related Germany. Switzerland had to digest the bust of the property bubble of the 1990s. Both Germany and Switzerland decided not to follow the spending rush of the U.S., the UK and Southern Europe.

|

|

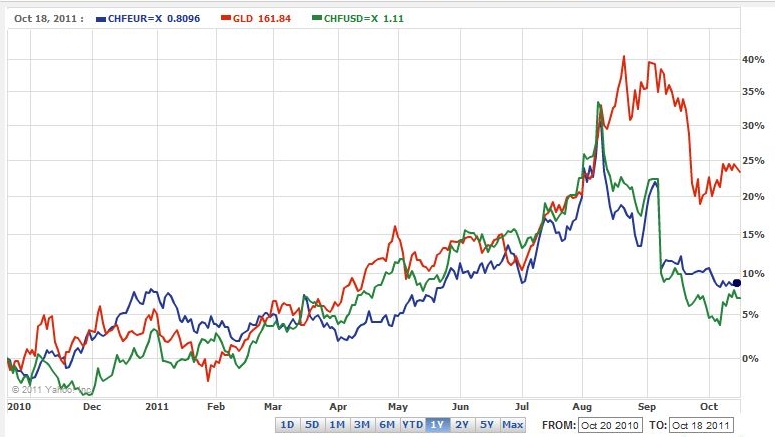

2010-2011: Tight Relationship between USD/CHF and gold

In 2010 and 2011 the relationship between gold and CHF became parabolic. Gold tumbled only three weeks after the SNB introduced the cap. CHF remained artificially weak and gold outperformed.

|

|

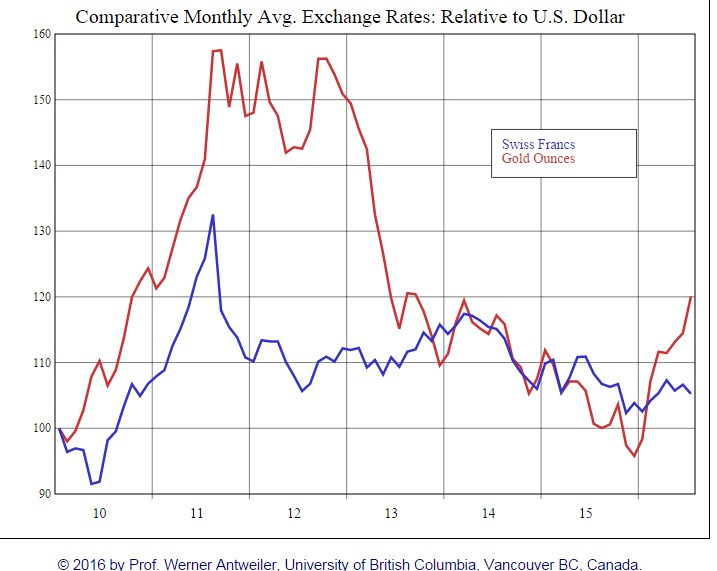

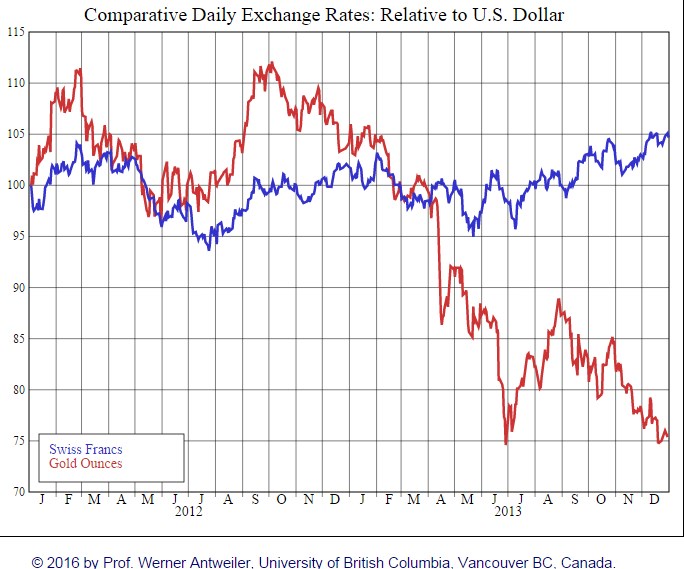

2013: Emerging Markets and the gold price collapse

The 2011/2012 advance of gold against CHF ended in 2013. Due to the weakness of Emerging Markets since 2012, CHF could far outperform gold. That resulted in SNB losses of 13 bln. francs only on gold holdings in Q2/2013. |

|

2016: Gold starts another advance against CHF

In 2014 and 2015, gold and CHF were closely related again. After the end of the peg, the franc had a light advantage. But in 2016, Gold started another advance. The gold price improved by 20%, but the Swiss Franc did not follow. Reasons for the stronger gold price was the rising oil and the expectation that the Fed would not raise rates less quickly than expected. On the other side, the SNB continues to depress the franc with FX interventions that are focused on the weak euro.

|

2010 to 2016: Gold and CHF

|

The German economy, China, gold and CHF

Inflation is no longer the principal concern for the American economy and investors: this is the slow growth in both employment and GDP.

But, similar to the 1970s, gold, German stocks and the Swiss franc are seen as alternatives.

German and Swiss engineering and machinery firms have a strong exposure to Emerging Markets and in particular to China. While Germans concentrate more on machinery and engineering, the Ricardian comparative advantage for Switzerland is the luxury sales to rich clients from Emerging Markets, e.g. watches, precision instruments, jewellery, luxury tourism and pharmaceuticals. We all know that gold rises with higher oil prices, so does the Swiss franc. The reasons are:

- Oil and gold prices rise with higher GDP growth and demand, especially from Emerging Markets and their central banks. In risk-on periods the latter often want to reduce their US dollar dependency.

- Higher prices for imported oil increases the U.S. trade deficits and weakens the greenback.

- Gold production costs and consequently gold prices rise when oil inches up.

- For the Swiss, higher oil prices are neutralized thanks to small distances and higher sales to their rich Middle Eastern clients. Effectively Switzerland has a trade surplus with the Middle East while the U.S. has a big deficit.

- Since the Swiss concentrate on the luxury sector, prices and exchange rates are not big issues, but a slowing demand from Emerging Markets or from the biggest trading partner, Germany, is.

The huge Swiss trade surplus with the United States in the pharmaceutical sector may additionally strengthen the Swiss economy, keyword “Obamacare”. On the other side, Switzerland is less concentrated on China than German exporters are.

See more for