We think that the main drivers of CHF are rising internal demand and GDP growth and rising prices of Swiss stocks. Bond prices or short-term money-markets funds (aka carry trade) are less important.

For months and nearly years the financial establishment claimed that the Swiss franc should depreciate because investors would buy Spanish and Italian bonds, purchase undervalued Spanish or Italian stocks and sell secure Swiss bonds. In the meantime these peripheral bond yields have fallen to about 3%. Their prices are overtaking the ones of U.S. Treasuries. Spanish stocks are back to 2006 levels despite weak internal demand but the Swiss franc has not depreciated yet.

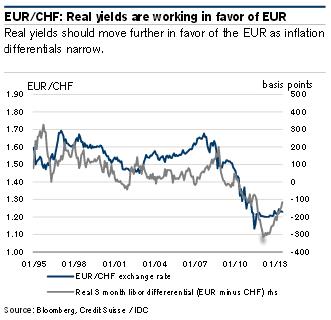

Another attempt to talk down the Swiss franc and to weaken their own Swiss labor costs,comes from Credit Suisse:

Rising real yield differentials between Euro zone and Switzerland

Credit Suisse claims that real yield differentials would speak in favor of EUR and against the CHF.

We see several issues with this evaluation:

We see several issues with this evaluation:

1) For short-term investors like money-market funds, nominal rates are more important. The nominal interest rate difference of 0.5% 0.25% 0% between ECB and SNB key rates is insufficient to enable a carry trade. Investors, especially Swiss ones, have become far more risk-averse than before the financial crisis. Risk-averse investors often prefer cash and cash-like investments in local currency.

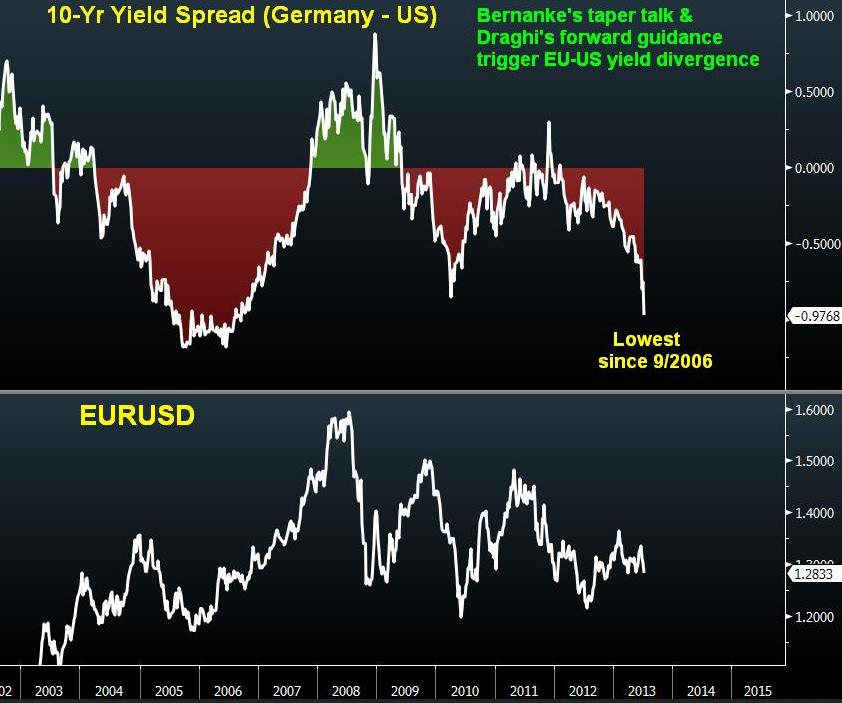

2) For long-term investors, real government bond yields seem to be important, e.g. 10 year yields compared to the inflation rate.

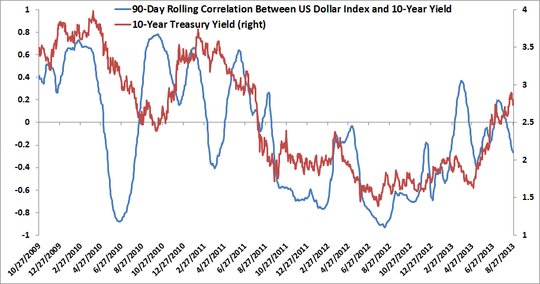

For several months we see a high difference in real 10 year yields between German Bunds and US Treasuries, +0.05% real yields for Germany vs. +0.95% for the US. Despite that difference, investors did not buy the relatively cheap US treasuries, on the contrary This did not support the dollar as Ashraf Laidi was suggesting.

Source Ashraf Laidi

Former FX Concepts hedge fund manager Bob Savage, now active on track.com, proved that long-term yields are rather unrelated to FX rates.

Rather, we think that growth and inflation expectations are the major driver of long-term yields. Since risk-averse investors, e.g. insurances and pension funds, are the ones that buy government bonds, but they prefer bonds in local currency to exclude the currency risks. Therefore long-term government bond yields are largely unrelated to FX rates. Short-term yields, however, are for us the major driver of money market funds and therefore one driver of FX rates.

3) FX traders are nearly irrelevant for longer term FX rate movements. They close their positions after a certain period, they are only able to accentuate price movements. While in 2013 FX speculators were on the side of the SNB, this has changed since February 2014 (see more details).

4) In times of close to zero interest rates, stock markets are far more important than government bond yields. The Swiss balance of payments shows that recent currency movements in EUR/CHF are driven by equities rather than by government bonds or money market funds.

5) Swiss GDP growth is at 2.2% y/y, far higher than the one in the euro zone. Together with the still strongly positive trade surplus and demand from the – as opposed to Southern Europeans and Americans – not balance sheet-constrained Swiss consumers, it seems that Swiss firms are still poised for higher profits. Higher demand for Swiss equities could bolster the franc.

Rising inflation is an expression of higher demand and of the competitiveness of Swiss companies

Apart from spillover effect from rising real estate prices in the inflation rate, the most important driver of inflation, however, is internal demand, that will – as opposed to Southern Europe – remain strong and support profits of Swiss companies.

Inflation is partially an expression and the final consequence of the productivity of companies. In times of tight labor supply, competitive firms are ready to attribute higher wages to employees – visible e.g. in the +0.5% for prices of Swiss services1. Secondly, these competitive firms are able to charge higher prices without negative influence on demand. Both higher wages and higher market prices are the main factors of healthy demand-pull inflation.

Rising inflation of Swiss services and goods is, hence, just an expression of the competitiveness of Swiss companies, while the euro zone is constrained by austerity and slowly rising or falling salaries.

SNB law does not allow for financial repression

The law behind the Swiss National Bank (SNB) focuses on price stability. Hence it does not allow for financial repression – strongly negative real interest rates. The SNB must hike interest rates once inflation rises to (or towards) 2%. We judge that from 1% inflation, the SNB will remove the CHF cap.

Read also:

- even if they are accentuated a bit by rent payments that count as services, too [↩]