In this analysis we explain why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this finally happens, then debt will be reduced and both public and private deficit spending could stop. We will see that this path is very long.

Updates for 2013 and 2014:

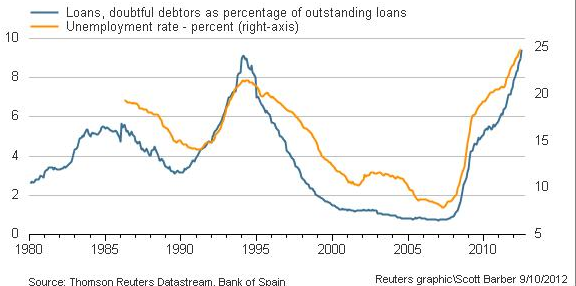

Spanish banks’ bad loan ratio rises to record in June 2013: Reuters

Spaniards are spending more, this helped GDP or GDC (Gross Domestic Consumption) – how we call it. This higher private spending helped to contain the explosion of public debt and to reduce unemployment. But it considerably increased the trade deficit with Switzerland.

Q1-Q3 2014 compared to 2013: Swiss exports to Spain +12%, Swiss imports from Spain -9.7%, Balance +1.1 bln. for Swiss

(source Swiss Customs)

We do not consider these Keynesian measures as improvement of competitiveness.

The new Debt Reduction Financial Cycle, an important driver of the EUR/CHF Rate

(originally written in 2012, arguments still valid today, as visible in the updates above)

We think that the upcoming new financial cycle will have an important influence on the EUR/CHF exchange rate. Read the basis of this cycle of debt reduction.

The main important criteria for measuring risk are public and private debt and the investors’ risk aversion. We call these two aspects the “risk differentials” among different countries. Risk differentials become apparent in close to negative yields for Swiss or German government bonds or in high yields for peripheral bonds. The reverse carry trade and the interest rate parity is a direct consequence of risk differentials and different compositions of CPI baskets (more details here).

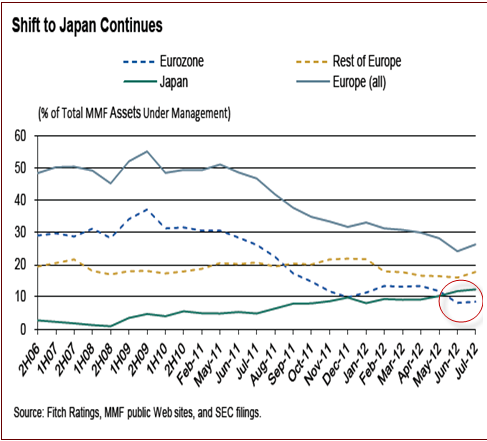

Risk aversionIn certain periods, like during the carry trade time between 2003 and 2007, risk appetite was high among wealthy investors. But since 2008 after several boom-bust cycles that started in 1998, they have become the opposite: risk-averse. Risk aversion is today the most important criterion and far more important than it was before 1998. Most wealthy investors aim to preserve the value of their capital against inflation (return of capital) and not to beat inflation with high returns (return on capital). A good way of preserving capital is to invest in a country where inflation is negative, but GDP growth positive (like in Switzerland or Japan), i.e. invest into safe-havens. This development can be seen in the 2012 money market funds movements (see graph). Thanks to capital inflows, Switzerland, Germany and Japan could improve investments and GDP. A completely different situation than during the carry trade period, when capital was leaving these countries. At that time, Swiss economists wanted to follow the “Irish model”1 Fortunately Switzerland did not. We judge that :

Certain areas do not need to deleverage, these are German, Japanese or Swiss housing, because they deleveraged already in the (late) 1990s and did not build a big bubble before 2008. Certainly, risk averseness does not prevent stock markets from going higher, because there are still some investors with risk appetite left, but a lot less than before 2008. |

|

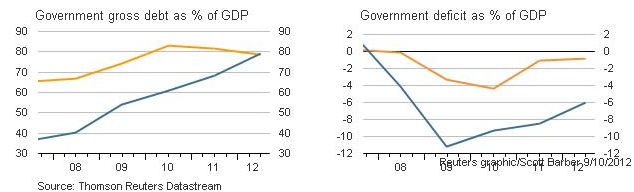

Public and private debtThe Spanish debt/GDP ratio has strongly risen since 2008 and is poised to continue this ascent. As Nataxis explains, it will be difficult for the country to reach austerity targets. Even if the ECB enforced a 3% yield for ten-years government bonds, this would not help. |

|

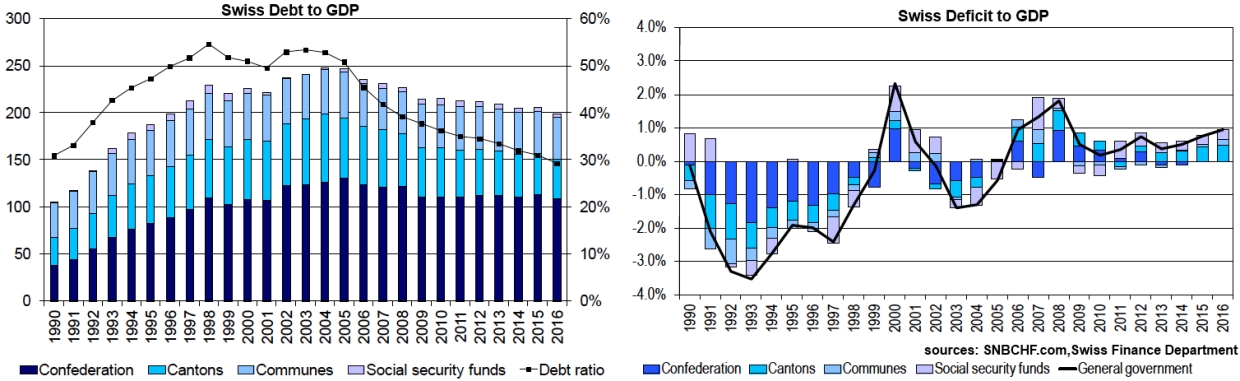

| The situation for Italy is not a lot better, because the current account surplus and the latest positive news on debt, was only achieved via a considerable weakening of consumer spending (GDP -2.6% YoY), higher taxes and thanks to the cheap euro around EUR/USD 1.23. Swiss debt is far smaller with 40%. The Swiss even have a public surplus: | |

| Hardly any risk-adverse wealthy investor would put capital into peripheral bonds as long as the debt and deficit situation not improves considerably. Last but not least, many investors think that Germany will one day pay a significant part of the peripheral debt, the risk of German Bunds will sooner or later increase. |

Hence:

The debt situation in the peripheral euro economies needs to stabilize so that the SNB is able to sell (big parts of their) FX reserves. Peripheral debt should not increase any more.

For us there are two other main criteria for a rise of the EUR/CHF exchange rate and a reduction of SNB’s currency reserves, namely: Higher interest rates in the euro zone and on the way there, higher growth in the euro zone than in Switzerland.

Otherwise the strongly positive Swiss current account and one day higher Swiss interest rates may drive CHF higher with the time. See more on the current account development in the history of the Swiss balance of payments.

- see more in G. Rich, 2005: “Swiss GNP improves far more than GDP” or in the UBS March 2008 paper “Currencies: a delicate imbalance, Unprecedented global imbalances will eventually adjust” [↩]