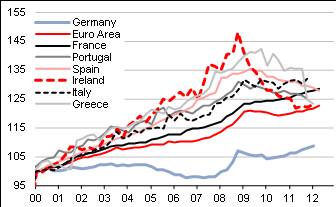

Lors des échanges commerciaux et interbancaires, il y a des banques émettrices de monnaie et vis-à-vis une banque réceptrice. Normalement, à la fin de la journée, tout cela devrait être ramené à l’équilibre. Ceci n’est plus le cas depuis la crise américaine de 2007 (subprimes) comme nous le voyons sur le graphique ci-dessous de quelques pays de la zone euro.

Read More »

Category Archive: 2.) Germany

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

Great Graphic: US-German 2-Yr Differential and the Euro

The US premium over Germany is at its widest since 2006. This is despite a small reduction in odds of a hike in December. There are many forces are work, but over time, the widening differential will likely give the dollar better traction.

Read More »

Read More »

Deutsche Bank CEO Returns Home Empty-Handed After Failing To Reach ‘Deal’ With DOJ: Bild

Following the seemingly endless procession of short-squeeze-fueling trial balloons last week - from settlement rumors to German blue-chip bailouts to Qatari investors - Germany's Bild newspaper confirms the rumors that sparked weakness on Friday: Deutsche bank CEO John Cryan has failed to reach an agreement with the US Justice Department.

Read More »

Read More »

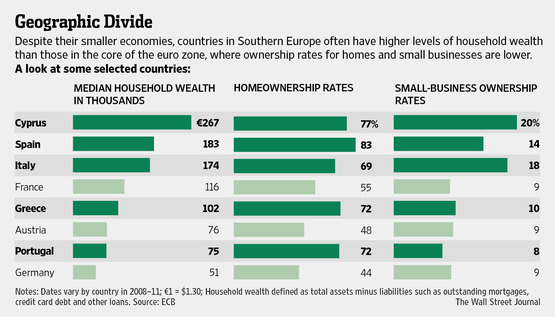

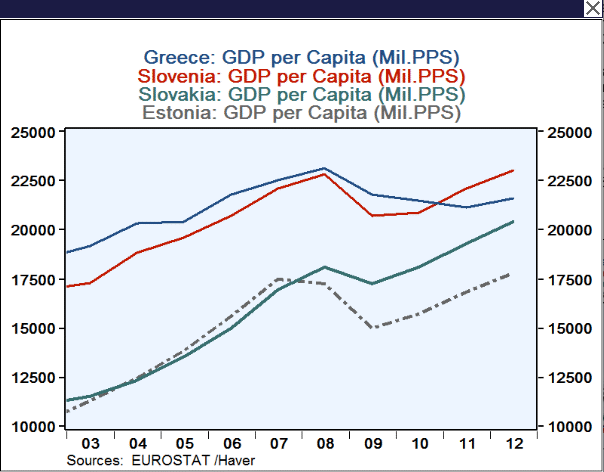

The European Transfer Union From North To South and from Poor to Rich between 1999 and 2007

Cheap ECB rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany's middle-class and poor, most of them not owning a home, were the ones that financed it.

Read More »

Read More »

German Economists and Merkel, the Implicit Followers of the Gold Standard

With ECB's OMT & "conditionality", that requires austerity and implicitly reduction of salaries in European periphery, Merkel & German economists have created consequences similar to a gold-standard.

Read More »

Read More »

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »