Category Archive: 1.) Zerohedge on SNB

Wall Street and SNB In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name.

Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to unde...

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

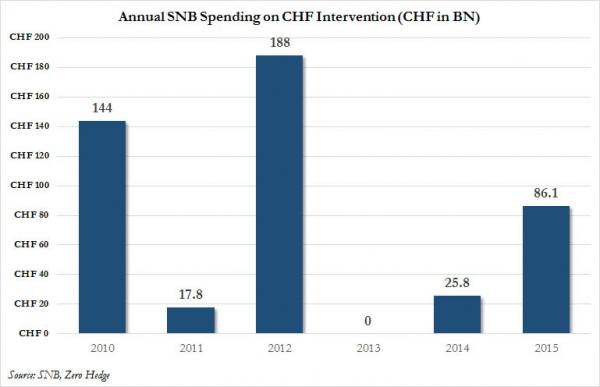

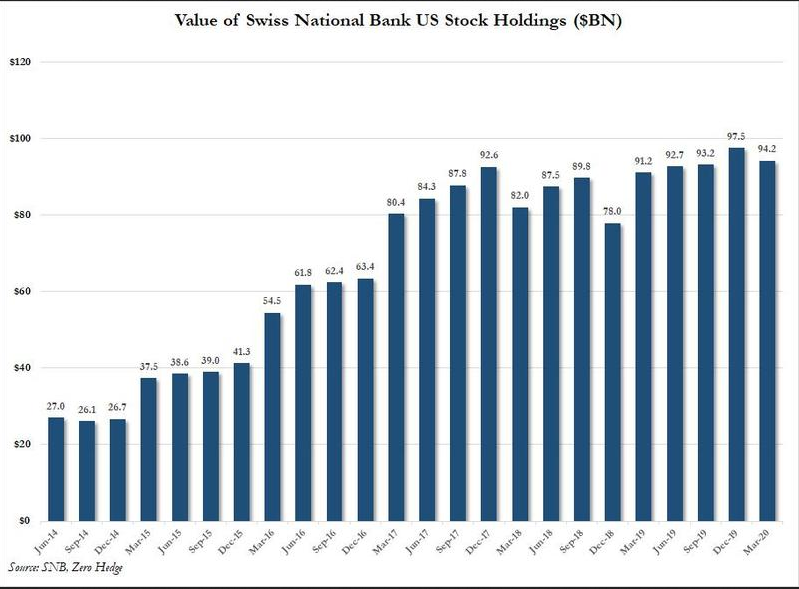

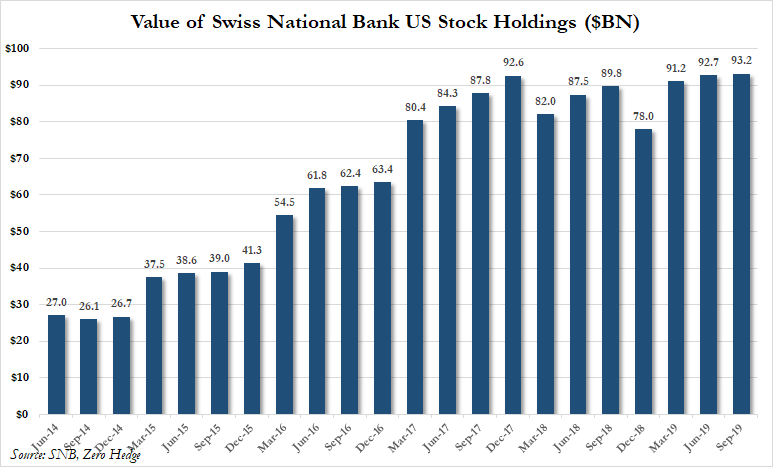

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

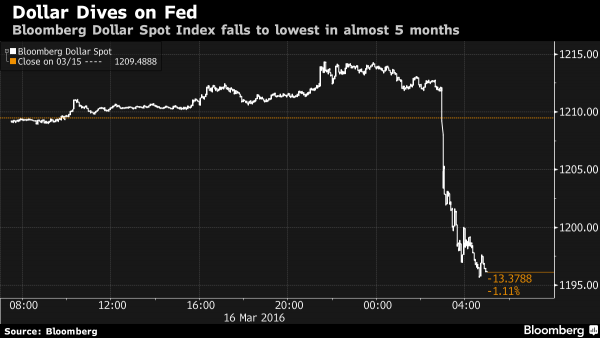

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog,

Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative ...

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Ban...

Read More »

Read More »

The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

Currency stability is a prerequisite for China's economic transition

Defending the yuan is prohibitively expensive – China cannot beat the market

Progressive devaluation managed by PBoC...

Read More »

Read More »

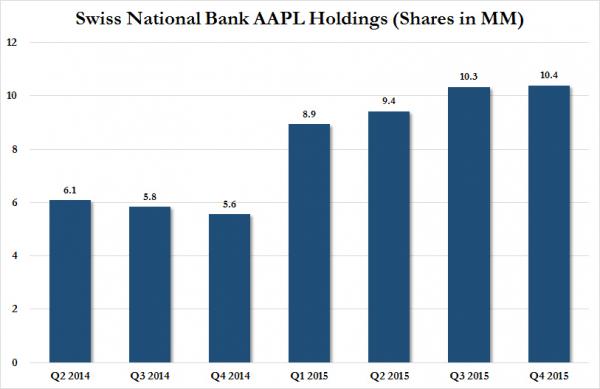

The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions...

Read More »

Read More »

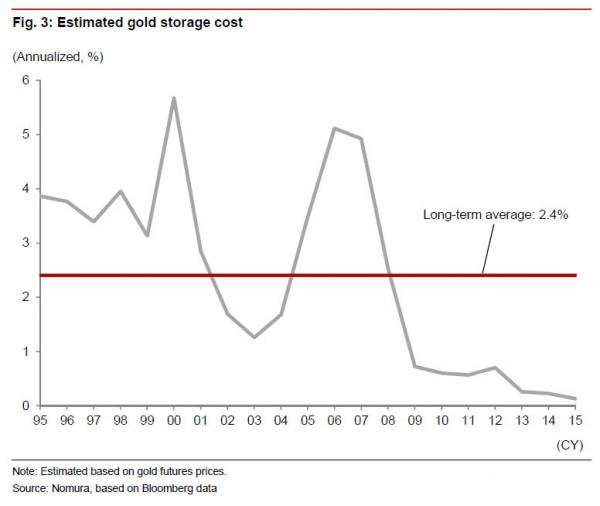

How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Pan...

Read More »

Read More »

“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »

Swiss Franc Plunges To One-Year Lows Amid SNB Intervention Chatter

With the biggest drop in 3 months, EURCHF has broken above last September's highs, plunging below 1.06. Amid chatter of SNB intervention, this is the weakest Swissy has been since the removakl of the ceiling a year ago.

EURCHF reached 1.10592...

...

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »