Category Archive: 1.) Zerohedge on SNB

West Virginia Gov. Personally On The Hook For $700MM In Greensill Collapse

The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill.

Read More »

Read More »

“Everything Is On Fire”

Authored by Egon von Greyerz via GoldSwitzerland.com,“Everything is on fire” – Heraclitus (535-475 BC)What Heraclitus meant was that the world is in a constant state of flux.But the big problem in the next few years is that the world will experience a fire of a magnitude never seen before in history.I have in many articles and interviews pointed out how predictable events are (and people).

Read More »

Read More »

UBS Reportedly Re-Starts Layoffs After “Doubling” One Time Bonuses To Some Associates

On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses.

Read More »

Read More »

UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn't just for rank-and-file minimum wage jobs.UBS has now said that, amidst historic competition and a "retention crisis" in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted.

Read More »

Read More »

Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn't yet known as the bank weighs whether it should cover some client losses associated with the "low risk" trade-finance funds that collapsed earlier this year.

Read More »

Read More »

Gold Is Laughing At Powell

Authored by Matthew Piepenburg via GoldSwitzerland.com,Recently, my colleague, Egon von Greyerz, and I had some unabashed yet blunt fun calling out the staggering levels of open hypocrisy and policy desperation unleashed by former Fed Chairman, Alan Greenspan.Poor Alan was an easy target of what I described as the “patient zero” of the reckless interest rate suppression and unbridled monetary expansion policies of the Fed which have always led to...

Read More »

Read More »

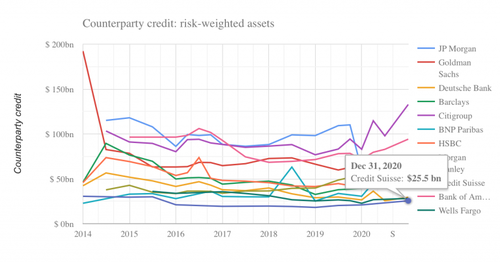

The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the...

Read More »

Read More »

Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of "stealth" prime broker deleveraging, as tens of millions of shares were yet to be accounted for.

Read More »

Read More »

Gold Could Offer A Way Out Of Switzerland’s Failing Inflationist Experiment

Authored by Brendan Brown via The Mises Institute,Never mind that the US Treasury’s indictment late last year of Switzerland as a currency manipulator rested on some flawed evidence and does not identify the crime.

Read More »

Read More »

As Markets Crashed, The Swiss National Bank Went On A Tech Stock Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in - either directly or in the case of the Fed indirectly via Citadel - and buy stocks to prop up the market and shore up confidence. That joke is now the truth.

Read More »

Read More »

Jim Bianco: “This Is One Of The Biggest Moments Of Truth In Financial Market History”

To contain the economic and financial ramifications of the coronavirus pandemic, Central Banks are going all in. Jim Bianco, founder and chief strategist of Bianco Research, warns that this time, monetary policy might be unable to stop financial markets from collapsing.

Read More »

Read More »

“ECB Is Worst-Run Central Bank In The World” – Felix Zulauf Sees 30percent Plunge In US Stocks “Taking The World With It”

Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond.

Read More »

Read More »

UBS Tumbles After Biggest Swiss Bank Misses Key Targets As Investors Pull Money

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals.

Read More »

Read More »

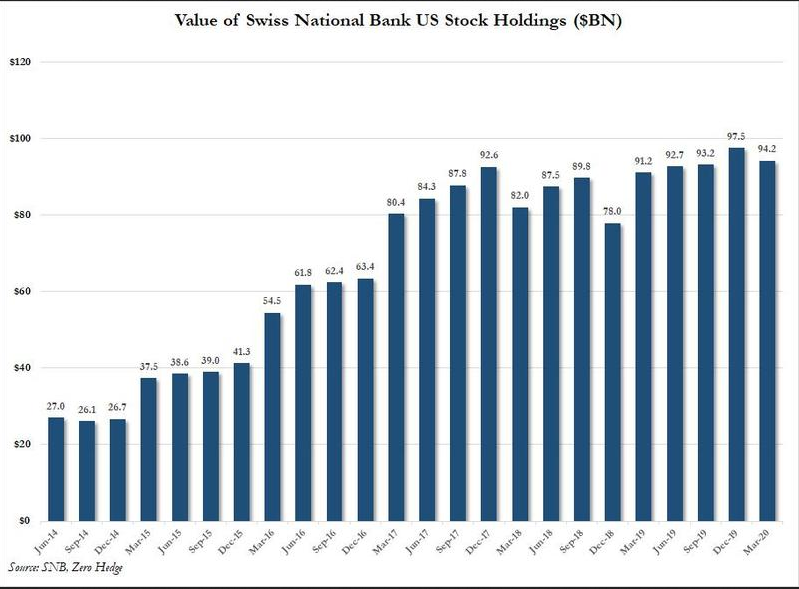

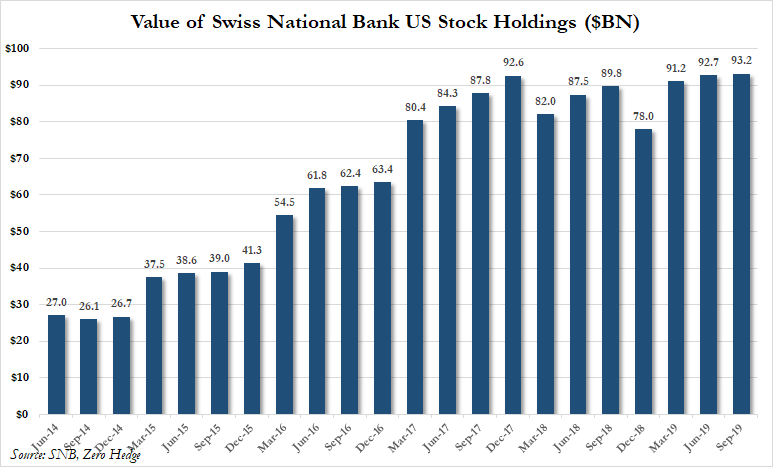

Swiss National Bank Now Owns Record $94 Billion In US Stocks After Q3 Buying Spree

In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump's "trade optimism" tweets.

Read More »

Read More »

Robinhood’s “Infinite Money Cheat Code” Gives Traders Access To Unlimited Funds

If one is a central bank - such as the SNB and BOJ - life is easy: you just print as much money as you need out of thin air, and buy whatever you want, without regard for price. For those who are not central banks, having access to unlimited borrowed money may be the next best thing.

Read More »

Read More »

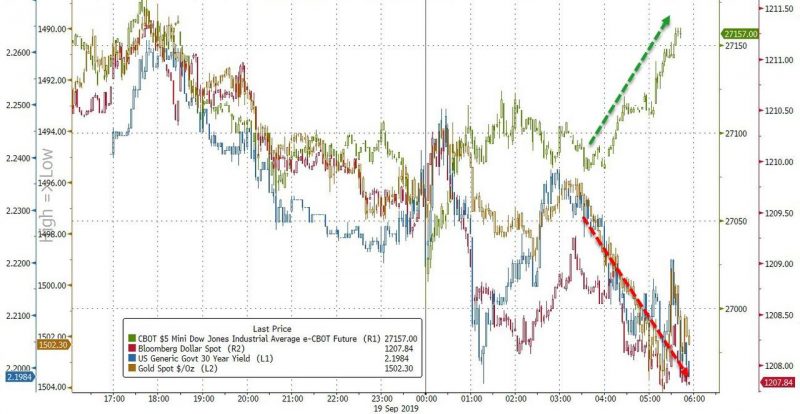

A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions.

Read More »

Read More »

Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews...

Read More »

Read More »

Towards A Globalist Utopia: “Negative Rates Are Coming, Whether You Like It Or Not”

There is nothing that a human mind can’t conceive. It can shoot for the stars or dive in the ocean which twinkles in the shadows of stars and ascend back with sparkling mind bearing uncanny ambition only to float contended. Today, we live in fear of losing wealth, we worry what economic consequences would do to our cash, we look through a microscope and scrutinize every word, every policy, every regulation or find something to put above ‘every’ and...

Read More »

Read More »

Rothschilds To Take Swiss Bank Private In 100 Million Francs Bid

Benjamin de Rothschild’s family plans to take Swiss Bank Edmond de Rothschild (Suisse) S.A. private as it consolidates and simplifies the bank's legal structure. According to Bloomberg, Edmond de Rothschild Holding SA will acquire all publicly held Edmond de Rothschild (Suisse) bearer shares at 17,945 francs per share, a 6.7% premium to Tuesday’s closing price, in a deal worth about $100 million.

Read More »

Read More »