Category Archive: 1) SNB and CHF

Spiritus rector des kranken Bonussystems ist Oswald Grübel

97 Franken – das war der Kurs der CS-Aktie im Mai 2007. Vergangene Woche notierte die Aktie noch bei einem Zehntel. Bei einem solch dramatischen Kurszerfall muss die CS sich nicht wundern, wenn kritische Fragen gestellt werden. Weshalb beträgt der aktuelle Wert der CS-Titel nur noch rund die Hälfte des in der Bilanz ausgewiesenen? Besteht die Gefahr eines Konkurses der CS? Wer wird dieses Too Big To Fail-Institut allenfalls retten? Die SNB, der...

Read More »

Read More »

Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger.

Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved.

Read More »

Read More »

Im Goldlager – Dans les entrepôts – Inside the gold vault – Nel deposito aureo

Diese Filmsequenz gehört zum Thema “Alles über unser Geld” des Informationsangebots “Unsere Nationalbank”. Sie erlaubt einen Einblick ins Goldlager der Nationalbank. Ce film illustre le thème “Tout savoir sur l’argent” traité dans le cadre de “Notre Banque nationale”. Il permet de découvrir les locaux de stockage de l’or de la Banque nationale. This short film, …

Read More »

Read More »

Einblick in die GV 2016 – AG 2016 – Behind-the-scenes look at the 2016 GM – Uno sguardo all’AG 2016

Diese Filmsequenz gehört zum Thema “Das ist die Nationalbank” des Informationsangebots “Unsere Nationalbank”. Sie gibt einen Einblick in die Generalversammlung der Nationalbank. Ce film illustre le thème “A la découverte de la Banque nationale” traité dans le cadre de “Notre Banque nationale”. Il donne un bref aperçu de l’assemblée générale de la Banque nationale. This …

Read More »

Read More »

Die Nationalbank bei der geldpolitischen Lagebeurteilung (Mediengespräch vom Dezember 2015)

Diese Filmsequenz gehört zum Thema “Die Bedeutung der Preisstabilität” des Informationsangebots “Unsere Nationalbank” und zeigt die Verkündigung des geldpolitischen Entscheids durch Thomas Jordan, Präsident des Direktoriums, am 10. Dezember 2015.

Read More »

Read More »

Einblick ins Repogeschäft

Diese Filmsequenz gehört zum Thema “So wird die Geldpolitik umgesetzt” des Informationsangebots “Unsere Nationalbank”. Er zeigt, wie das Repogeschäft der Nationalbank funktioniert.

Read More »

Read More »

Bekräftigung des Mindestkurses (Mediengespräch vom Juni 2013)

Diese Filmsequenz gehört zum Fokusthema “Die Geschichte des Mindestkurses” des Informationsangebots “Unsere Nationalbank”. Sie zeigt die Verkündigung des geldpolitischen Entscheids während der Phase des Mindestkurses durch Thomas Jordan, Präsident des Direktoriums, am 20. Juni 2013.

Read More »

Read More »

SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

SNB intervenes for 6.3 bil francs in the week ending last Friday. Once again a record high since January 2015. The SNB raised the intervention level to 1.0850. Apparently conversion of GBP->CHF flows into GBP-> EUR flows – via EUR/CHF purchases. Speculators: are long CHF 10K contracts against USD versus 6.3K last week.

Read More »

Read More »

FT Alphaville Izabella Kaminska interviews Geoffrey Brian West.

FT Alphaville’s Izabella Kaminska interviews theoretical physicist Geoffrey Brian West 2016, Festival of Finance. Camp Alphaville.

Read More »

Read More »

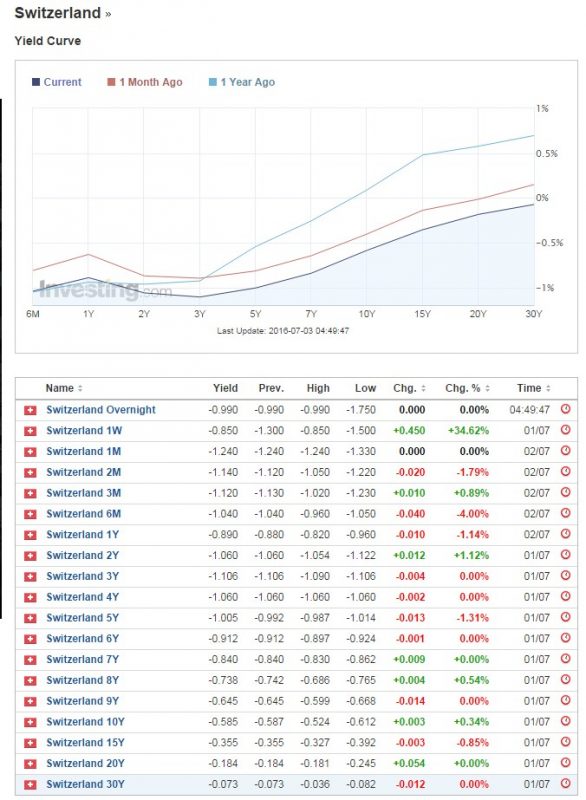

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

Swiss Balance of Payments and International Investment Position 2015

The Swiss National Bank (SNB) is publishing the annual Swiss Balance of Payments and International Investment Position report today. This year, the report is being released earlier – in May instead of August, as in previous years. It is based on the dataset for the fourth quarter of 2015, which was released with the press release of 21 March 2016 headed ‘Swiss balance of payments and international investment position, Q4 2015 and review of the year...

Read More »

Read More »

El-Erian: Cash is more valuable than ever

Mohamed El-Erian, chief economic adviser at Allianz Global Investors. says that Investors shouldn’t underestimate the role of cash in their portfolios We should add that the Swiss Franc is one of the most important havens for holding cash.

Read More »

Read More »

Purchasing Power Parity, REER: Swiss Franc Overvalued?

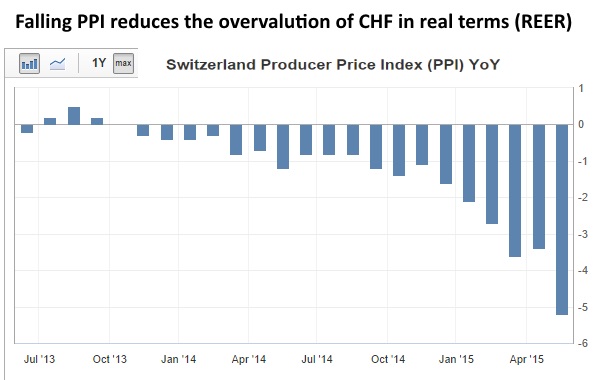

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

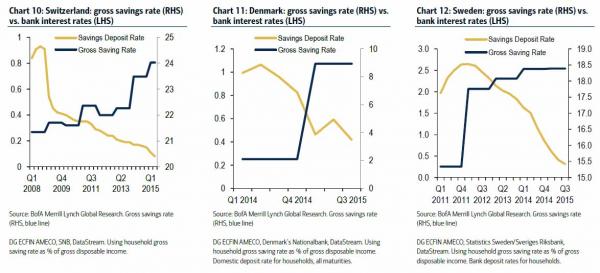

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 16.06.2016

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 16.06.2016 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

Swiss balance of payments and international investment position: Q1 2016

The current account surplus amounted to CHF 10 billion in the first quarter of 2016, CHF3 billion less than in the year-back quarter. The decline was primarily attributable to trade in goods, where the receipts surplus of CHF 8 billion was CHF 2 billion lower than in the first quarter of 2015. The receipts surplus for services remained stable at CHF 5 billion. In the case of primary income (labour and investment income), receipts and expenses were...

Read More »

Read More »

Gerald Braunberger, verantwortl. Redakteur Finanzmarkt, F.A.Z., zur Sozialen Marktwirtschaft

Beim Denkraum Globalisierung am 2. Juni 2016 in Leipzig diskutierten Vertreterinnen und Vertreter aus Politik, Wirtschaft und Zivilgesellschaft über die Herausforderungen der Globalisierung und skizzierten konkrete Lösungsvorschläge.

Read More »

Read More »

SNB’s Maechler on Negative Rates and our Critique

At the SNB news conference, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. For us, negative rates make only holding money on accounts less attractive but not cash, real estate or stocks. Negative rates reduce the profit of banks and therewith GDP.

Read More »

Read More »