Category Archive: 9a.) Real Investment Advice

educing Stock Position: A Strategy for Managing Concentrated Holdings

? Planning is key! Just like we plan for retirement and finances, having a strategy for reducing your stock position is crucial. #FinancialTips ?

Watch the entire show here: https://cstu.io/7ae172

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-12-25 CPI Day

Today's market activity will hing upon this morning's CPI Print (which showed consumer prices rising higher than expected). WEven more telling will be tomorrow's PPI numbers showing input costs. The question to be answered by investors is what the trend of inflation is, and what the Fed will do next. Will companies be able to pass along higher costs to consumers? What is driving inflation? Oil price increases are a short-term indicator, but have a...

Read More »

Read More »

Truflation Data Points To A Coming Decline In CPI

The graphs below, courtesy of Truflation, are very telling. The Truflation US Inflation Index uses over 30 million data points to assess price changes and, as a result, provide a robust forecast for the BLS CPI number. Moreover, their data have proven to be an incredibly accurate forecasting tool. As we share in the graph …

Read More »

Read More »

Growth And Value Are Not Mutually Exclusive

Might Nvidia and Tesla, with price-to-earnings ratios (P/E) nearly double and quadruple that of the S&P 500, respectively, be value stocks? Conversely, is it possible that Ford is not a value stock despite a P/E of 10, a price-to-sales ratio (P/S) of .20, and a 7.5% dividend yield? Based solely on that information, answering the …

Read More »

Read More »

Mastering 401k Contributions and Traditional IRA Funding Techniques

?? Super savers, here’s a key financial tip! ?? Always track where your contributions are coming from—whether it’s your paycheck, bonuses, or other sources. Smart saving starts with smart planning! #FinancialWisdom #SavingsGoals

Watch the entire show here: https://cstu.io/6e70ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

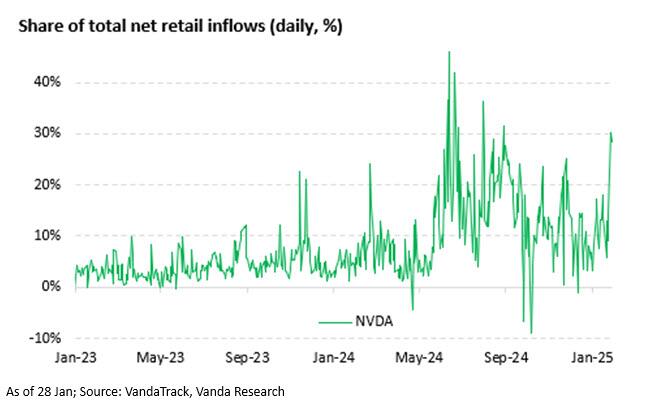

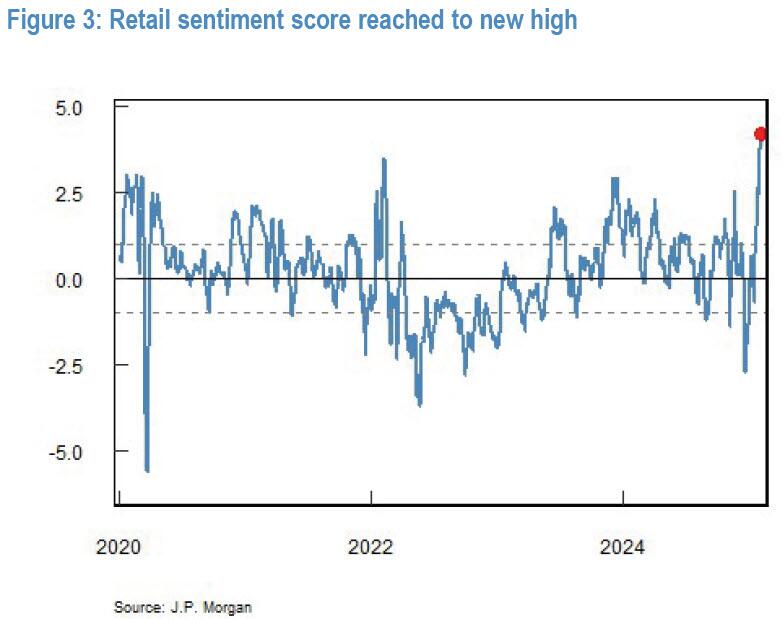

2-11-25 FOMO is Alive & Well

Markets are coming to grips with that Trump Tariffs really mean, and are adapting through sector rotations. Lance & Jonathan discuss the prices of eggs & milk and grocery dates. The market defies more negative news because retail investors continue to step in and “buy the dip.” Retail sentiment is quite remarkable. Since the pandemic, retail investors have never been this bullish on the stock market. Such is amazing, given that their...

Read More »

Read More »

Ethereum Falters Due To Massive Short Positions

If one weren't paying attention to the cryptocurrency market, one would think that all cryptocurrencies were doing well. For instance, meme coins are all the rage, and Bitcoin has been up about 50% since the election. Donald Trump and his pro-crypto rhetoric help explain the rally. Moreover, Trump has nominated pro-crypto people to serve important …

Read More »

Read More »

Bull Bear Report – Technical Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and …

Read More »

Read More »

Strategies to Maximize 401k and IRA Savings for Super Savers

Check out this important financial tip for super savers! ?? Make sure you're aware of where your contributions are coming from. #FinancialAdvice #SavingsTips

Watch the entire show here: https://cstu.io/3fc979

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-8-25 Everything You Wanted to Know About Retirement Income

Want to create retirement paycheck? Richard Rosso & Danny Ratliff serve up their first Candid Coffee episode for 2025 with tips, tidbits, and Danny's new theme park adventure site, "Rattland."

They'll also cover Retirement income strategies, how to generate income in retirement, and the best retirement investment options; plus Passive income for retirees and Retirement planning tips 2025.

And they answer a LOT of questions.

1:05 -...

Read More »

Read More »

2-10-25 The Super Bowl Indicator

Sunday's Super Bowl LIX delivered a lickin' to Kansas City at the hands of Philadelphia; what does the "Super Bowl Indicator" portend for markets (and does it really matter) Lance Roberts examines the veracity of the Super Bowl Indicator and other Stock market predictions, Financial market trends, Investment strategies, and Economic indicators. We also address the threatened Trump Tariffs next on Aluminum & Steel: more sticks &...

Read More »

Read More »

The Benefits of Working with a Financial Advisor for Retirement Planning

Planning for retirement is one of the most important financial goals in life, yet it’s also one of the most complex. While creating a retirement plan on your own may seem feasible, the expertise of a financial advisor can make a significant difference. Financial advisors offer personalized strategies, help navigate complex financial decisions, and provide …

Read More »

Read More »

Bessent Follows Yellens Strategy

Bond vigilantes had been questioning Janet Yellen's debt management tactics in her role as Treasury Secretary. Specifically, they accused her of shifting debt issuance away from longer-term maturities and toward shorter ones. We think her strategy made sense. Yellen was issuing more debt where demand was the greatest and trying to limit the amount of …

Read More »

Read More »

Predicting Tech Stock Movements: A Cautionary Tale

? Don't underestimate the resilience of tech giants like Apple and Microsoft! ? Long-term predictions can be tricky! #TechIndustry #StockMarket

Watch the entire show here: https://cstu.io/41fdc2

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Inflation: The Role of Supply and Demand in the Economy

Supply and demand drive inflation, but slowing economic growth is the solution. An interesting conundrum! #EconomyTalks #Inflation #SupplyDemand

Watch the entire show here: https://cstu.io/dd3cf6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Quick Market Rotations: Favorable Shifts Happen Fast!

Ever wonder why certain markets suddenly surge? ? Rotations happen fast in the financial world! ? Stay on top of your portfolio and risk management! #FinanceTips #MarketInsights ??

Watch the entire show here: https://cstu.io/d9c943

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-7-25 Taking the No-buy Challenge

TIring of overconsumption and desirous of paying off debt, more and more Americans are participating in the "no buy 2025" trend to reduce spending. Rich and Jonathan discuss strategies for improving household budgets, Money Saving Tips and Frugal Living Hacks, with Financial Discipline Strategies and Spending Freeze Guidance, plus tax traps to avoid as a result of the Social Security Fairness Act, and the challenges from inherited IRA's....

Read More »

Read More »

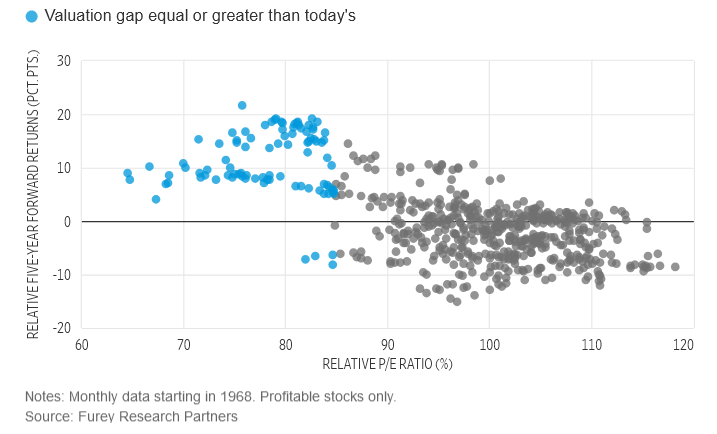

Small Cap Stocks Are Offering Outsized Returns

The Wall Street Journal published an interesting article For Small Cap Stocks, Look Past The Trump Trade. It is worth sharing the article's premise and the potential pitfalls in the analysis as quite a few articles seem to be popping up recently touting small-cap stocks. Let's start with the scatter plot below, courtesy of Fuery …

Read More »

Read More »

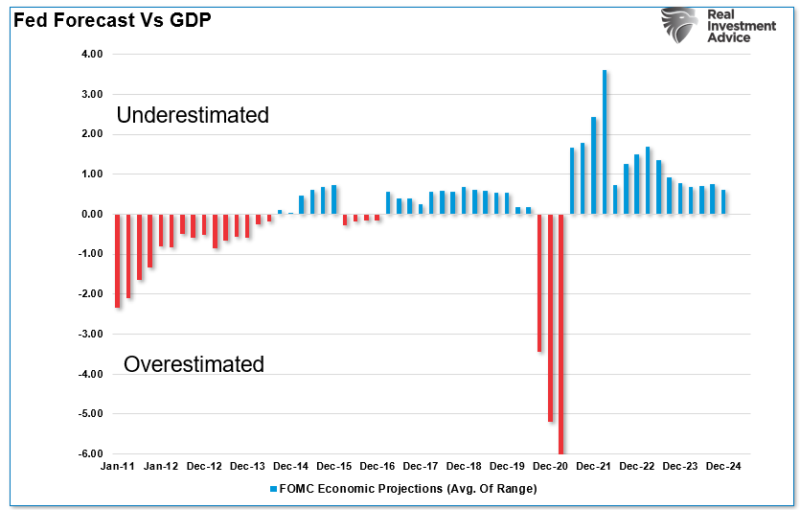

Forecasting Error Puts Fed On Wrong Side Again

The Federal Reserve's record of forecasting has frequently led it to respond too late to changes in economic and financial conditions. In the most recent FOMC meeting, the Federal Reserve changed its statement to support a pause in the current interest rate-cutting cycle. As noted by Forbes: "The policy-setting Federal Open Market Committee agreed unanimously …

Read More »

Read More »

Avoid Emotional Trading: Key to Better Long-Term Returns

Emotional trading leads to mistakes & selling bottoms. Turn off, let the market digest. Don't follow the herd. Timing is key. #StockMarketTips

Watch the entire show here: https://cstu.io/9193b9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »