Category Archive: 9a.) Real Investment Advice

China Yields Collapse

Treasury yields rose sharply following the Fed meeting on Wednesday, yet they are collapsing in the world's second-largest economy, China. While our economy is robust, large foreign economies, including China, struggle. Our recent article Global Conditions and Commentary, highlights the strong historical relationship between the global economy and the U.S. Moreover, it summarizes the economic …

Read More »

Read More »

Will BRICS Countries Truly Dominate the Global Market: An In-depth Analysis

? Did you know about the BRICS countries' market domination theory? ? Watch to learn more! #BRICS #EconomicTheory #GlobalMarket

Watch the entire show here: https://cstu.io/4d9295

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

12-19-24 Did the Fed Steal Christmas?

Heads-up: We're on vacation for the next two-weeks starting Monday (12/23); audio podcasts will be available on iTunes, Spotify, and a host of other audio platforms. Check our website, www.realinvestmentadvice.com for complete links. The House's Continuing Resolution fails to pass muster, thanks to pressure from president-elect Donald Trump and the emerging D.O.G.E. team. Meanwhile, the Fed cuts rates, as expected, but adds a hawkish slant to their...

Read More »

Read More »

Strategies for Generating Reliable Income During Retirement

Creating a reliable income stream during retirement is essential to maintaining your lifestyle and achieving your financial goals. With longer lifespans and rising costs, having a clear plan for generating income is more important than ever. In this article, we’ll explore key retirement income strategies, including annuities, dividend-paying stocks, and bond ladders, and provide tips …

Read More »

Read More »

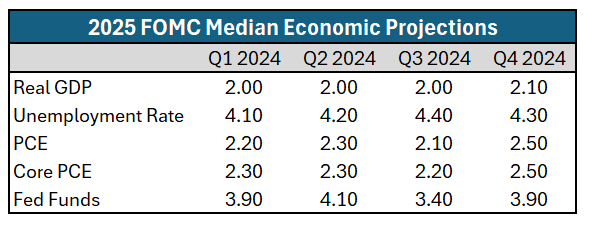

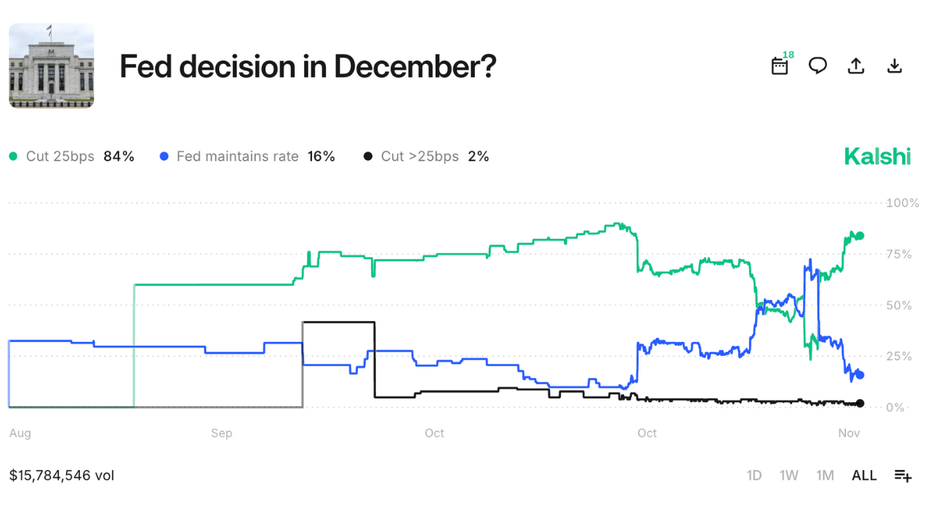

Cut And Pause: FOMC Summary

As widely expected, the Fed cut the Fed Funds rate by 25bps, to 4.25-4.50%, at yesterday’s FOMC meeting. Moreover, they intimated that after cutting rates by 1% since September, they are likely to be more data-dependent, which may slow the pace of further rate cuts. They want to see inflation trend lower again and/or the … Continue...

Read More »

Read More »

Use Drone Mentality to Financial Success.

Beware of the mysterious drones hovering over eight cities! They're causing quite a stir. However, what if a drone mentality to financial success truly existed? We probably wouldn't mind. Not long ago, Jeff Bezos, the CEO of Amazon, made big media headlines by suggesting that drones will be used to deliver light packages in the …

Read More »

Read More »

12-18-24 Dump the 60/40 for 100% Stock Retirement Portfolio?

It's Fed Day with it's much anticipated rate cut; what will matter more is the Fed's dot-plot and comments on expectations for 2025. Meanwhile on Wall Street, sloppy trading continues as fund manager rebalance portfolios. Markets are sitting on the 20-DMA and holding firm. The Healthcare Sector is the year's worst performer: Will it offer the most opportunity in 2025? This sector tends to perform better AFTER elections. Lance reveals a new...

Read More »

Read More »

Understanding the Impact of Inflation on Your Retirement Savings

Is a million dollars enough for retirement? ?? Watch to learn why inflation is a key factor to consider! #retirementplanning #financialtips ?

Watch the entire show here: https://cstu.io/9ecc27

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

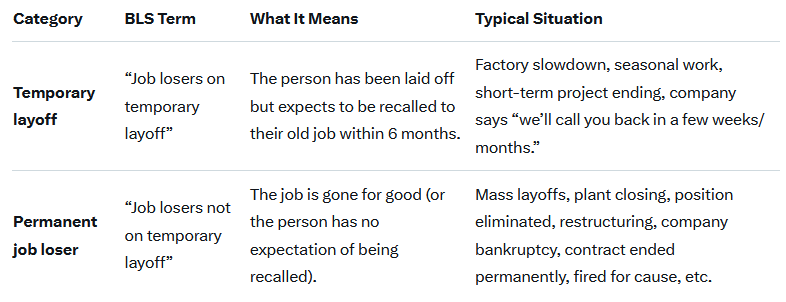

More Revisions Coming To Employment Data

In August, the BLS revised 2024 employment growth lower by 818k jobs in its preliminary revision of its Current Employment Statistics (CES). Despite the substantial revision, more reductions to the official employment data are likely to come next month. In January, the BLS will release its final benchmark revision. The preliminary and final revisions to …

Read More »

Read More »

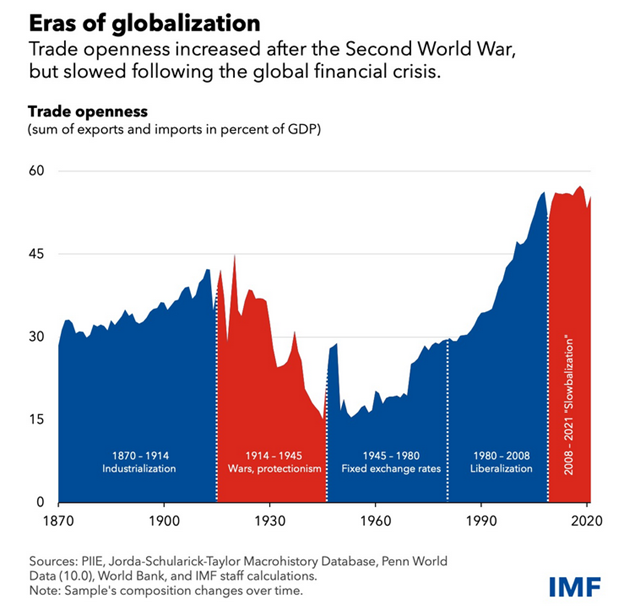

Global Conditions Portend A Catch-Down In America

For $20,000, you can buy a global airline pass to see the world. Or, for the low price of free, you can take a quick trip with us worldwide. Unfortunately, our global trip is not as exciting as an around-the-world pass. Still, it may enlighten you about some economic struggles abroad. Moreover, why, in time, …

Read More »

Read More »

12-17-24 This is Nuts

Retail Sales numbers this week will feed into expectations for 2025. Fed meeting tomorrow: Cut and pause, or cut and slow? Employment revisions are also due, but markets won't care. The stock market is still hitting all time highs, but that's not necessarily the case, sector by sector: Basic Materials, Industrials, Financials, and Energy are not mirroring the S&P 500; the Magnificent 7 is responsible for the bulk of growth. It's a very narrow...

Read More »

Read More »

Smart ETF Tax Strategy: Avoid Losses and Maximize Profits

Did you know you can sell one ETF at a loss and buy another similar one without tax implications? ETFs play by different rules! ?? #InvestingTips

Watch the entire show here: https://cstu.io/b79ad1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Dollar And Domestic – International Relative Stock Returns

The U.S. dollar index is up over 6% this year, almost all attributable to a post-election surge. As many developed nations show stagnant economic growth or even contraction, the U.S. economy continues to hum. Further bolstering the dollar is the likelihood that the Fed will slow rate cuts or stop them after this Wednesday's FOMC …

Read More »

Read More »

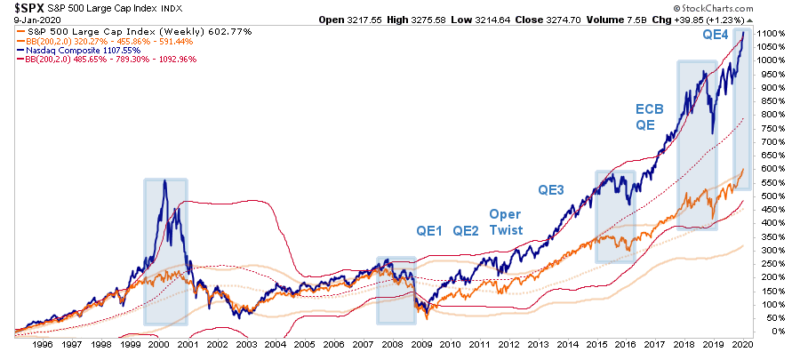

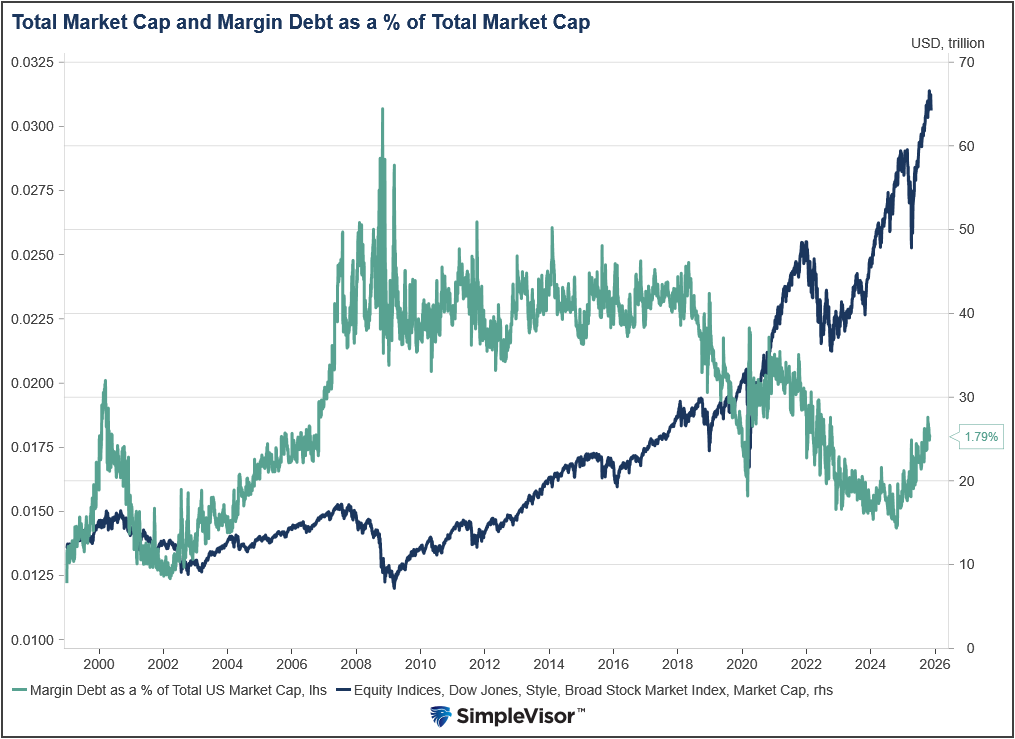

Permabull? Hardly.

I never thought someone would label me a "Permabull." This is particularly true of the numerous articles I wrote over the years about the risks of excess valuations, monetary interventions, and artificially suppressed interest rates. However, here we are. "Lance, you are just another permabull talking your book. When this market crashes you will still be telling …

Read More »

Read More »

12-16-24 Why NFIB Optimism Matters

Over the last several years, we have regularly discussed the importance of the National Federation Of Independent Business Survey (NFIB) concerning the economy. As noted in our most recent update (October 12th) on the index:

“While Wall Street’s bullish narrative is compelling, the latest data from the NFIB Small Business Optimism Index provides a stark contrast. Small businesses are the backbone of the U.S. economy, and the sentiment captured in...

Read More »

Read More »

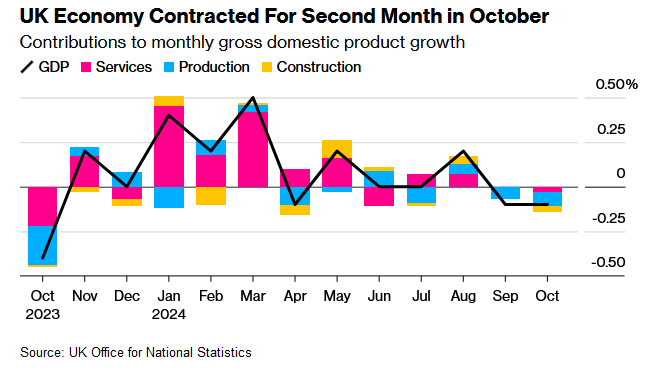

Britain And European Economic Growth Sputters

Yesterday's Commentary touched on the divergence between robust economic growth in the U.S. and near-recessionary conditions in Canada. We highlighted the importance of this to U.S. investors because of the historically strong correlation between the two economies. Unfortunately, Canada is not a one-off instance. Britain, Europe, and China also exhibit poor economic growth. Given the …

Read More »

Read More »

The Role of Tax-Efficient Investing in Wealth Accumulation

When it comes to building long-term wealth, it’s not just about how much you earn but how much you keep. Taxes can significantly impact your investment returns, making tax-efficient investing a crucial component of any wealth accumulation strategy. By utilizing tax-advantaged accounts, employing strategies like tax-loss harvesting, and selecting tax-efficient funds, investors can reduce their …

Read More »

Read More »

How Expectations Drive Short-Term Market Returns

Invest wisely! Market values depend on expectations. Don't just follow the crowd. #investingtips #marketexpectations #stocks ??

Watch the entire show here: https://cstu.io/c78d89

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Technical Analysis: Your Market Navigation Tool

Technical analysis is like a roadmap for navigating the market in real-time. It helps us understand market trends and make informed decisions. ? #StockMarket #Investing

Watch the entire show here: https://cstu.io/ebfef4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

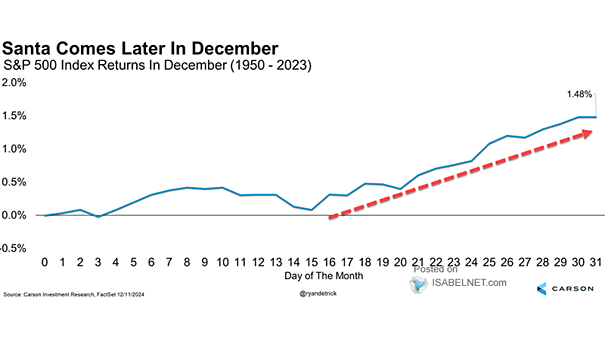

Trump Election Sends NFIB Optimism Surging

Inside This Week's Bull Bear Report First Comes The Fed, Then Santa Last week, we discussed that the risk to the markets was the annual portfolio rebalancing process. To wit: "With the year-end approaching, portfolio managers need to rebalance their holdings due to tax considerations, distributions, and annual reporting. For example, as of this writing, …

Read More »

Read More »